Accor's Investor Day: 7 Top Slides From the Hotel Group's Presentation

Skift Take

Accor held a day of presentations on Tuesday in Paris for investment analysts, offering an array of insights into strategy at the $8.7 billion hotel group.

For developers, a key detail was that Accor plans to open more than 1,200 hotels in the next five years, adding to the 5,400 it has now.

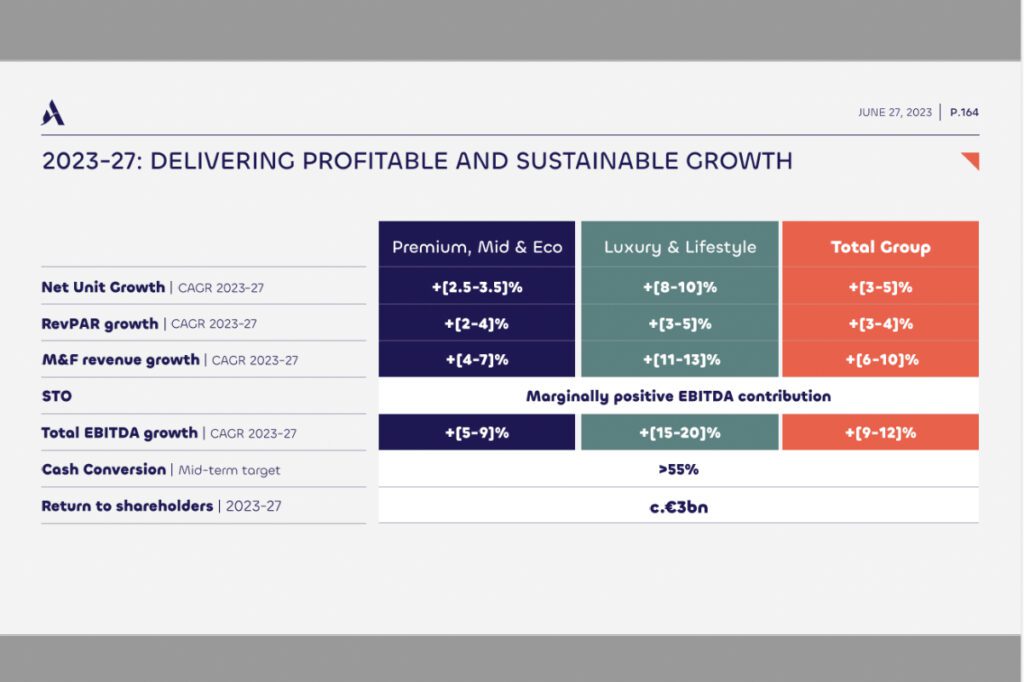

For investors, a key detail was that Accor's management had become more optimistic. Executives said they felt confident that actions they're taking to fine-tune the company's organization and operations would help boost EBITDA by between 9% and 12% a year through 2027 — starting from this year's projected level of between $1.01 billion and $1.05 billion (€920 million to €960 million).

The company's six-hour event, with a 172-slide presentation, also included several strategy insights. Seven slides stood out to us. Here they are.

1. Rebound in Net Rooms Growth

Accor projected it would return to its pre-pandemic level of net unit growth of between 3% and 5% between now and 2027 on average. A 4% or higher target would be an improvement. In the year through March 31, it grew its room count by only 2.9%.

Notably, Accor seeks to increase the share of its portfolio in the luxury and lifestyle segments.

For its other hotels, it plans to expand its use of the franchise model, rather than the management model where it's more hands-on, because more real-estate partners in some markets prefer franchising.

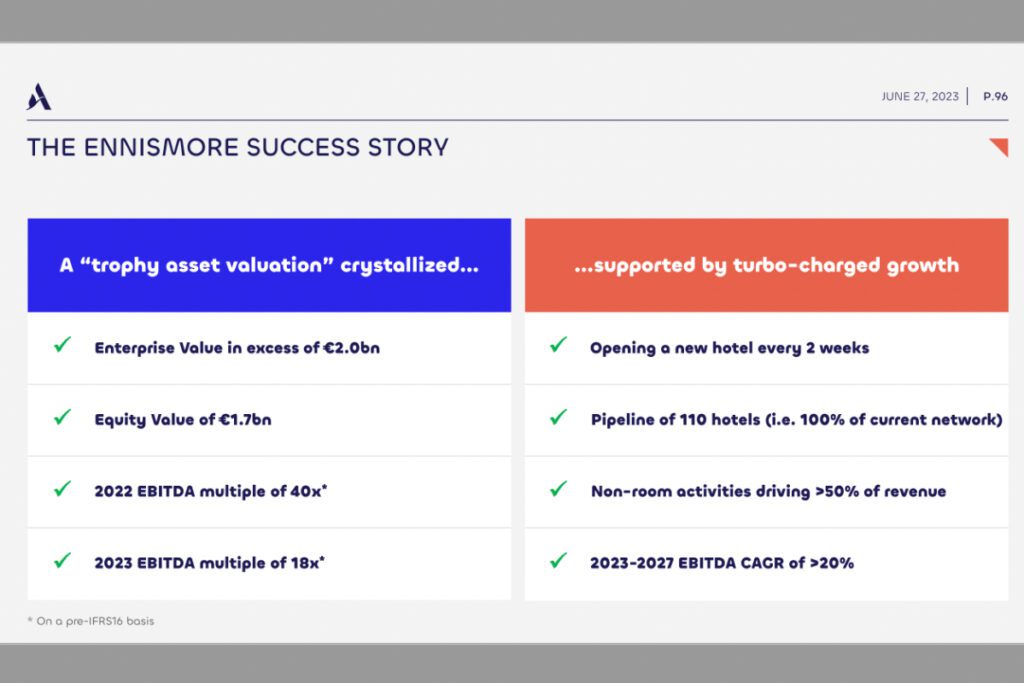

2. Data on Ennismore

Accor's buzziest joint-venture company is Ennismore, a set of 17 luxury and lifestyle brands, such as Hoxton and Delano. For the first time, it revealed some key numbers about the group's performance.

One highlight: Ennismore's EBITDA is projected to be greater than 20% a year through 2027.

Ennismore plans to roughly double its network in the next few years, adding 110 hotels (with 30,000 rooms) to its current 137 hotels (with 24,000 rooms).

Last September, Ennismore founder and co-CEO Sharan Pasricha said on-stage at Skift Global Forum that he believed North America offered the biggest opportunity for Ennismore.

Accor said on Tuesday that Ennismore has 39 hotels in North America, with 18 in the pipeline there.

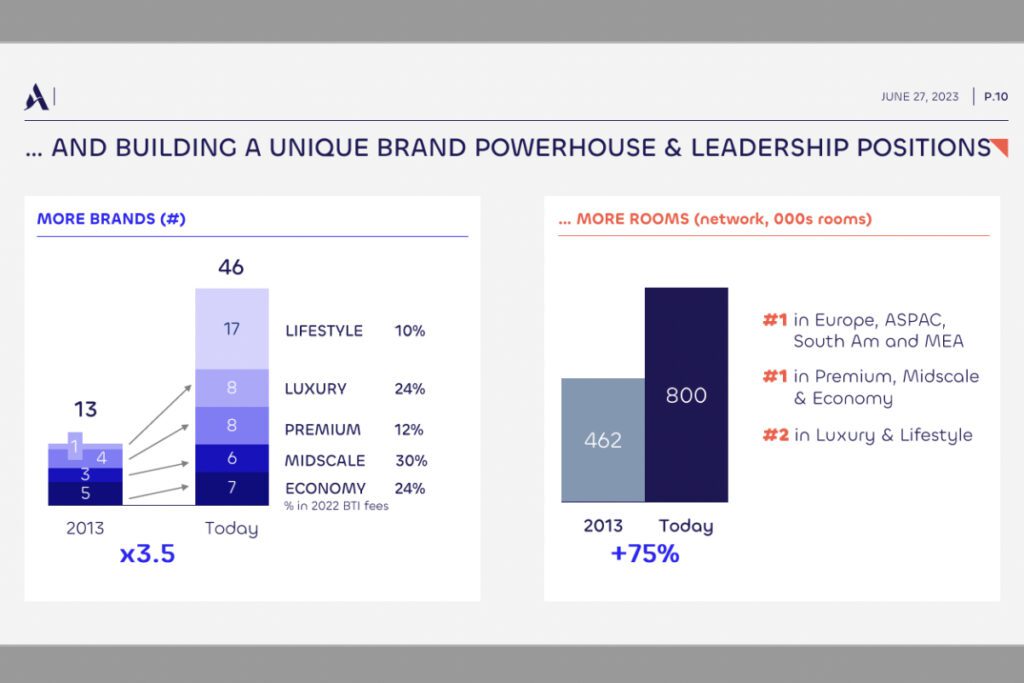

3. Broadened Brand Portfolio

Accor has 46 brands, more than any other hotel group, and a sharp rise from the 13 it had when Sébastian Bazin became CEO in 2013.

One chart captured this growth, particularly the group's expansion into luxury and lifestyle properties as it nearly doubled its room count since 2013.

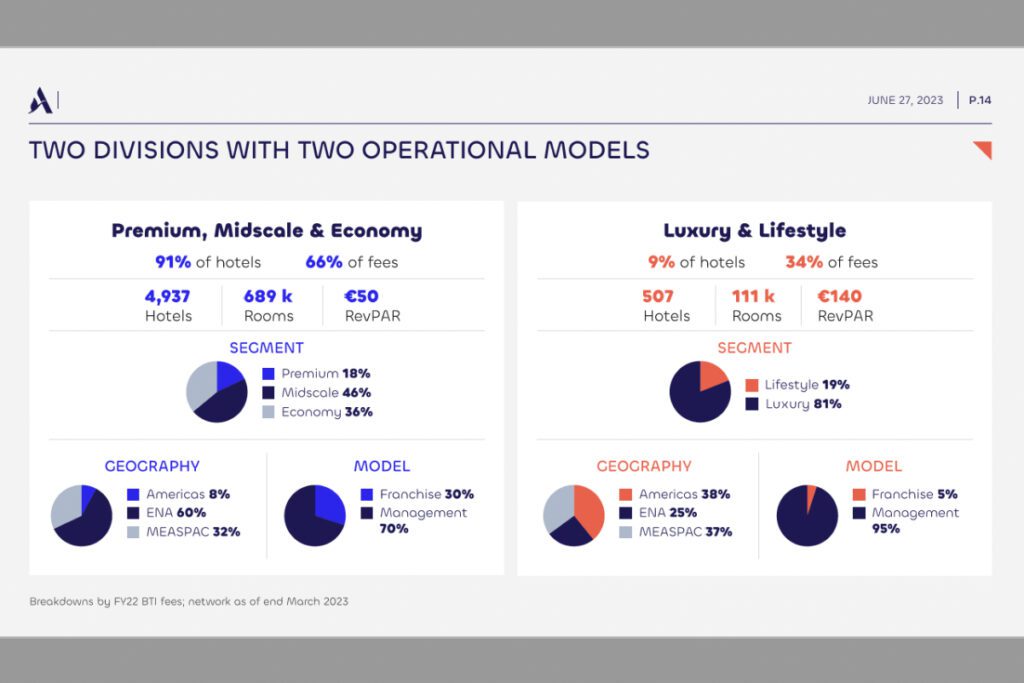

4. Completed Re-Org

To better manage its brands, Accor mostly completed a re-organization around January that split its hotel brands into two divisions. One slide captured the differences between the divisions.

5. The U.S. Isn't a Top Target

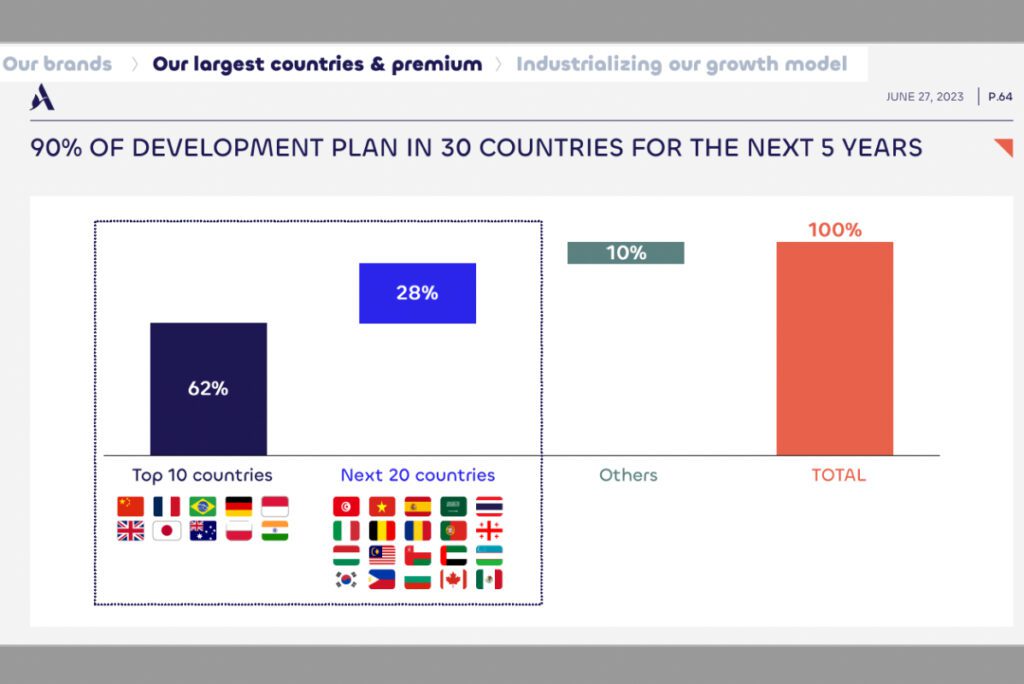

The Paris-based hotel group isn't well known in North America, and that may continue to stay true for some time.

A surprising chart highlighted the 30 countries that were top on the list for Accor's development plans for its economy, mid-scale, and premium hotel group. The U.S. didn't make the cut.

The story's more promising for its luxury and lifestyle division, which is more assertively hoping for growth in North America.

6. Online Travel Agencies Should Worry

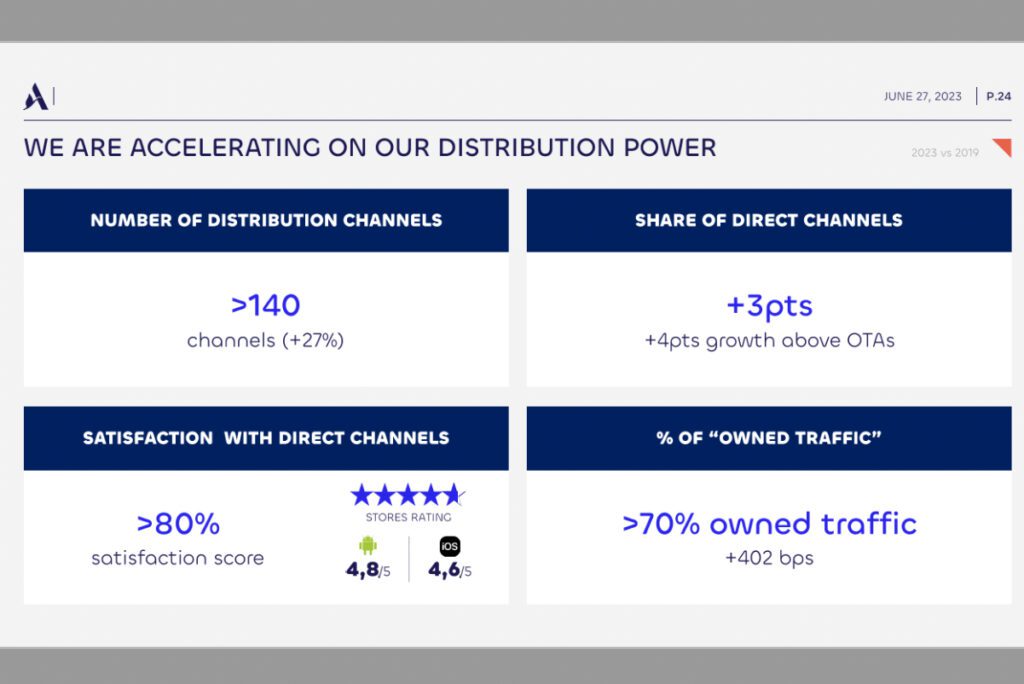

Perhaps the most fascinating presentation of the day, from a business strategy perspective, was by Alix Boulnois, chief digital officer. A key takeaway was that Accor had made internal changes to improve its skill at distributing its rooms and rates more profitably.

One remarkable statistic related to how it had grown its share of direct bookings, which are typically cheaper for Accor than third-party bookings, at a pace 4 percentage points above the growth in bookings via online travel agencies. In other words, it boosted its direct bookings compared with the pre-pandemic era.

7. Reducing Carbon Emissions

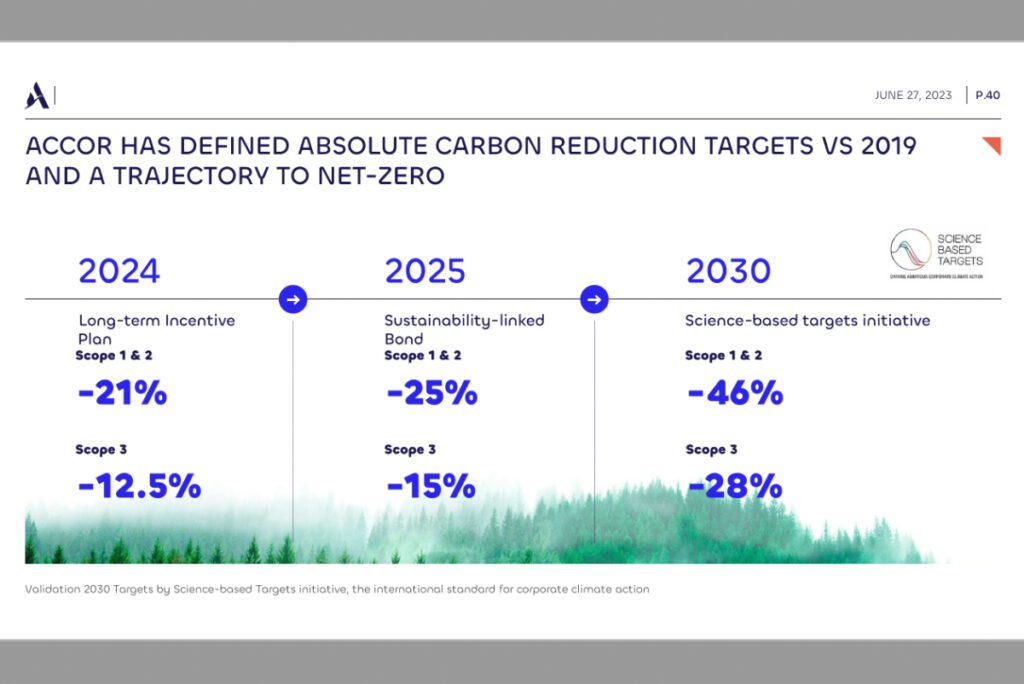

The performance statistic the next generation may most care about is how well companies are cutting their carbon emissions today. Accor claimed some early progress on reductions and reaffirmed its goals.

Its updated reporting was in line with the analysis in Skift Research's recent report. See: "Hotel Companies Show Progress on Greener Emissions Accountability: New Skift Research."