How Kayak Fared 10 Years After Priceline's Offer to Buy It

Skift Take

Dennis' Online Travel Briefing

Editor’s Note: Every Wednesday, Executive Editor and online travel rockstar Dennis Schaal will bring readers exclusive reporting and insight into the business of online travel and digital booking, and how this sector has an impact across the travel industry.Ten years ago this week, on November 9, 2012, the Priceline Group (today's Booking Holdings) announced a deal to acquire Kayak, the Connecticut-based metasearch engine, which had been a public company for less than four months.

"A bomb just dropped in the online travel world: Priceline the world’s largest travel company, has agreed to acquire travel meta-search company Kayak, for about $1.8 billion," wrote Skift founder Rafat Ali, adding, "Priceline will gain a great online and mobile team to build its portfolio and will put muscle behind the Kayak brand." After regulatory scrutiny, Priceline welcomed Kayak into the fold on May 21, 2013.

To understand the context, Kayak was among the hottest things in U.S. online travel in those days, although Google had acquired flight-tech company ITA Software in 2011.

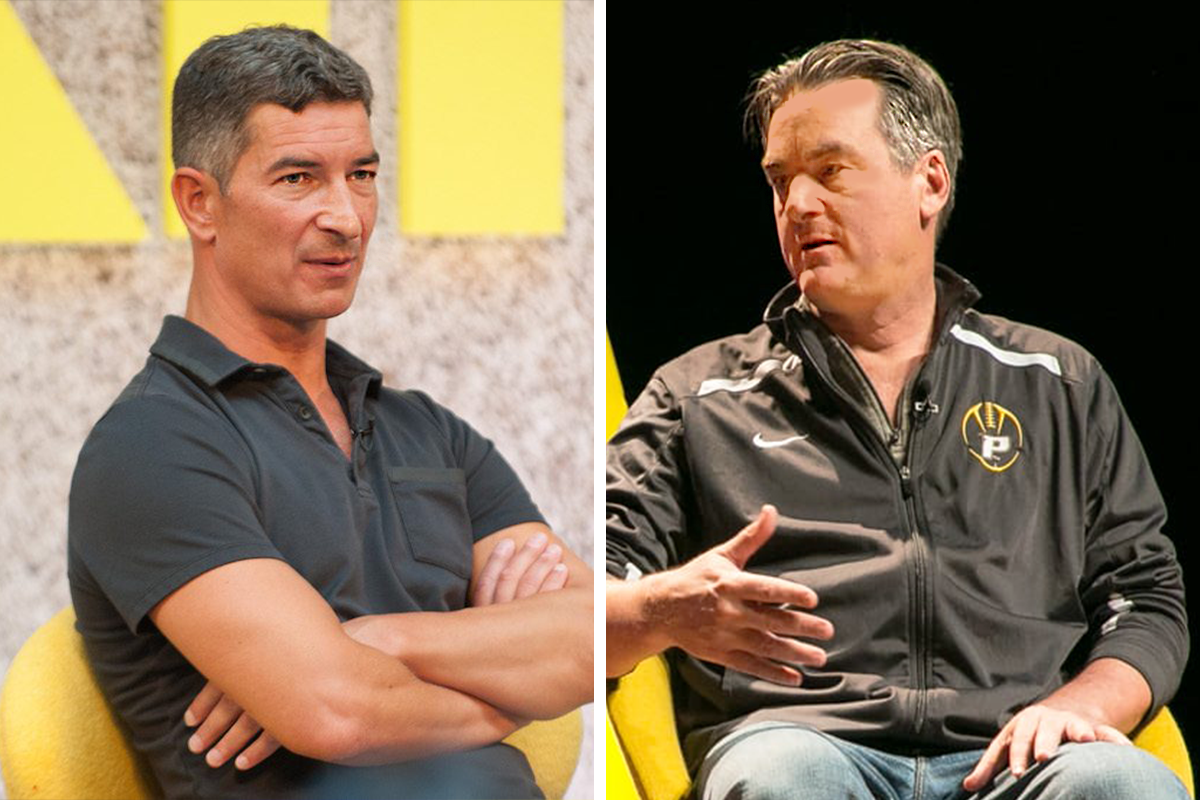

When Kayak, which was co-founded in 2004 by Steve Hafner and Paul English, went public on Nasdaq on July 20, 2012, Skift published a blog with around 18 updates documenting every move that day. When the closing bell clanged on its initial trading day, Kayak's share price had increased 26 percent to $33.18, while 70 percent of Nasdaq's other listings headed downward.

So what has been the