Wyndham Believes Banking Crisis Won't Hurt Its Hotel Pipeline

Skift Take

Wyndham's executives believe that investor concerns that the U.S. banking crisis will hurt its hotel development are groundless.

The world's largest hotel franchisor said on Thursday during an earnings call that it hadn't seen signs that March’s bank collapses — which led to deposit flight and tightened lending in the U.S. — had hurt the availability of financing that underpins the development of its U.S.-based select-service hotels.

"We feel really strong about the 2023 financing situation," said Michele Allen, chief financial officer.

In response to multiple analyst questions on this topic, the Parsippany, New Jersey-based hotel operator noted that between a third and a half of its hotel conversions and new constructions had financing in place.

"We're not concerned about financing largely for new construction projects that don't currently have financing in place," Allen said. "There certainly seems to be a good amount of capital still available. And on the conversion side, ... we've got 40 deals executed since that March 10 date [the peak of the banking scare]. That's actually up versus the same time last year. And then we're also seeing buy/sell volumes across our portfolio increase year-over-year."

Some analysts feel the claims makes sense.

"Fears over the pipeline and net unit growth outlook are overdone," wrote Steven Pizzella, a research analyst at Deutsche Bank, in a report released before the earnings call.

Yet the financing topic for hotel development was top of mind for other analysts on Thursday's call.

Yet Wyndham's executives argued that their owner and developer community had been somewhat insulated from the tightening in U.S. credit. Many of its franchisees are seasoned pros with well-capitalized organizations with long-standing relationships with regional banks, they said.

The executives also noted that rising interest rates affect all types of commercial real estate, but hotels are perceived by lenders as relatively attractive. Hotels can continuously adjust nightly rates to offset some of the rising inflation or interest rate impacts. That helps encourage loans for hotel development.

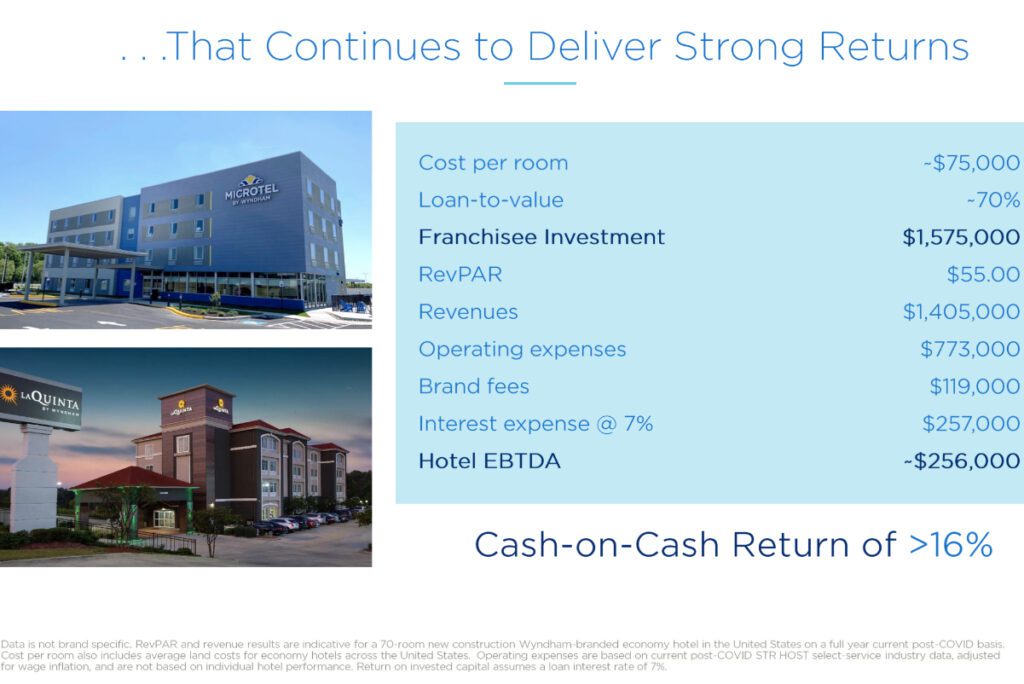

Wyndham on Thursday used a hypothetical example to illustrate. In a case where new financing to construct a new U.S. hotel had an interest expense of 7 percent — notably above the recent decade-long average — a 70-room property flagged with one of Wyndham's economy brands in the U.S. would still generate an average cash return of 16 percent a year on a $1.5 million loan to a typically qualified franchisee.

This rough calculation assumed average U.S. land costs for new construction and accounted for today's wage inflation. That return is favorable compared to other potential commercial real-estate investments today, executives said.

Net room growth for the quarter was up 4 percent, year-over-year.

Robust Quarter for Wyndham

Wyndham ended the quarter on March 31 with above-average results relative to its company history, producing $67 million of net income on $313 million in revenue. The company produced adjusted earnings before interest, taxes, depreciation, and amortization of $147 million.

Strong pricing thanks to the pandemic surge in travel has helped the business. Wyndham saw its global revenue per available room — or RevPar, a key industry metric — rise 11 percent compared to 2019, thanks primarily to stronger pricing power.

The company's economy brands such as Microtel and Super 8 saw especially strong gains, nearly outpacing the approximately 14 percent inflation in the U.S. dollar since the pre-pandemic period.

The pricing strength continued in April for most of the company's roughly 9,100 hotels.

"Over the last four weeks through April 22, our RevPAR was up 2 percent versus last year and up 10 percent over '19," said Geoff Ballotti, president and CEO.