Budget Airlines Now Generate More Unit Revenues Than Legacy Airlines in U.S.

Skift Take

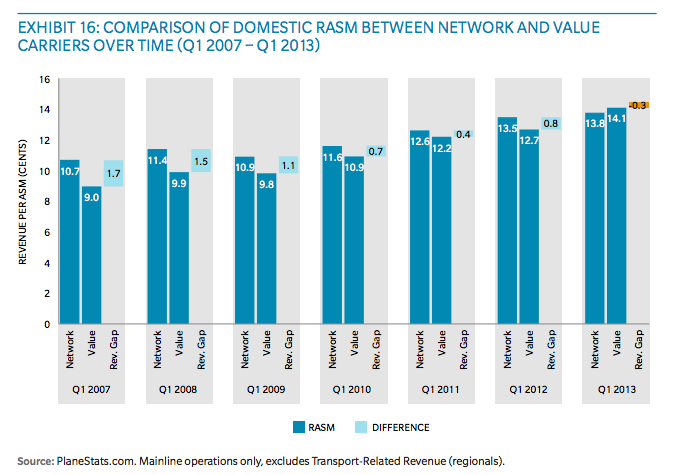

This may go down as one of the seminal moments in U.S. airline history: This year, for the first time ever, U.S. low-cost carriers unit revenue on domestic routes exceeded that of legacy mainline carriers, according to Oliver Wyman’s annual Airline Economic Analysis report.

While low cost carriers fly shorter routes, inherently generating higher unit revenue, this unprecedented spike in domestic revenue per available seat mile among U.S. low-cost carriers is still evidence of a major change.

RASM in the above chart refers to "Revenue Per Available Seat Mile" and is used as unit of measurement to compare the efficiency of various airlines.

Other low cost-carrier trends from the report:

- A narrowed cost gap between U.S. network airlines and low cost airlines during the past five years from 34 percent to less than 4 percent. Even so, ultra-low-cost airlines (Spirit, Allegiant) modeled after Europe’s Ryanair operate at costs that are a step below even traditional low-cost carriers and are a growing challenge to both network and low-cost carriers.

- The challenges once posed by low cost carriers to network carriers are

now being posed by ultra low cost carriers to both network and low cost carriers. - Some ultra-low-cost airlines unbundle their products to the maximum extent and charge low base fares and high ancillary fees. Added together, these low fares and high fees can equal the higher fares and lower ancillary fees at traditional airlines. Is this situation sustainable, or will traditional airlines find ways to regain their historic revenue premium?