Skift Take

Recent U.S. travel data contains signs of optimism for 2022.

Data from a few travel technology vendors highlight the headwind for recovery created by the omicron variant.

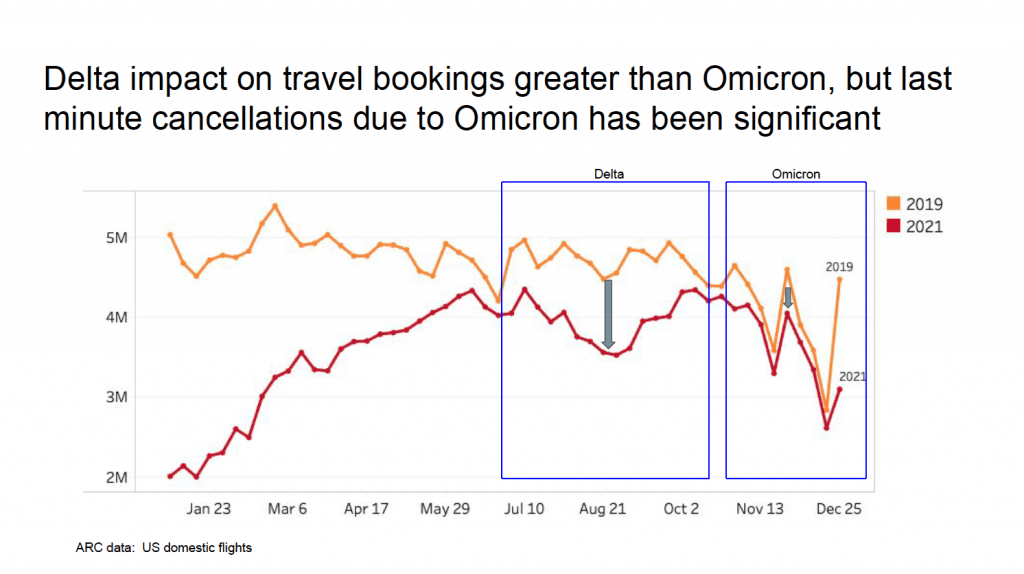

Omicron slammed U.S. travel, but December didn’t witness the same crash in domestic bookings for leisure travel that the U.S. saw when the delta variant first emerged. The data, while not surprising, holds a few nuanced lessons for travel marketers.

December’s results marked a month-over-month decrease compared to November 2021, with sales dropping 30 percent, passenger trips down 21 percent, and U.S. domestic trips down 20 percent. The chart below paints this picture by using flight data from U.S. travel agencies passing through ARC (Airlines Reporting Corporation), an airline-owned tech service.

“The end-of-year decrease we typically see in sales and trips was more pronounced this year with consumers worried about the omicron variant,” said Steve Solomon, vice president of global sales, marketing, operations, and customer experience at ARC.

The lesson for travel companies is that they need to offer continued flexibility for rebookings in 2022, a point echoed in recent hotel reports about omicron finally hitting hotel bookings.

“While not surprising, the nuance is that searches and bookings are still normal — people are just canceling more frequently at the last minute depending on the spread of omicron,” comments Scott Thornburg, a spokesperson at Sojern, an advertising technology vendor for the travel sector.

But travel companies also need to tailor their marketing message to an audience that appears ready to eager to get back traveling again.

During the winter holidays, omicron appeared to prompt many Americans to hold off on traveling altogether because of the safety issue of visiting family during the omicron surge. They didn’t switch to staycations, Thornburg said.

Plus, travelers show a willingness to pay to fly. The average U.S. round-trip ticket in December 2021 was $460, down only 4 percent from pre-pandemic December 2019, ARC reported.

ARC pulled the data from 10,783 U.S. retail and corporate travel agency locations and online travel agencies. Results do not include sales of tickets bought straight from airlines.

Regarding vaccination requirements on airlines, many Americans aren’t fussed. An early January survey of 3,000 travelers by Cardify, a consumer data insights company, found that only 44 percent of respondents would choose an airline with a vaccine requirement.

Meanwhile, 21 percent said they would choose an airline specifically without a vaccine requirement, and 33 percent said vaccine requirements didn’t matter.

For the international picture, see Skift Research’s latest Travel Tracker Report for December 20221: Americans Traveling Abroad Hits a Pandemic High.

Overall, the leisure travel story is brighter than the business travel one.

Just 54 percent of companies surveyed by Deloitte, the advisory firm, think they will reach their pre-crisis business travel spending levels by the end of 2022. That’s problematic for full-service hotels and network airline groups, which depend on high-margin corporate travel for their profitability. To help fill the gap, brands may emphasize luxury leisure travel and remote working options. For context, see Skift Megatrends 2022.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: arc, coronavirus recovery, omicron, omicron variant, travel recovery

Photo credit: A pre-pandemic reception desk at The Delavan Hotel and Spa in Buffalo, New York. Source: The Delvan.