Travelers can keep pinning as Pinterest raises $200 million

Skift Take

Pinterest Inc., an online bulletin board where members share photos of clothing, food and art, raised $200 million in a financing round that values the company at $2.5 billion.

The funding was led by Valiant Capital Management, San Francisco-based Pinterest said yesterday in an e-mailed statement. Existing investors Andreessen Horowitz, Bessemer Venture Partners and FirstMark Capital also contributed.

Pinterest is now worth more than publicly traded Internet companies Zynga Inc., Yelp Inc. and Pandora Media Inc., even though it has yet to generate revenue. The number of unique users is growing at more than 300 percent from a year earlier, leading to increased interest from investors, said Rick Heitzmann, a partner at FirstMark in New York and board observer for Pinterest.

“We think we’ll build a really big business in discovering and curating all the things people love in their lives,” Heitzmann said in an interview. “It’s really resonating with people.”

The investment makes Pinterest one of the most valuable venture-backed Internet companies. Twitter Inc., the microblogging service, was valued at about $9 billion after early employees sold shares to a fund managed by BlackRock Inc., three people with knowledge of the matter said last month. Dropbox Inc., a file-sharing service, raised money in late 2011 at a $4 billion valuation, while room-sharing site Airbnb Inc. was raising capital at a valuation of about $2.5 billion late last year, people familiar with the matter said in October.

Virtual Pinboard

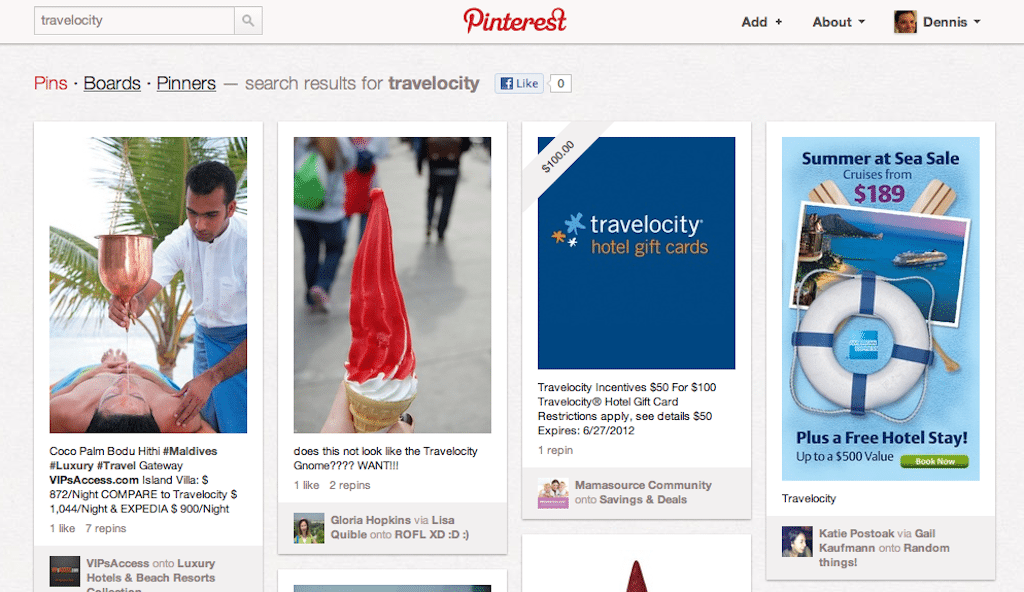

Pinterest operates a social-networking website where users can collect and share photos on the Internet by pinning them to a virtual bulletin board. Users can re-pin others’ finds, which include recipes, wedding dresses, party ideas and creative educational tips. The company will use the capital to build its service, including developing new technology and recruiting top engineers, designers and businesspeople.

In May, the company raised $100 million in a financing round that valued it at about $1.5 billion, a person with knowledge of the matter said at the time.

Bloomberg LP, the parent of Bloomberg News, is an investor in Andreessen Horowitz.

With assistance from Brian Womack in San Francisco. Editors: Jillian Ward, Reed Stevenson. To contact the reporter on this story: Ari Levy in San Francisco at [email protected]. To contact the editor responsible for this story: Tom Giles at [email protected].

![]()