Rising Hotel Rates Don’t Always Mean Rising Commissions

Skift Take

This sponsored content was created in collaboration with a Skift partner.

For an introduction to “The Data Snap” series, click here.

“Correlation is not causation.” This age-old rule of data analysis is remarkably salient in 2024 as inflation and other economic factors are changing the relationship between hotel rates and commissions paid to travel management companies (TMCs). An unprecedented divergence of these two metrics is forcing travel businesses to rethink forecasting and revenue management strategies.

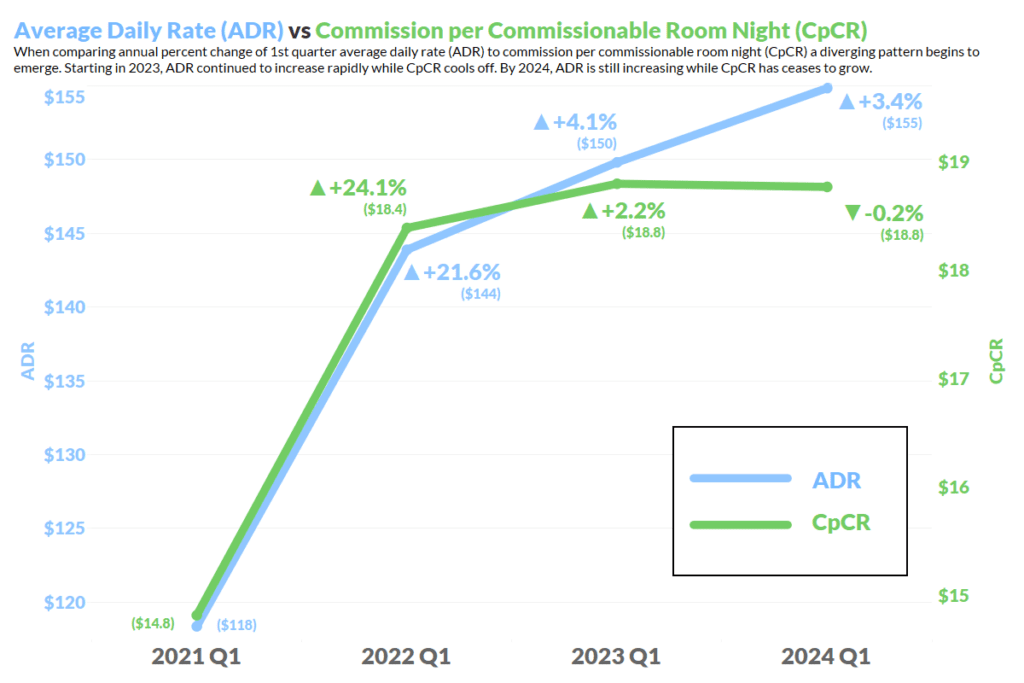

According to Onyx Insights data, starting in 2022, hotel average daily rates (ADR) started to grow at a faster rate than commissions per commissionable room night (CpCR). CpCR refers to the average commission income that TMCs earn for each room booked that is eligible for commission. Because these two measures have historically increased or decreased in parallel, TMCs could accurately forecast commissions as a percentage of ADR.

However, in 2023, while ADR continued to rise, CpCR began to stabilize, indicating a significant shift. This divergence suggests that even as hotels charge more per room, the commissions paid to agencies booking those rooms are not increasing proportionally, presenting a new challenge in revenue management.

Where Is the Greatest Impact?

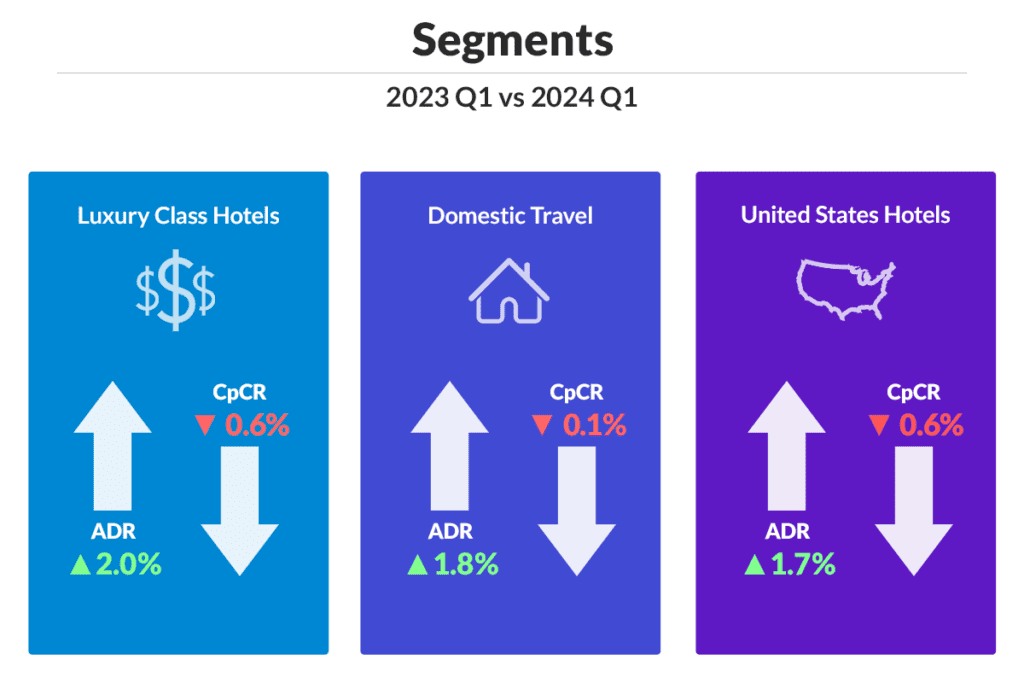

Commissions are not only diverging from ADRs but also declining in the luxury and domestic segments globally and in the U.S. across all sectors. TMCs that manage a lot of business in these sectors in particular should be on the watchout for changes in the market that may impact their potential to sell commissionable rates.

Why Is ADR No Longer a Reliable Indicator for Commissions?

Many potential factors may be causing rates to diverge from commissions, but these three trends may help explain why the direct comparison between these two metrics is becoming increasingly difficult to reconcile.

Hotels might respond to each of these cases by selling more bulk rates to TMCs (which are typically non-commissionable) or doubling down on direct booking strategies that result in fewer commissionable rates altogether:

- Occupancy is lagging rate growth: In its 2023 State of Travel report, Skift Research wrote that “unlike other recessions, where occupancy and ADR recover in pace with each other, the Covid recovery has seen ADRs lead occupancy.”

- Corporate travel is still unpredictable: On a global level, corporate travel spending is coming close to 2019 figures, in part reflecting higher hotel costs. Yet 36 percent of business travelers told Skift Research that they thought it would be at least three years before their companies returned to 2019 spending levels, if ever.

- Travelers are shopping around more: According to a quarterly Skift Research survey of U.S. travelers, a majority said that they booked directly with hotels in Q1 2024 (56 percent); however, that number declined about 5 percentage points on average from 2021 to 2024.

More Accurate Data Analysis = A Better Way Forward

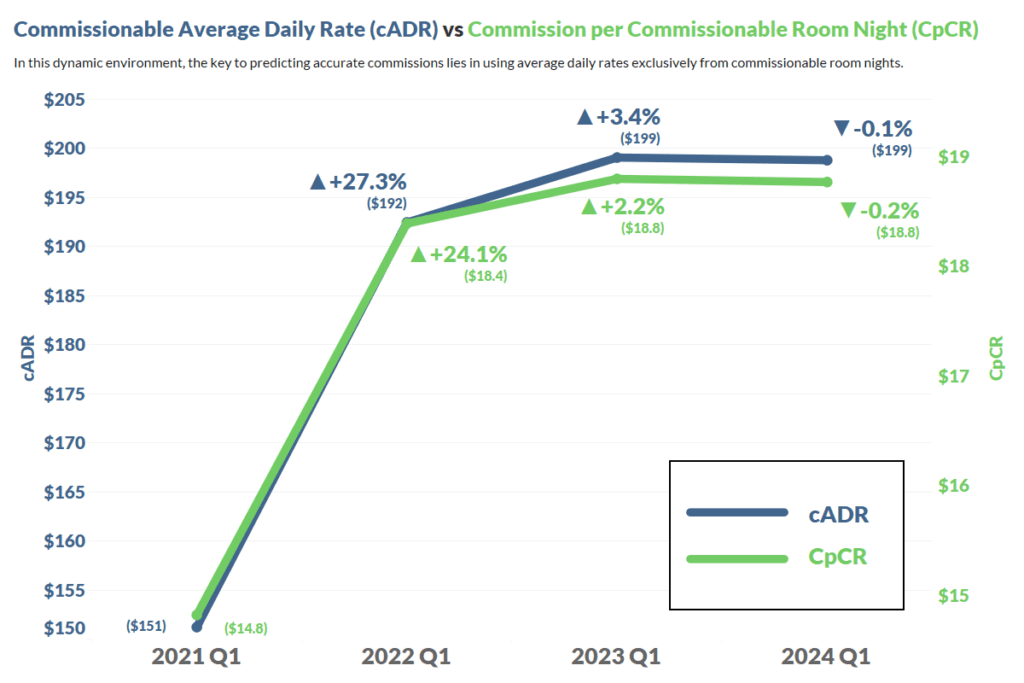

With more non-commissionable rates potentially on the market, a direct comparison of CpCR with all ADRs is no longer valid. While it’s always good practice for TMCs to evaluate if they can direct more share to fewer preferred suppliers to mitigate commission impacts, doing so could also potentially impact TMC relationships with their corporate buyers and travelers if they limit hotel choices.

A better solution is to pivot by using more precise data.

For example, comparing commissionable ADR (cADR) with CpCR shows trendlines more closely in step with each other. Unsurprisingly, looking at commissions paid in comparison only to rates that are eligible for commissions offers TMCs a much more accurate view into their revenue forecasts.

By using metrics that trend together more directly, TMCs will be able to forecast their revenues more accurately without upsetting the balance of their supplier relationships — or by extension, customer perceptions.

As the hospitality landscape undergoes significant transformations, the need to adapt revenue management strategies and analysis has never been more critical. Successfully navigating this new terrain will be a pivotal determinant of future success.

“The Data Snap” is a monthly article series that paints a clearer picture of the dynamic hotel booking landscape, empowering hotels and agencies to make data-driven decisions that help them build productive partner relationships and drive more revenue.

Onyx Insights offers a comprehensive view of the industry landscape, enabling hotels and TMCs to make well-informed decisions and better serve their clients and partners. Onyx CenterSource processes over 100 million transactions annually on behalf of 200,000 agencies and 150,000 hotels globally, representing nearly $2.1 billion in hotel commission payments. Visit onyxcentersource.com to learn more.

This content was created collaboratively by Onyx CenterSource and Skift’s branded content studio, SkiftX.