How Commission Yields Affect Hotel Profits: A European Case Study

Skift Take

This sponsored content was created in collaboration with a Skift partner.

Commissions on hotel room sales are an integral cost of doing business. But beyond surface-level revenue figures lies a more intricate puzzle that quietly shapes financial performance across the industry: Commission yields.

Yield, in the context of commissionable transactions, represents the percentage of total revenue that is paid out in commission. A lower yield means that for every commissionable room night, the hotel retains more revenue while a travel management company (TMC) earns less. Conversely, a higher yield translates to higher commissions for the TMC but a lower take-home revenue for the hotel.

In a market where every percentage point counts, tracking and understanding yield is essential. Whether a business model favors high volumes at lower rates or low volumes at premium rates, having access to real-time, precise analytics can be a game-changer.

Commission Yields on the Global Landscape: Why Small Differences Matter

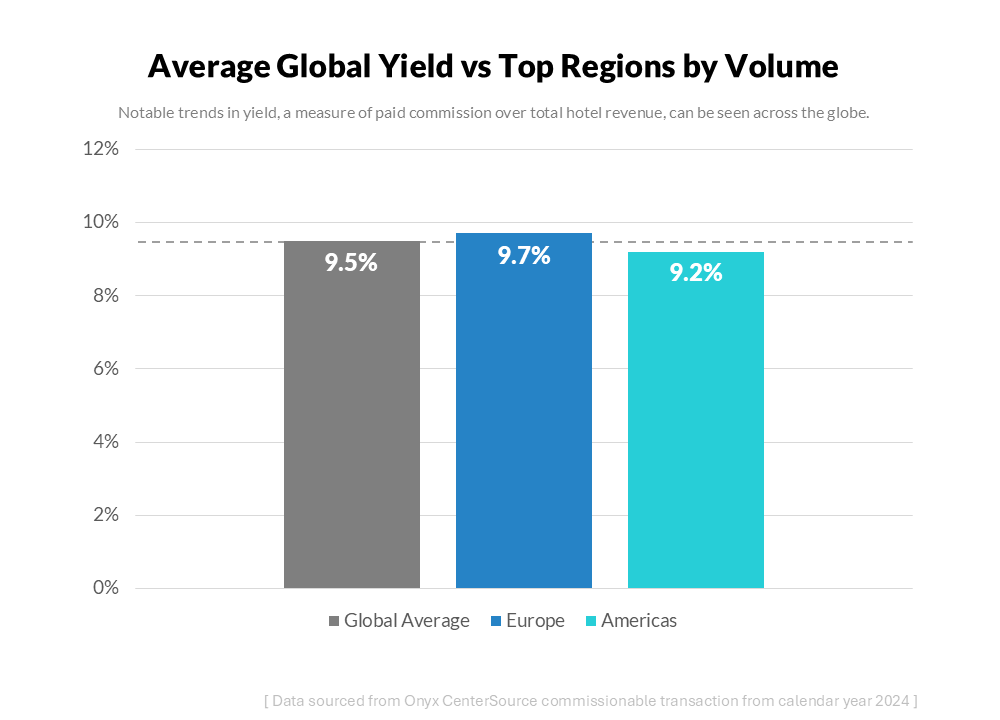

Globally, commission yields hover between 8% and 12%, but even minor variations can have significant financial implications. According to Onyx CenterSource data, European-based hotels recorded yields 0.2 percentage points (pp) higher than the global average at 9.7% in the 2024 calendar year, while hotels in the Americas were 0.3pp lower than the average at 9.2%. These fractions may appear negligible, but in an industry worth hundreds of millions, a 0.1pp shift could translate to over $100,000 in commission earnings or retained revenue.

European Commission Yields: A Deeper Dive

According to Skift Research, Europe is the world's most sought-after travel destination. Europe’s accommodation sector generated total revenues of $359 billion in 2024, and Skift Research estimates that revenue will rise to $384 billion by 2026.

The EMEA region not only leads in revenue, but it is also outperforming the global average in terms of revenue per available room (RevPAR), according to the Skift Research 2025 Global Travel Outlook. In 2024, RevPAR reached 123% of 2019 volumes on average, compared to 113% globally.

Of course, the region is not a monolith, which is why hotels and TMCs alike need nuanced and sharp data analysis capabilities. Given that 58% of hotel revenues come from third-party bookings in Europe — compared to 43% in the Americas — understanding commission yield variances is critical.

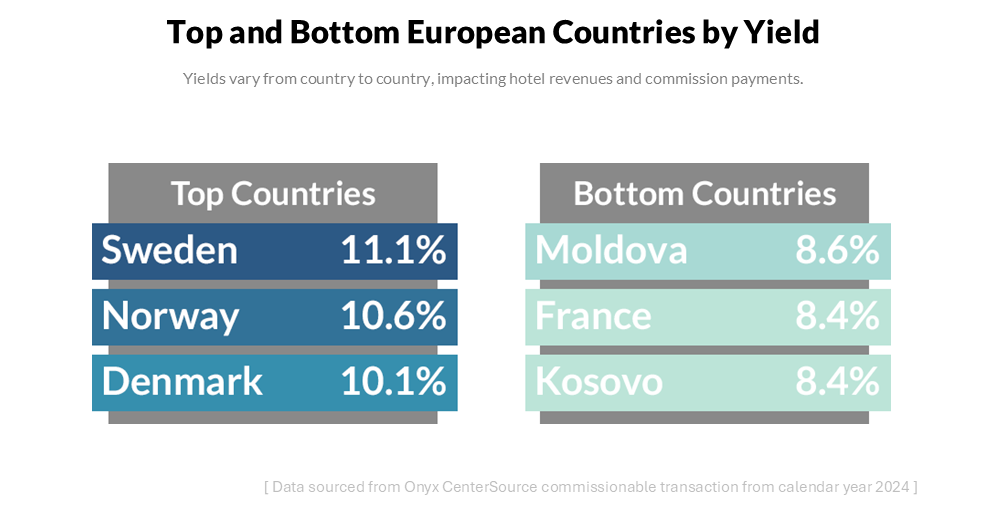

Though the regional average commission yield stood at 9.7% in 2024, the numbers varied significantly by country. Hotels in Sweden, Norway, and Denmark led with the highest yields, offering lucrative opportunities for TMCs. In contrast, Moldova, France, and Kosovo saw the lowest yields, making them less attractive for commission-based revenue strategies.

Other Factors Driving Commission Yield Variances in Europe

While commission yields vary by geography, they’re influenced by a range of more deeply nuanced factors — including hotel ownership structures, classification, and urban versus suburban locations — which play a critical role in determining commission levels.

In Europe in particular, several important trends highlight the variability in potential commission yields that hotels and TMCs should consider:

- Chains vs. Independents: For large global chains, commission structures are often dictated at the corporate level, with agreements spanning multiple properties. These deals frequently bundle upfront commissions with backend rebates, marketing funds, or performance-based incentives. In contrast, independent hotels have far more flexibility. According to Skift Research data, nearly 60% of hotels in Europe are independent, compared to fewer than 30% in the U.S. Since their commission levels are often dictated by local competitive pressures rather than broad corporate agreements, independent hotels have greater control over revenue distribution, which may lead to more variability in yields in the region on a hotel-by-hotel basis.

- Urban vs. Suburban Hotels: According to Onyx CenterSource data, European hotels have a disproportionately high percentage of commissionable transactions occurring in urban locations — 65% versus the global average of 45%. Given that urban hotels generally have higher average daily rates (ADRs), this naturally leads to higher commission yields.

Meanwhile, in the Americas, the bulk of commissionable stays take place in suburban settings, where ADRs are, on average, $80 lower than in urban areas. This discrepancy directly influences the overall yield in these regions.

Commission Yield Strategies Across Hotels and TMCs

Hotels and TMCs approach commission yields in different ways. It’s a delicate balance, and depending on a company’s business model, there are numerous ways that they might calculate yield.

For instance, luxury and upscale properties rely more heavily on travel agents and independent contractor networks and typically offer higher commission rates in exchange for a steady flow of high-value guests. These properties also command higher ADRs, making them more attractive for commission-driven businesses.

Furthermore, not all TMCs operate the same way. Some agencies rely heavily on supplier commissions to offset client fees, while others structure their earnings through management fees and negotiated rates. The size of the agency and its client base can significantly impact how commissions are structured and shared. Large, multinational agencies often have tiered agreements where commissions vary by volume, while smaller agencies may depend more on standard industry rates. Commission earnings and yield remain powerful tools TMCs use to drive supplier and point-of-sale booking strategies, both systemically and, in some cases, through advisor-driven offerings during the sales process.

Using Data to Optimize Commission Yields

By analyzing real-time data, businesses can compare their performance against competitors, pinpoint discrepancies, and uncover opportunities to enhance their commission structures.

With the help of benchmarking, the OnyxInsights Yield Dashboard enables hotels and TMCs to identify opportunities to align their commission yields with industry standards, optimize their revenue strategies, and maximize profitability.

The tool offers granular insights, allowing users to make data-backed decisions to improve revenue retention and commission earnings while maintaining competitive positioning.

In the commission game, knowledge isn’t just power — it’s profitability.

“The Data Snap” is a recurring article series that paints a clearer picture of the dynamic hotel booking landscape, empowering hotels and agencies to make data-driven decisions that help them build productive partner relationships and drive more revenue.

OnyxInsights offers a comprehensive view of the industry landscape, enabling hotels and TMCs to make well-informed decisions and better serve their clients and partners. Onyx CenterSource processes over 100 million transactions annually on behalf of 200,000 agencies and 150,000 hotels globally, representing nearly $2.1 billion in hotel commission payments. Visit onyxcentersource.com to learn more.

This content was created collaboratively by Onyx CenterSource and Skift’s branded content studio, SkiftX.