Skift Take

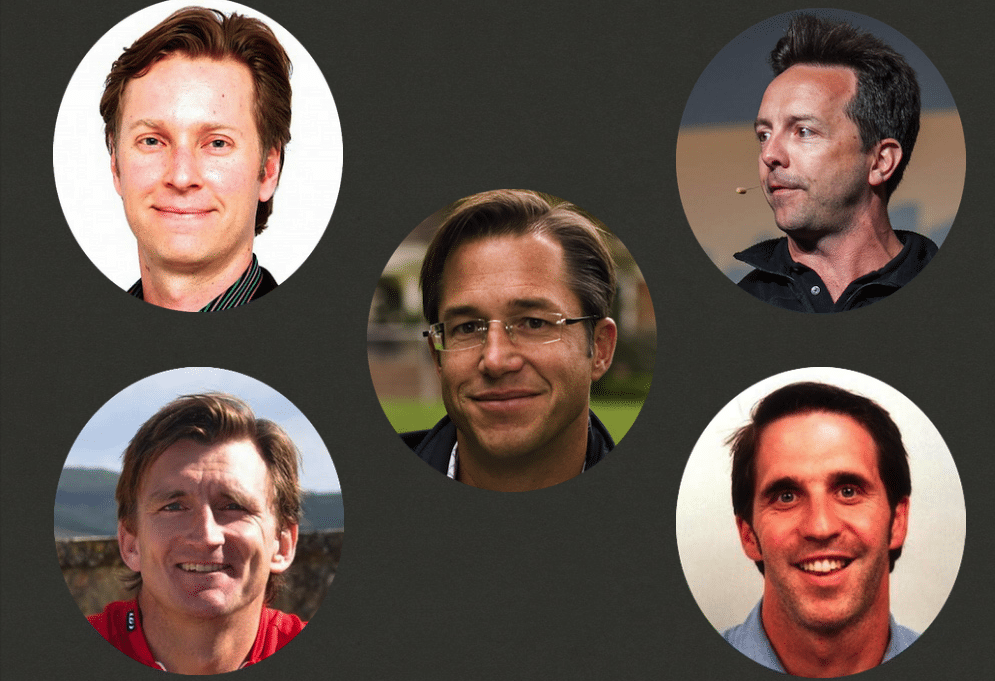

Ask anyone who the most successful investor in travel is, and they'll talk about Joel Cutler of General Catalyst Partners. But, when it comes to individual investors, this gang of five has a lot of experience and is pretty good. None are infallible, of course, but this is where a lot of the smart money is.

Erik Blachford, a former CEO of Expedia, was traveling to Seattle for a board meeting of Zillow, the real estate marketplace co-founded by his good friend Rich Barton, who founded Expedia for Microsoft and was the online travel agency’s first CEO. Blachford, a Zillow investor, booked his hotel stay through Sam Shank’s Hotel Tonight, and wanted to have some fun with his entrepreneurial and investor buddies.

“I then used Room 77 [founded by Brad Gerstner] to get a bead on the relative quality of my room in hopes of giving Sam a hard time, but of course it turned out to be just fine,” Blachford says.

Blachford, Barton, Gerstner, Shank and Hugh Crean, the former CEO of Farecast, make up what you might call a Fab Five group of angel investors in travel. You see their names pop up a lot in launch announcements: They invest at times in each others’ companies, and their investments in other companies frequently overlap.

Ties that bind

For example, all five are involved as a founder, investor, or board member in Room 77 and Hotel Tonight; Barton, Gerstner and Shank have collaborated with TravelPost and Duetto Research; Crean, Blachford, Shank and Gerstner are investors in Russia online travel agency Ostrovok, and Blachford and Barton were early investors in Hipmunk.

Click on the image below for the full family tree:

If you have founded a travel startup, are seeking advice and a seed round, and then land one of the Fab Five as an investor, your success won’t be assured — but your new business will instantly get some credibility in the travel industry.

You want to get these guys on speed-dial.

The informal group doesn’t conduct any secret meetings, and there are no gang signs that they covertly display to one another that we know of. The scope of their personal and business relationships, and the extent of their common investments vary, of course.

Blachford likes to think of the five as something akin “to the old Bill Clinton idea of a kitchen cabinet.”

“We’re all pretty happy to be customers of one another’s companies and investments because we all know that the only feedback that really counts is dead, honest feedback,” Blachford says. “And, personally, there’s nobody I would trust more to give honest feedback than these guys.”

Rich Barton says it’s the nature of networks that you build up strong business and personal connections with people, and he notes that the five have had their share of investment sucesses and failures.

He calls it “very valuable” to “be able to pick up the phone any time to track what the others think is interesting.”

“Most of the things we’ve brainstormed about with each other, and with Erik, in particular,” Barton says. “I haven’t done anything in my career without chatting with him and vice versa.”

Barton, Blachford and their families spend a lot of personal time together, Barton says. “You are more likely to get a great idea on a chair-lift or sharing a beer than in a room with a whiteboard.”

The idea for Hotel Tonight

Sam Shank of Hotel Tonight says he makes about 7-10 angel investments per year, but considers himself “more like a trainee” when grouped with the four other investors.

Shank says he has known Brad Gerstner since around 2004 when Shank founded hotel review site TravelPost.

Gerstner, in turn, did a stint in 2000 at General Catalyst Partners, where Hugh Crean currently serves as an entrepreneur-in-residence under managing partner Joel Cutler, whose company also invested in Room 77. Kayak, which is poised to enter the Priceline family, and ITA Software, acquired by Google, are just two of Cutler/General Catalyst Partners’ notable successes.

In a further intertwining of resumes, Gerstner was co-CEO of cruise and vacation seller National Leisure Group in the early 2000s when Crean was NLG vice president of product and corporate development.

Shank says he got to know Barton in 2010 when Expedia’s first CEO brought together Expedia alums Simon Breakwell, Greg Slyngstad, and Sunil Shah, and they bought TravelPost from Kayak. Shank was an advisor to this reincarnated TravelPost, which eventually admitted failure and pivoted into photo-sharing app Trover.

Shank’s mobile-only Hotel Tonight, which has attracted some $35 million in funding, including angel investments from Barton, Blachford, Gerstner, and Crean, is currently being emulated by brands big and small across North America and in Europe, and is the subject of mucho buzz.

Shank says “Brad [Gerstner] was one of the first guys I talked to” about Hotel Tonight.

“On Hotel Tonight, when I wanted to validate the idea, I talked to the smartest people in travel and they not only validated the idea, they invested in it,” says Shank, referring to the foursome.

Not all of the five investors’ targets come about through their joint networking. Shank says he discovered Ostrovok on his own through AngelList, and Crean, Blachford, Gerstner (and Cutler) invested in it, as well.

Shank sees very practical advantages to knowing and comparing notes with the other four. First, there are “not that many great travel deals per year” amidst the bloated number of travel startups, and “it is very hard to do due diligence,” Shank says.

If someone else in the group has done the due diligence and research about a potential investment, then that can be efficient way of vetting startups, and can inspire confidence, Shank says.

Second, it is also very easy to reach out to the other four for specialized information or an introduction, says Shank, adding that Blachford will soon visit Hotel Tonight’s office to speak with employees. “That’s hugely valuable for the team,” Shank says.

Hits and misses

Shank, Crean, Gerstner, Blachford, and Barton have notched a lot of successes in their investments, but not everything turns to gold.

Barton, for example, says it’s par for the course that the 2010 rendition of TravelPost, which figuratively threw up its hands in defeat, pivoted into becoming the Trover app. And, what an odyssey it has thus become for TravelPost.

Shank founded TravelPost in 2004, and he sold it to SideStep in 2006. Kayak then acquired SideStep (and TravelPost) in 2007 for $196 million.

In 2010, Kayak sold TravelPost to Barton and his ex-Expedia cadre, and they sold it back to Dealbase, where Shank is co-founder and a board member, in late 2011 or early 2012 when Barton and Jason Karas used the initial investment in the new TravelPost to launch photo-sharing app Trover.

“Entrepreneurs don’t fail, we learn,” Barton says of his TravelPost-to-Trover experience.

“It didn’t work,” he adds, referring to his company’s plans for a new TravelPost. “We pivoted and that’s fine.”

Likewise, Gerstner has seemingly been very successful with many investments over the years, including so far in his Room 77, which attracted $43.6 million in funding, including a Series C round from the likes of General Catalyst Partners, Expedia, Concur Technologies, Felicis Ventures, and Zillow’s Spencer Rascoff and Blachford.

But, Gerstner, who is founder and CEO of Altimeter Capital, also invested in Off & Away, an auction site that shut its doors after about a year-and-a half of operations in 2011.

That’s how it goes in travel startup land, where many new ventures eventually pivot and/or fail.

The five investors — Barton, Blachford, Crean, Gerstner, and Shank — don’t constitute a formal group, and their networks reach much farther than themselves. Some of them not only participate in angel investments, but later rounds, as well.

Barton says he frequently bounces ideas off Barney Harford, the CEO of Orbitz Worldwide, and his confidants go beyond the seeming “boys club” of the other four investors as Amy Bohutinsky, Zillow’s chief marketing officer, frequently serves as a sounding board.

Krista Pappas, an investor in Gerstner’s Room 77 and a colleague of Crean’s at Farecast and later Microsoft’s Bing Travel, also gets her points across to some of the group.

Pointers for travel startups

Meanwhile, Blachford and Barton, two ex-CEOs of Expedia, offered some advice for travel startups.

“I can’t speak for anyone else, but to me there’s a bright shining line between the entrepreneurs who are willing to ask themselves whether real travelers in the real world would use their services and the entrepreneurs who think that travelers ‘could’ or ‘might want to’ use their services,” Blachford says.

“Just because something is possible technically doesn’t mean anyone is going to want to use it for their actual travel planning. If the basic legs of the investment stool are market, team, and product, in that order (for me anyway), the pitch needs to show how the team has really thought about how their product solves a problem in an identifiable market, and I have to believe the team has the chops to execute on the vision.”

And, Barton isn’t anxious to see pitches with legacy thinking unwittingly written all over them.

“The smartphone is the platform,” Barton says. “If anyone shows me a demo on a website or screenshots of a website on a PowerPoint, I don’t even consider it,” Barton says.

“And, anything that improves the way hoteliers do their revenue management or consumers’ experience booking hotels might be worth a look, he says.

“Hotels is the gift that keeps on giving,” Barton says.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Photo credit: Clockwise from top left: Sam Shank, Brad Gerstner, Hugh Crean, Erik Blachford, and Rich Barton (center).