Watch Video: Why Hotel Brands See Lots of Room to Grow in Luxury and Midscale

Skift Take

Skift's Senior Research Analyst Pranavi Agarwal and Senior Hospitality Editor Sean O'Neill went live this week on LinkedIn to discuss Skift Research’s latest report that looks at hotel performance and unit growth by chain scale in times of crisis and recession in the U.S.

Key topics of discussion were the expected resilience of the luxury segment in a potential 2023 recession — unlike what has been seen in prior downturns — as well as portfolio development of the branded players towards the opportunistic luxury and midscale space. Many of the themes discussed will be examined in further detail at our Future of Lodging Forum in London on March 29.

We also provide a short excerpt from the full report here, focussing on the market share opportunities for the branded players.

Brands are pushing further into the luxury space — globally, branded luxury rooms account for 6% of the total branded supply across all the chain scales, but 8 percent of the pipeline, with majority of growth coming from luxury resort hotels in Caribbean & Mexico and from Asia Pacific.

During fourth quarter 2022 earnings, Hyatt management said that in 2022, 66 percent of their gross room additions were in the luxury, lifestyle, or resort properties, with “nearly 135,000 luxury lifestyle and resort rooms now part of our portfolio, a number that is larger than the entirety of our portfolio just a decade ago”. IHG management said that their luxury and lifestyle estate represents 13% of their existing rooms, but 20 percent of the pipeline, suggesting further expansion in the luxury space. Accor has said that luxury “which is always getting a larger share of the pipeline” accounts for 40 percent of the pipeline (as of third quarter 2022 earnings), having grown from 25 percent of the pipeline four years ago.

In addition to luxury, the other great whitespace opportunity is in midscale or premium economy.

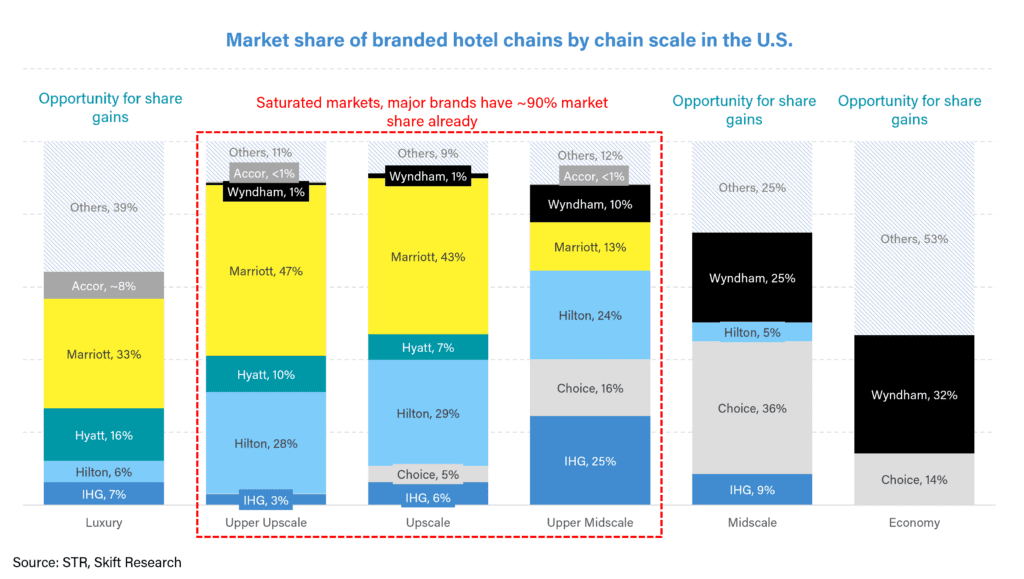

Market share analysis of the branded hotel room supply by chain scale shows that whilst upper upscale, upscale, and upper midscale segments are largely saturated, with the major hotel brands already having 90% market share, it is the luxury, midscale, and economy segments which offer the greatest whitespace opportunity for share gains.

In recent months, we have seen a flurry of new brand launches in these opportunistic segments.

In the midscale/premium economy space, which Dimitris Manikis of Wyndham Hotels has called “a segment too important to ignore”, many hotel chains have launched their first conversion brand in this segment such as Hilton with its new conversion brand Spark. Chris Nassetta, CEO of Hilton has said that “Premium economy represents a large and growing segment of travelers, totaling nearly 70 million annually in the U.S. alone […] It’s the biggest segment in the U.S. It’s the biggest segment in Europe.”

Matt Schulyer of Hilton further added that “40 percent plus of the U.S. hotel industry is in this premium economy space. And we don’t have a product there. And yet we think we can now because the consumer is evolving to seek value. And post pandemic travel is important for a big part of the consumer. Value for money is important. You marry these two together and having a product in the economy sector makes a lot of sense.”

Other major brands have also expanded into this segment, with Marriott acquiring City Express in the Caribbean and Latin America and Accor launching Handwritten Collection. In luxury, in 2021, Accor launched a new conversion brand called Emblems and IHG launched Vignette Collection.

Skift Research provides proprietary research, analysis, and premium data tools for travel industry leaders and their teams to better understand their industry and the outside forces driving change. Click here to see subcription options.