Skift Take

During the past weeks, all eyes have been on the Middle East. The players have certainly delivered, and it feels like the region is on the cusp of something much bigger as well. This is what it means for the travel industry.

Skift Research Director Wouter Geerts spoke on Wednesday at Skift Global Forum East in Dubai about the state of travel in the UAE and the broader Middle East. Below is a version of his talk, as well as the presentation he delivered in PDF format.

We used to talk in pre-pandemic years about how travel is moving East, with the epicentre and greatest volumes of travel no longer happening in North America or Europe, but in Asia. The pandemic has shifted that momentum back somewhat, and the Middle East has really taken on the role of connecting parts of the world.

The top 10 routes for 2022 compared to 2019 you can see how the Middle is now so relevant: 7 of the top 10 routes originate or arrive in the Middle East, or do both.

At Skift Research we have been tracking the performance of the travel industry since the start of the pandemic. We track demand performance in 22 countries, using data from 20 different data partners from across all travel sectors. We are seeing how the Middle East has recovered, and other regions are also fully or near-completely recovered. There is a real feeling now – with the exception of some parts of Asia – that we have moved beyond the pandemic recovery and start to plan for longterm growth again.

That’s not to say that there aren’t any roadblocks and that it will be smooth sailing from here. Make no mistake about it, we continue to find ourselves in uncertain times. Large parts of the world are on the brink of a recession and inflation is extremely high in all corners of the globe.

The high inflation, as well as returning demand, has resulted in extremely high prices for travel products. The UAE, for example, has had the highest hotel prices compared to pre-pandemic levels of all major travel economies.

While we know that the luxury traveller – which is the UAE’s bread and butter – tends to be more resilient to rate increases (and Richard Clarke of Bernstein will likely talk about this more later today), we are seeing travellers being put off from traveling at all, or finding cheaper alternatives for flights and accommodation.

In this light, with demand coming back but with worries about inflation, recession and high prices, it is interesting to take a closer look at some of the targets set by key destinations in the region for the coming decades.

The Middle East is driving growth in the travel industry, with countries looking to diversify their economic output and looking at tourism as a sustainable way to grow and insulate their economies moving forward.

Dubai International airport has seen major expansion, and the country doesn’t just want to be a hub for connecting flights, but aims to expand hotel stays to 40 million per year in the next 10 years.

Saudi Arabia has also recently announced a massive expansion of its Riyadh International Airport, and wants to attract 100 million travellers by 2030.

Qatar and Oman are also seeing the importance of tourism and have set targets to triple and double visitor numbers in the next decades.

There are some conditions which will determine whether these targets are achievable, and some levers that these destinations can pull to move towards these targets. I will spend the rest of my time with you today to walk through some of the most important conditions.

Air connectivity will be paramount to achieving these targets, and we have seen strong expansions here. The good news is that air connectivity is pretty much recovered already to the Middle East and is now only 6% below pre-pandemic levels.

The UAE signed a historic agreement with Israel, and the diplomatic crisis with Qatar was resolved, which have boosted demand for travel in the region.

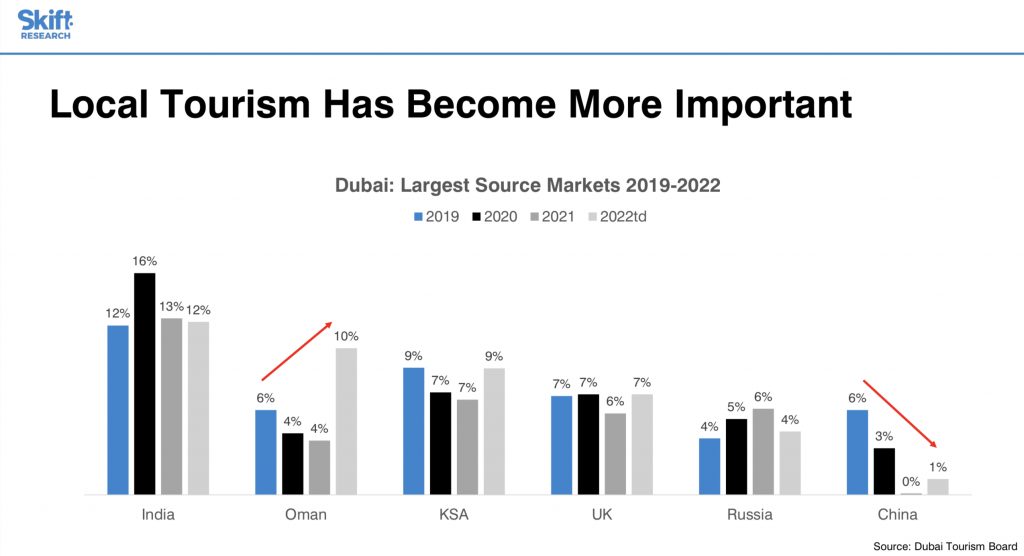

We are seeing that local tourism is becoming more important, with arrivals from Oman increasing considerably, while China for now remains very much down.

But that’s not to say that China will not come back, and actually what more and more destinations in this region are understanding is the importance of making their destination attractive and easy to access for travellers from two countries in particular: India and China. They were already important source markets before the pandemic, these two countries have massive potential for future growth.

And as other regions like Asia and Africa further develop economically, there is so much potential for the Middle East. The region is well-positioned geographically to capture growing demand for travel, and potential increases in travel spending, in developing regions like Asia and Africa where average spending per trip today still lags more developed countries.

The region could become a true superconnector between all regions in the world due to its central location and as travel demand becomes less West to East, and more hub and spoke from all parts of the world.

Now, I talked about the World Cup already, and these large events are needed for the region to continue attracting more travellers. We can see the not-very-surprising impact that the World Cup has had on flights to Qatar over the past weeks, but what is interesting is that it has also boosted demand for accommodation in Dubai, and especially at the lower end of the market. The World Cup has attracted a different type of traveller, and is therefore not necessarily cannibalizing your usual traveller to the region.

And the diversification of traveller types will be necessary. Of course, the Middle East wants to attract high value travellers, and it is unlikely to lose its image as a luxury destination, but a more diverse and therefore resilient traveller segmentation will benefit growth in the coming years. This means that the infrastructure needs to change as well.

The capacity of flights into the country has shifted towards more low-cost-carriers during the pandemic. This will help to attract more travellers and opens up the destination as a viable option to more consumers.

New Types of Travelers

And across the region we are seeing the accommodation offering and mix changing. Dubai remains a very upscale and luxury hotel market, but the UAE as a whole has seen the number of active short-term rentals more than double since the start of the pandemic, and this is the same in many other markets. This will help attract other types of travellers who are looking for more local and experiential experiences.

This will also provide opportunities with the new business traveller in mind. One thing cities like Dubai, Abu Dhabi and Doha have been strong historically is business travel, but traveling for business has changed.

With more remote work and more flexibility, the data is showing the rise of truly blended travel, with business trips increasingly including a weekend, while leisure travellers are more often taking their laptop on their trips to be able to extend a trip by working a few days from their destination. And so business travellers no longer just stay in a 5-star hotel from Monday to Friday, but are covering a much wider range of possibilities.

Attracting these new types of travellers will allow the Middle East to see an increase in the length of stay, more in-destination spending, and a better dispersal of travellers away from the traditional tourist hotspots.

All this will help destinations like Dubai move beyond their stereotype of just being a shopping destination, or just a religious destination in the case of Saudi Arabia. Attracting a broader mix of travellers, and dispersing them better across the complete offering will be paramount for this region to continue growing in a sustainable way.

And talking about sustainability, over and over again survey respondents tell us that they want more sustainable travel. And the pandemic was set up as an opportunity for the industry to build back better, to put sustainability more at the core of travel as it saw demand come back.

It’s becoming increasingly clear that whatever this opportunity was, we have as a society and industry failed to really grasp it, with pent-up demand and short-term injections of much needed cash much more important.

The Middle East still has room to improve for sure, as do all destinations. According to an Index put together by Euromonitor International, the region is quite skewed to the right. But at the same time many initiatives coming out, like the Urban Plan 2040 for Dubai really looks at sustainability far more as a core component of any future growth.

If the region can become a superconnector between different regions, a melting pot of all surrounding areas, if it can diversify its offering to attract a wider range of travellers and to insulate itself from setbacks which will undoubtedly come, and if it can make sure that quantity isn’t the be all and end all, it will be well on its way to achieve the targets set.

But I want to leave you with a final thought: Does it really matter if targets are not met? If it helps the economies of these countries diversify and grow, if it preserves and strengthens societies and cultures, if it can help to provide a more sustainable future and connected world, let’s not focus too much on the numbers and just look at the potential ahead for this region.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: sgfe2022, skift live

Photo credit: Skift Research Dirctor Wouter Geerts on stage at Skift Global Forum East on Dec. 14, 2022 in Dubai. Skift