Travel's Final Push to Full Recovery Stalled: New Skift Travel Health Index

Skift Take

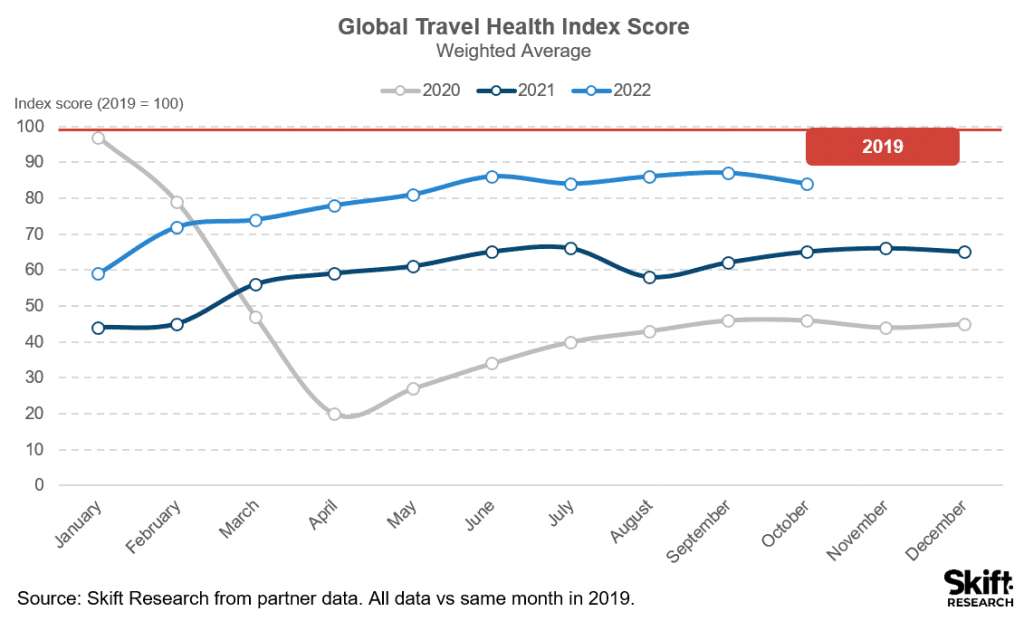

Skift Research has been tracking the performance of the major travel sectors in 22 countries since the beginning of the pandemic in the Skift Travel Health Index. We have seen a steady upward trend, but the final push to full recovery seems more stubborn than we initially thought.

While there was continuing talk of strong demand at our Skift Aviation Forum this week, the latest Index Highlights report shows that there are enough uncertainties and headwinds to suppress overall growth of the travel industry. The Index has now been sitting around the 85 percent mark since June, and has not been able to break through that metaphorical ceiling.

In October, the global average score of the Skift Travel Health Index dropped three percentage points to 84 percent compared to October 2019. Although this is a month-over-month decline, it is still 19 percentage points higher than a year ago.

Aviation Sector Performance

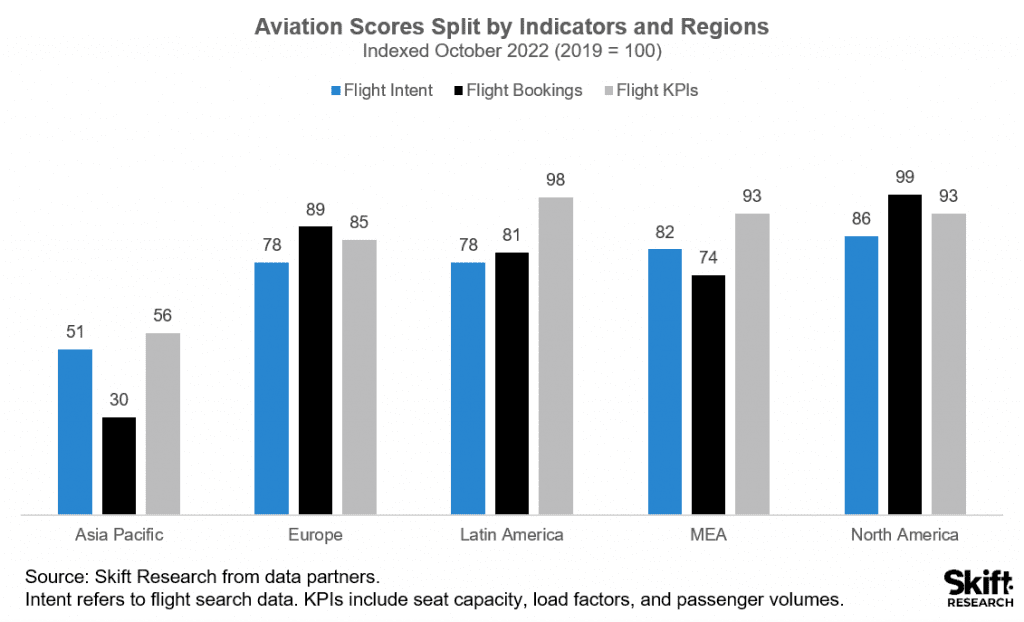

The Index consists of more than 80 indicators provided by 20 data partners and taken from public sources, and so we can split and slice the indicators in ways that provide further insight into performance within each sector. Here we provide a quick look at the aviation industry performance, with discussions on other sectors found in our latest report.

The Asia Pacific region is seeing weakness across all stages of the travel experience, with searches and actual performance (including data for seat capacity, load factors, and passenger volumes) at around half of pre-pandemic levels. Bookings for future flights are also low at only 30 percent of 2019 levels, which indicates that weakness will continue for the foreseeable future.

North America is showing strong forward momentum with booking levels falling 1 percent short of 2019 levels, and actual October performance at 93 percent.

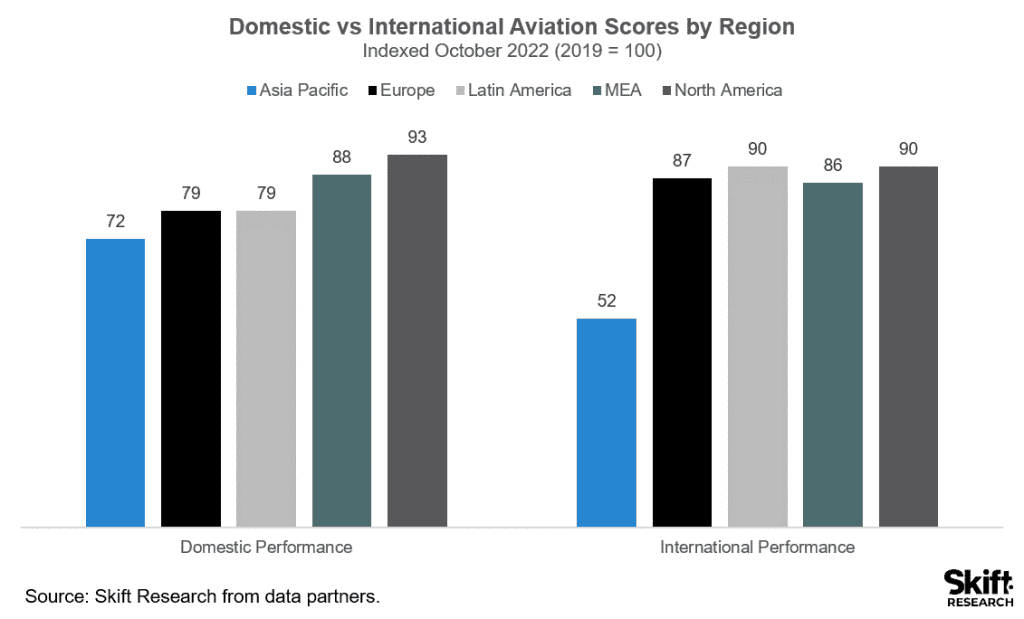

When splitting the indicators by domestic and international performance, we see that international performance is pretty much on par with domestic performance in North America, and the Middle East and Africa. In Europe and Latin America, international performance is actually registering higher scores than domestic performance. The black sheep is once again Asia Pacific, where international performance is suffering due to China’s continued border closures.

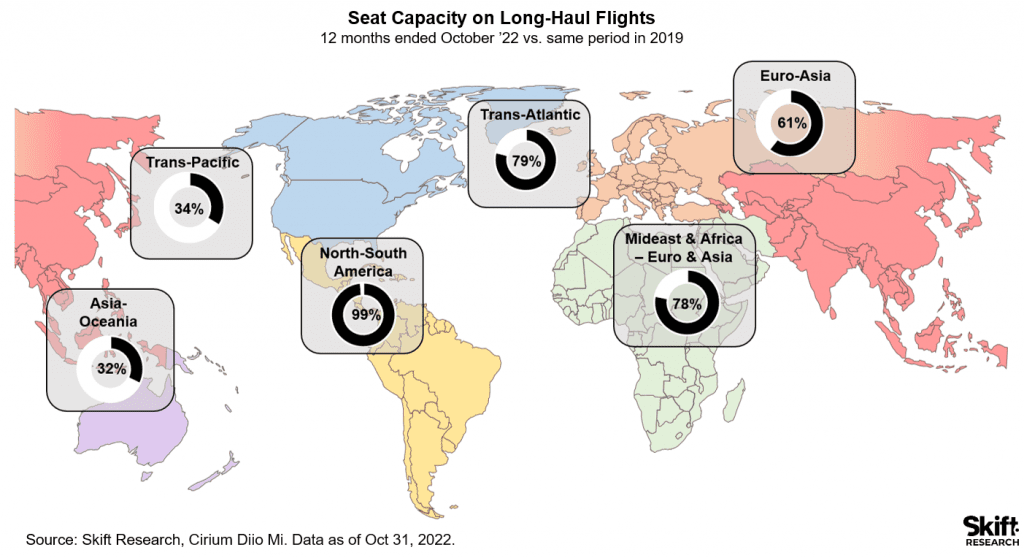

This insight is corroborated by data from Cirium on inter-regional long haul flights. The strength in flights within the Americas is in strong contrast to international Trans-Pacific and Asia-Oceania flights.

More analysis can be found in our October 2022 Highlights report and on our Skift Travel Health Index data dashboard.