U.S. Trump-Branded Hotels' Foot Traffic Fell in September Says Foursquare

Skift Take

U.S. Republican presidential nominee Donald Trump's hotels business has been caught in the crosshairs of arguably one of the more divisive campaigns in U.S. history.

But the latest impact to Trump-branded hotels from Trump's campaign might not be as severe as expected -- according to Foursquare data.

Data show that while, indeed, foot traffic is on the decline at U.S. Trump-branded properties (or properties that license and use the Trump name that Donald Trump does not actually own), this doesn't represent a bottoming-out for these properties.

Foot traffic for April through September 2016 was higher than December 2014 through February 2015, before Trump announced his presidential bid in June 2015 and was also higher than it was from November 2015 to February 2016, based on the data.

Foursquare looked at check-ins and location data from its 50 million active monthly Foursquare and Swarm mobile app users at U.S. Trump-branded hotels, resorts, and golf courses from April 2014 to September 2016. Foursquare looked at explicit check-ins, or those where users actually share their locations with Foursquare, as well as implicit visits from Foursquare and Swarm app users who didn’t explicitly share their location but have their app’s location services running in the background on their mobile devices.

The analysis didn’t include any Trump-branded properties outside of the U.S.

The resulting data show the share of visits that Trump-branded properties received as a percentage of total visits to hotels, golf courses, and resorts in the same geographic areas. For example, the study looked at the Trump SoHo’s share of traffic compared to other hotels nearby in New York City.

Swing State vs. Blue State Properties

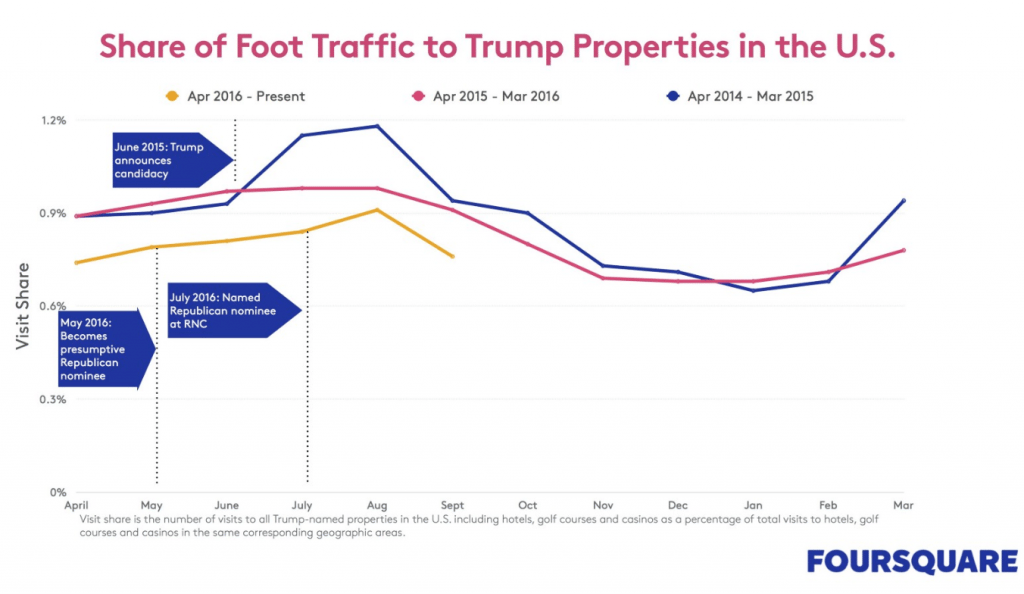

Overall visit share to U.S. Trump-branded properties was down 19 percent in September 2016 versus September 2014. While it's also apparent from the chart below that foot traffic for April 2016 to September 2016 is down from the same period in 2015 and 2014, it's not clear if Trump's campaign alone is to blame for the dip. Foot traffic from August 2014 to January 2015, for example, was declining and that was before the 2016 presidential campaign kicked off.

The sharp drop in foot traffic from August to September 2016 is mirrored by a similar drop that occurred from August to September 2014. Factors such as the end of the U.S. summer travel season could be at play with the August to September drop or there could be a variety of other reasons in the hotel market cycle that explains what's happening. "We are not in the political game, so we’ll leave it to the pundits to comment on what this means for the upcoming election and whether the trend lines are predictive," Foursquare said in a statement.

Still, Foursquare data show fewer women -- a group Trump has frequently targeted during his campaign -- have visited Trump properties in New York City and Chicago during the past six months than the previous year.

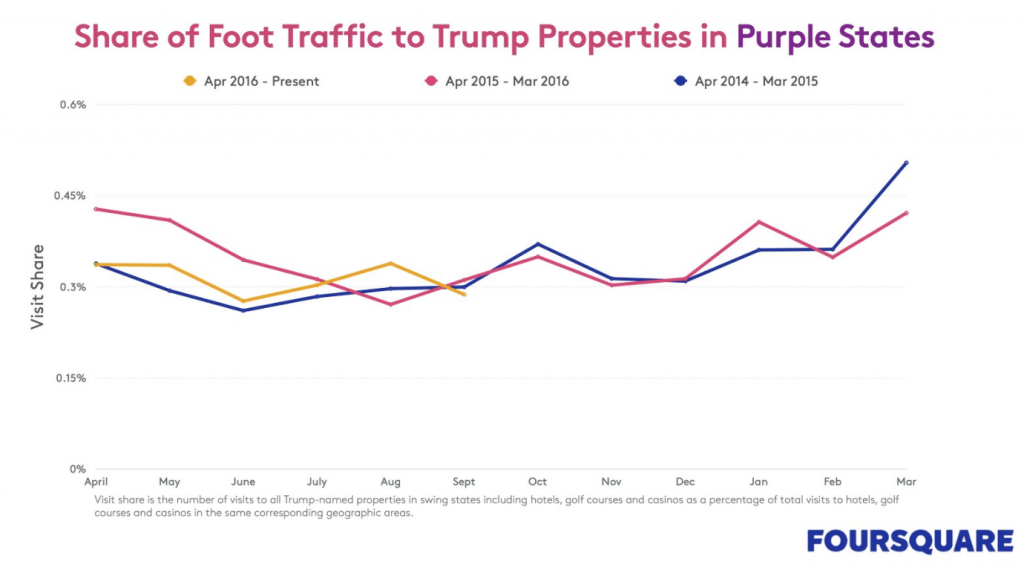

Trump-branded properties in "purple or swing states," or U.S. states that have voted for both Democrat and Republican presidential candidates in the past, saw a higher percentage of foot traffic between April and September 2016 than the same period in 2014. These include the Trump National Doral in Miami, Florida and the Trump International Hotel Las Vegas, Nevada. Traffic was sliding downward from June to August 2015 but was increasing from June to August 2016.

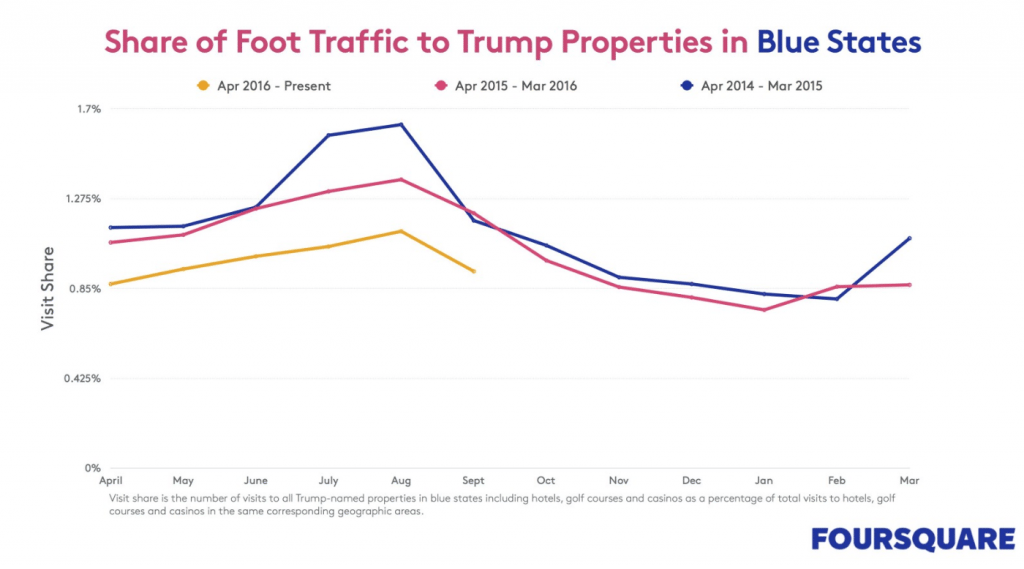

Foot traffic share to Trump-branded properties in "blue states," or those that traditionally elect Democratic politicians, continues to be down by a wider margin than swing states. As of September 2016 visit share to Trump properties was down 21 percent versus September 2014. These include properties in New York City and Chicago. Foot traffic followed a similar pattern for September 2014 to March 2015 and September 2015 to March 2016, the former period occurring before Trump's campaign.

It's worth noting that foot traffic does not equal hotel guests. Trump's Columbus Circle property in New York City is used regularly for campaign press events and is the site of protests and rallies.

A Skift survey in May also found Trump’s hotel business has clear challenges with its target market, with 56.9 percent of respondents indicating they were “less likely” to stay in a Trump-branded hotel because of Trump’s campaign.

Source: Foursquare and Swarm data