Skift Take

The quasi-hotel company has announced a deal with Gores' special purpose acquisition company.

San Francisco’s short-term rental startup Sonder has reached a merger agreement with Gores Metropoulos II Inc.

The company, which signs master leases with landlords to turn units into short-term rentals, announced the deal on Friday after speculation earlier this month.

Join Us at the Skift Short-Term Rental and Outdoor Summit on May 19

Gores Metropoulos II Inc. was set up in December last year, and is a newly organized blank check company — or special purpose acquisition corporations (SPACs) — formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses.

Can SPACs Revive Travel Venture Capital? Read Skift Research’s analysis of special purpose acquisition corporations.

Sonder said it is now valued at $2.2 billion. The transaction includes a $200 million private placement led by an affiliate of private equity firm Gores Group, with participation from Fidelity Management & Research Company LLC, funds and accounts managed by BlackRock, Atreides Management, LP, entities affiliated with Moore Capital Management, Principal Global Investors, LLC, and Senator Investment Group.

Last year, Sonder reached a valuation of $1.3 billion after a funding round.

Sonder said it recorded occupancy rates of no less than 40 percent during the height of the pandemic, in part due to its contactless procedures, such as digital check-in, keyless entry, professional cleaning, crowd-free lobbies, and kitchens in most if its units. Overall, it claimed a cross-market occupancy rate consistently around 75 percent.

The company now aims to achieve $4 billion of revenue in 2025.

The deal is expected to close in the second half of 2021, subject to approval by Gores Metropoulos II’s stockholders and other “customary closing conditions.” Sonder will retain its management team, with co-founder and CEO Francis Davidson continuing to serve as CEO, and Sanjay Banker remaining as president and chief financial officer.

The deal marks the latest in a series of SPAC deals and rumors, following Grab’s move to go public with Altimeter, resulting in a $40 billion valuation.

Earlier this month, luxury vacations club Inspirato was reportedly set to announce a similar deal with Thayer Ventures, while Hong Kong’s luxury Rosewood Hotel Group may also be planning to file for a special purpose acquisition company listing.

UPDATE: This story was updated when the deal was officially announced.

Register Now for the Skift Short-Term Rental and Outdoor Summit on May 19

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: short-term rentals, sonder, spac

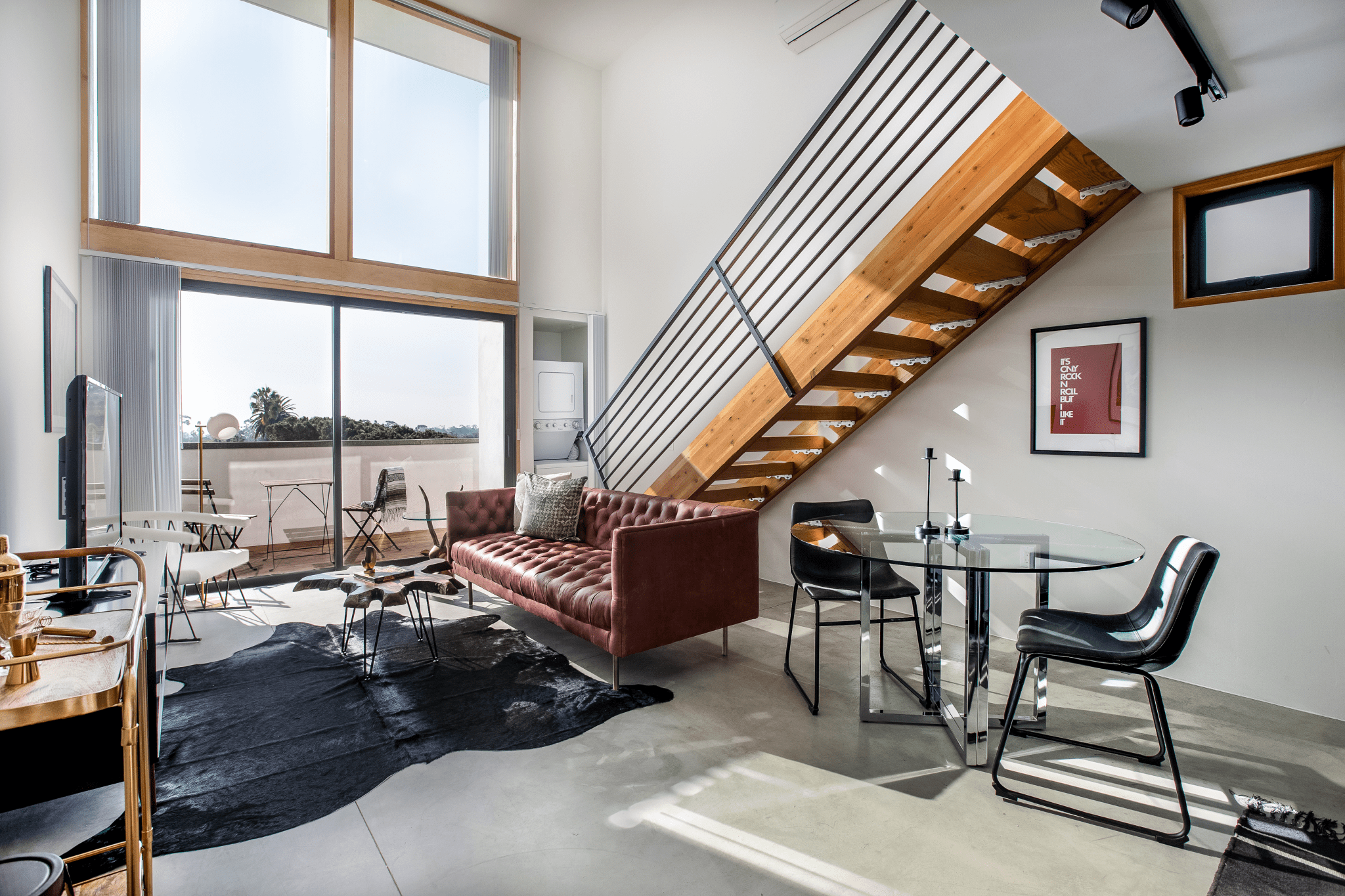

Photo credit: Sonder reached a valuation of $1.3 billion after a funding round last year. Sonder