Skift Take

CheapOair has already proven that it can make a viable business out of flights when its competitors are scurrying to build their hotel businesses. There will be pressures, and it won't be the fastest-growing business in the world, but there is plenty of room for companies like CheapOair that keep their heads down and focus on areas that others are neglecting.

Most online travel businesses are trying to diversify away from the flight business as fast as they can, treating airline tickets almost as a loss leader. In fact, even flight-shopping site Skyscanner recently acquired a hotel-search business.

Then there’s New York City-based CheapOair, and founder and CEO Sam Jain, who wants to do for flights what Booking.com did for hotels.

Jain outlined CheapOair’s strategy and ambitions exclusively to Skift in one of the few press interviews he’s given since CheapOair was founded in 2005.

OK, Jain has no illusions that CheapOair can achieve success on the scale that Booking.com has done, but he sees a huge upside in the fact that “airlines are craving to differentiate themselves.”

In that regard, representatives from Etihad Airways spent several days in CheapOair’s Manhattan office last week, awarding prizes to contact center agents who correctly answered questions about the meal choices in first class, for example. Emirates and Singapore Airlines have made similar appearances.

Jain argues that a single-minded focus on, and investments in, selling flights can make for a very strong business as carriers are really still in the beginning stages of unbundling their preferred seats, early boarding options, onboard Wi-Fi, and other ancillary services, and need help selling them to a wider audience.

The Tourists Got Here By Flying

Over dinner in Manhattan on a Friday night near Rockefeller Center with Jain and a couple of his executive team members, there are throngs of tourists from foreign countries nearby, and they are jockeying for position on Fifth Avenue’s gridlocked sidewalks.

You hardly hear any English as the international visitors gawk at store windows, line up landmarks, and pose for selfles on one of the most famous thoroughfares in the world.

The CheapOair execs must take comfort in the fact that most of these tourists got to New York via airplanes.

“Wherever you invest, that’s where you are going to grow,” Jain says, referring to the potential he sees in being “laser-focused on flights,” even as competitors are perhaps intelligent enough to pour their resources elsewhere, into hotels.

Jain says “nothing’s wrong” with the admittedly lucrative and more profitable hotel business, but he thinks the future is also bright for selling flights, and he has a vision for the place that CheapOair can carve out for itself as it hones and expands the business.

To understand the vision, you’d have to know that Fareportal, CheapOair’s parent company, has its roots in the sometimes-mysterious and little-understood world of airfare “consolidators.”

The consolidator business is intimately tied to ethnic travel, where Greek, Indian airlines and others would offer unpublished, special contracts to Greek or Indian travel agencies, respectively, throughout the world, and they in turn would consolidate all of these complex contracts and fares, and make them available to scores of other travel agencies in local markets.

Part of CheapOair’s secret sauce is that it still has access to these consolidator fares, as do some competitors, to varying degrees, although consolidator fares are no longer the basis of CheapOair’s business.

In addition to consolidators’ fare, CheapOair also gets access to other exclusive fares, which may only be available behind the curtains of its call centers.

Jain says he envisions the day when CheapOair might have a presence in 10 to 15 countries, expanding beyond its current base of the U.S., Canada and the UK. When that happens, customers would be able to establish one online profile, and access special fares for Dubai to Singapore flights, for example, that are only available when purchased in those countries.

How Can CheapOair Make A Business Out of Flights?

So how is CheapOair making a business out of flights when online travel agencies such as Expedia, Priceline and Orbitz are treating them to varying degrees as gotta-haves, but not necessarily the focus of their investments?

▪ In addition to having access to consolidators’ fares, CheapOair sometimes offers these and other special deals only through its company-operated call centers, and agents can also upsell or cross-sell customers once they get them on the phone.

▪ While most of the other online travel agencies have eschewed booking fees, except for flights involving multiple airlines, CheapOair unabashedly charges booking fees on virtually all of its flights, and thereby increases its profit margins, likely making them greater than those of its competitors.

▪ CheapOair claims that a larger portion of its business involves lucrative international flights, more than its competitors’ share.

▪ And, company employees staff all the CheapOair’s contact centers, located in New York; Las Vegas; Canada, and Gurgaon, India, and that’s one way to ensure that they are adequately trained on preferred sales techniques.

Meanwhile, some 200 of CheapOair’s 2,000 employees are engineers, and improving the flight search and booking process is high on the agenda.

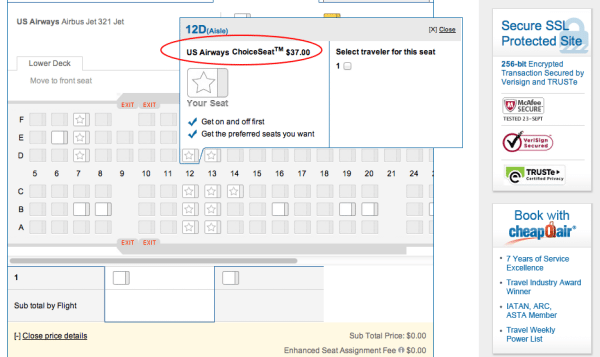

“It’s hard to do air well,” a fact that is sometimes given short shrift, Jain says, noting that CheapOair was the first online travel agency to sell both US Airways’ Choice Seats and American Airlines’ Main Cabin Extra.

CheapOair sells these airline ancillary services during the flight purchase process as an option before flyers even complete booking their flights, Jain says.

“There is only a short window to sell,” Jain says. “The customer buys it in the booking path or we lose the sale.”

Founded in 2005 under the Fareportal banner, CheapOair is the largest unit within Fareportal, which also takes in OneTravel and Travelong. Onetravel is more of a well-rounded online travel agency, with a broader array of products than CheapOair, and Travelong has a relatively small corporate travel business, but mostly does fulfillment (processing the tickets) for CheapOair.

Over the last couple of years, CheapOair has broken out of the lower tiers and been recognized as one of the five largest U.S.-based online travel agencies.

In fact, for August CheapOair says Experian Hiwise pegged it as having the third highest number of monthly unique visitors, behind Expedia and Priceline, and ahead of Travelocity, Orbitz, and Kayak.

But, given the fact that its main product is flights, CheapOair’s traffic numbers don’t translate into it being the third largest online travel agency in terms of gross bookings.

Jain says Fareportal, consisting mostly of CheapOair, but also including Onetravel and Travelong, is on track to achieve $3.2 billion in gross bookings in 2013, about an 18.5% increase from 2012. Of that number, Travelong accounts for some $40 million to $50 million.

CheapOair, with its flight obsession, is likely only the fifth largest U.S.-based online travel agency, behind Expedia, Priceline, Orbitz and Travelocity, when measured by its likely revenue.

Jain won’t reveal profit numbers, but says privately held CheapOair has been profitable every year since 2007.

A Changing Online Landscape

With a new strategic alliance between Expedia and Travelocity, which has Travelocity outsourcing most of its North American operations to Expedia starting sometime in 2014, Chris Cuddy, CheapOair’s chief commercial officer, sees his company’s position improving.

“I think it is great for us,” Cuddy says, referring to the Expedia-Travelocity alliance, and adding that Travelocity will likely become more hotel-focused, as is its new best buddy, Expedia.

The downside for CheapOair is that, barring huge acquisitions, it likely will have to be content to grow at a more measured pace than Priceline and Expedia. In addition, CheapOair will continue to face the prospect of having to compete against its partners, the airlines.

Still, growth indeed is on CheapOair’s agenda, and Jain says the company expects to launch in Australia in 2014, where it will find entrenched competitors.

CheapOair has a great brand when it comes to attracting discount-hungry travelers, but it faces the challenge of appealing to flyers who might prefer to be pampered in those Etihad first-class seats.

But, you can bet that there won’t be any rebranding for CheapOair anytime soon, and the company will be betting its future on the flight business.

That’s because the name CheapOair itself is both a blessing and a limiting factor.

Says Jain: “It’s like HotelTonight: You cannot sell hotels for tomorrow.”

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: cheapoair, expedia, priceline

Photo credit: CheapOair founder and CEO Sam Jain says the company unabashedly addresses the market for flights, and believes there is a huge upside to doing air right. In the photo, Jain speaks at a company holiday party in 2010. CheapOair