The Top 10 Skift Research Reports in 2020

Skift Take

One day left for 2020. As we count down to the arrival of 2021, a year of hope, healing and recovery, the Skift Research team looked back at what we have published since the pandemic started in March and came up with a list of reports that we believe will still be relevant and valuable for 2021, when travel executives plan and executive on rebound and regrowth strategies.

1. Skift Research Global Travel Outlook 2021

What will the long uphill climb to recovery look like in 2021 for the travel industry? With much uncertainty ahead, we have decided to take a different approach to our outlook report. Instead of forecasting travel market losses and gains, we present key themes that we believe will shape travel recovery in 2021 and beyond.

Our themes progress from a broad economic outlook to more specific sector and regional recovery paths. We cover why we believe leisure travel will return faster than business, but also why business travel is far from dead in the long run. We also discuss how the pandemic has driven changes in capital, investment, and consolidation across the travel industry, and what these changes mean in the face of a fragmented regional recovery.

Exhibit 1: 2021 Winners and Losers

2. Skift Recovery Index

To help the travel industry keep track of travel demands and industry performances and work on strategic planning for recovery, we launched our proprietary Skift Recovery Index — a real-time measure of where the travel industry stands in recovering from the pandemic — in May.

The recovery index is a mixture of leading and trailing indicators, taking into account indicators ranging from traveler intent in the form of website visits and searches, to future bookings, to actual achieved occupancies, revenues and cancellations.

3. U.S. Travel Tracker November 2020: Travel’s Dark Winter

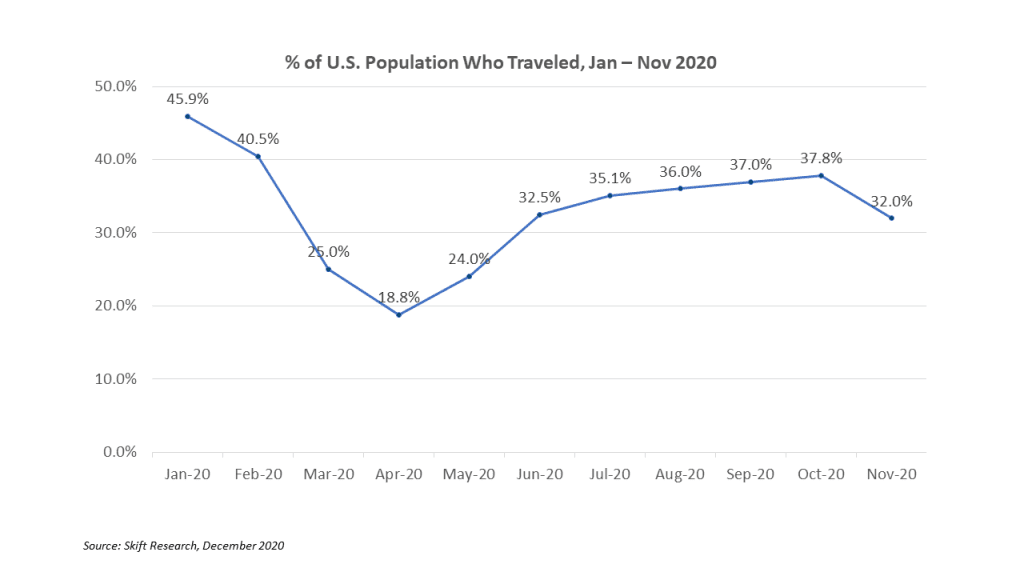

We planned to launch a monthly travel tracking survey for the U.S. and China starting in January 2020. As we were working on the survey questions, China locked down the entire country to control the spread of Covid-19. We decided to launch the survey in the U.S. only. And the premise of the monthly tracking was quickly changed to capture how deep the virus would impact travel and how the virus would change travel behavior and detect early signs of recovery.

For eight months when the coronavirus was raging in the U.S., our monthly travel tracker survey captured all the details of how many Americans traveled, who travelled, how they travelled and how they would travel after the pandemic is over.

Exhibit 3: U.S. Travel Incidence Rates January – November 2020

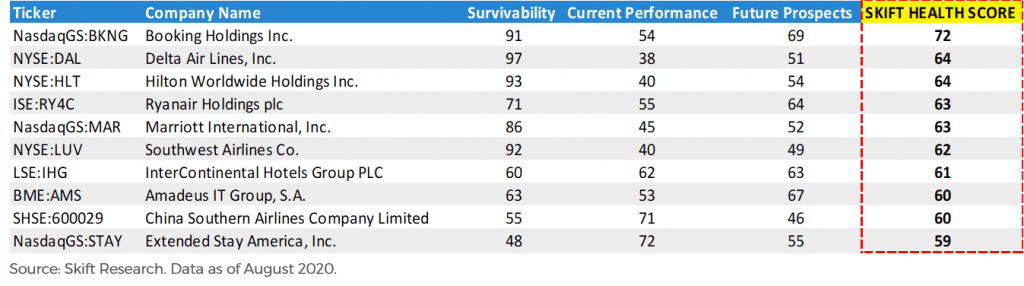

4. Skift Health Score

Another propriety dataset we launched in response to the pandemic is the Skift Health Score. We created the health score metric to assess the strengths of public travel companies in the current pandemic by delving into three crucial components of company businesses: survivability, current performance, and future prospects.

Our current version includes scores for 100 travel companies across hospitality, airline, cruise, and online travel and distribution sectors.

Exhibit 4: Top Ten Travel Companies with Highest Health Scores, August 2020

5. Travel Turned Upside Down — Insights, Analysis and Actions for Executives

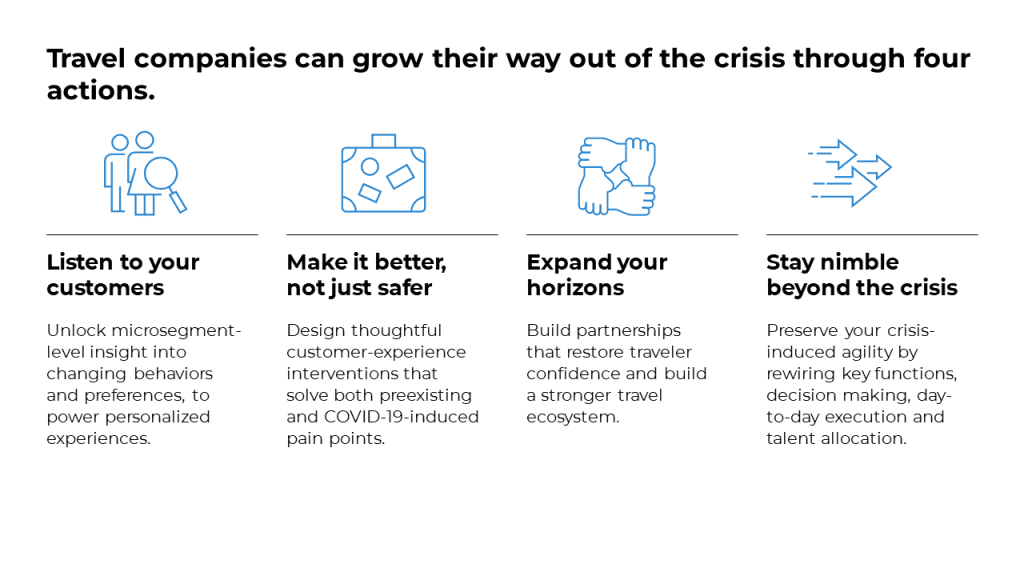

Can the travel industry and leaders in the travel business emerge from this global pandemic better and stronger? Can the future of travel be more aspiring, more influential to our collective effort of a better world? The Skift Research team have been researching and seeking answers to these fundamental questions since the beginning of the pandemic. We had a great opportunity to partner with McKinsey & Company to tackle these questions.

This report culminates with a set of four critical actions for travel companies to take, regardless of sector. We believe through self-reflection and acting on lessons learned from this pandemic, centering on building a people-focused business and a connected travel ecosystem, travel companies can emerge from this period not just intact, but better than before.

Exhibit 5: Travel companies can grow their way out of the crisis through four actions

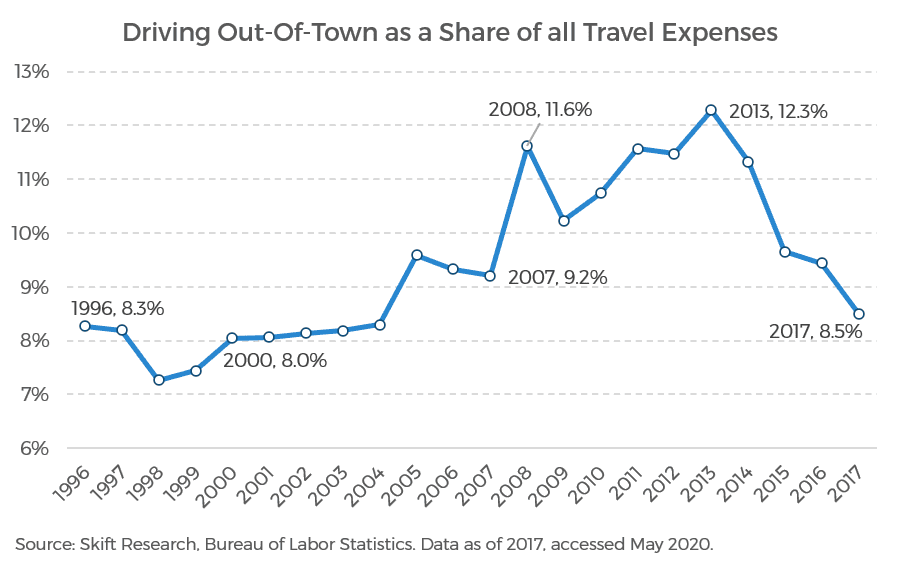

6. Travel Winners and Losers During the 2008 Financial Crisis: Lessons for Covid-19

In this report, we look back on the impact of the 2008/2009 financial crisis on travel and draw upon the lessons it can offer our industry. While we primarily focus on the U.S. market, where we have the most data, we believe the lessons we draw from the analysis apply to the much broader travel industry today.

Through a review of how major travel sectors in the U.S. fared during the 2008/2009 crisis and how long they took to recover, a success case study of how Marriott was able to first survive the crisis, and ultimately embrace the opportunity to reinvent, allowing the company to come out the other side stronger, and an unsuccessful case study of Extended Stay America that went into the crisis with an overoptimistic outlook and a poor cost structure, which led to its bankruptcy, we draw 13 lessons that we believe are still applicable today.

Exhibit 6: Spending on self-driving travel grew as a share of the travel industry 2008–2014

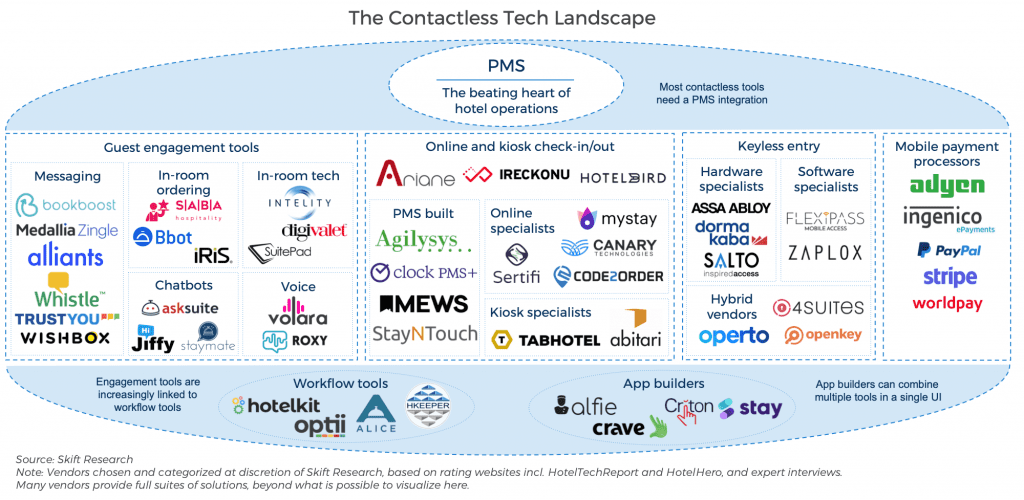

7. Contactless Tech in Hospitality 2020

The pandemic has accelerated the adoption of new technologies in the hotel industry, with contactless tech offerings at the forefront. Contactless technology offers hotels opportunities to reopen or continue operations in a responsible and safe way. But the impact of the adoption of these technologies will outlast this crisis.

In this report, we discuss the efficacy and longevity of contactless technologies, particularly in light of ever-changing consumer demands, and provide a clear and unbiased overview of the contactless tech that is available as well as vendors that are innovating the space.

Exhibit 7: 50 contactless tech vendors

8. Travel Marketing During Covid-19

When the entire travel industry comes to an abrupt stop, marketing is often among the first expenses to be cut, as it’s not considered critical spending and it doesn’t make sense to promote travel when nobody is allowed to travel. With restrained resources and changing mandates, how can travel chief marketing officers (CMOs) and their teams navigate through the crisis stronger, how can marketing lead the travel company for sustainable growth?

In this report, we delve into these crucial questions for answers. We examine tactics and strategies that winning companies and marketing teams have in common in navigating through a crisis and propose a people-centric instead of customer-centric framework in marketing plans.

Exhibit 8: People-centric marketing framework

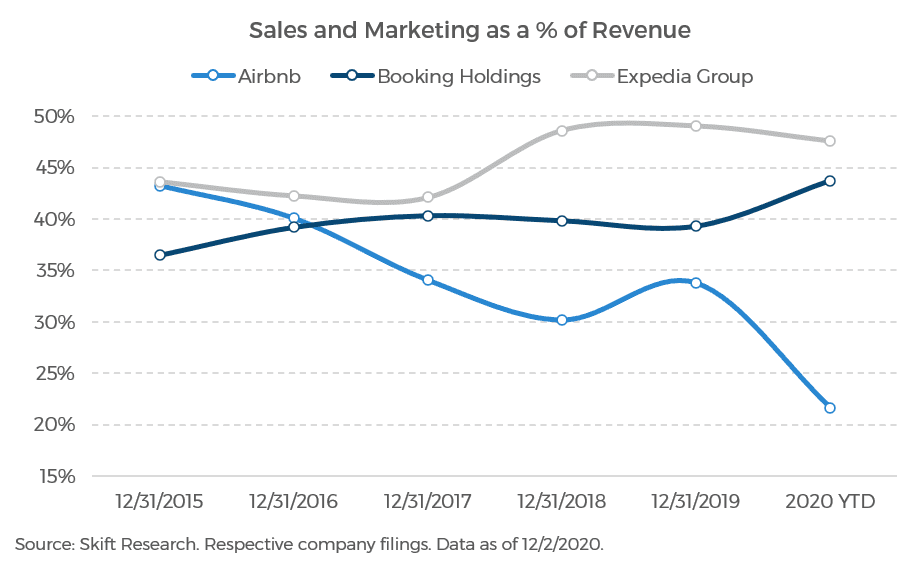

9. Airbnb and the Short-Term Rental Market 2020

The short-term rental ecosystem continues to grow and blossom. The global pandemic has only emphasized the need for continued innovation and professionalization within the space. How Airbnb, as the most prominent company in the space, chooses to engage with the broader short-term community will drive the future of this industry.

This report includes a proprietary estimate of the size of Airbnb’s Experiences and China business and examines Airbnb’s brand positioning and how that drives advertising efficiencies, repeat shoppers and high host retention. We also address Airbnb’s Covid response and places the company within the context of the broader short-term rental market, updating our 2019 market landscape report.

Exhibit 9: Airbnb’s strong brand leads to low sales & marketing cost

10. Hotel Distribution 2020 Part I: The Channel Mix

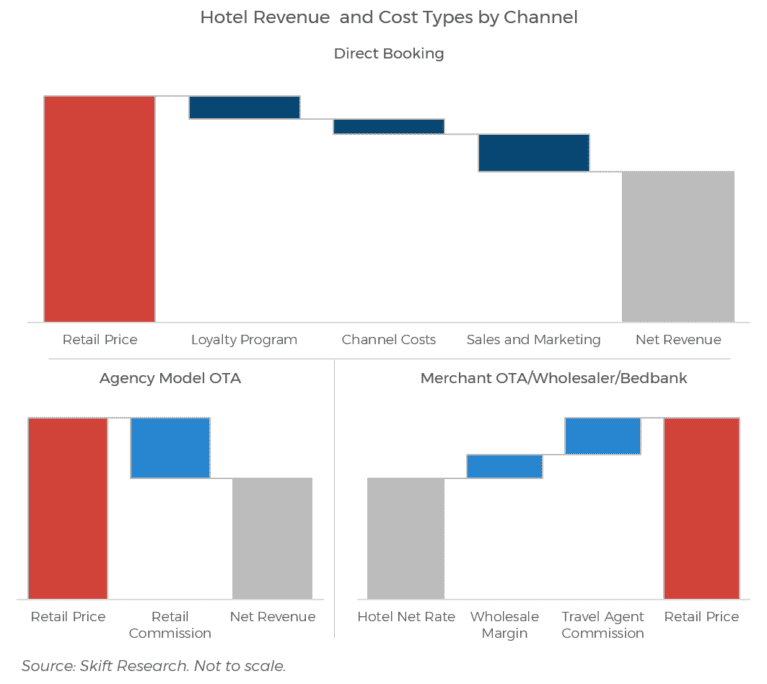

Hotel distribution is a complex process. Covid-19 seems to have bolstered direct bookings, and phone calls in particular (referred to as ‘voice’ in the industry), with many consumers having questions and wanting the direct contact with the hotel. There are, however, signs that third-party businesses, especially online travel agencies (OTAs), might have strengthened their position during the pandemic, as they continue to provide the most up-to-date and extensive view of open and available accommodations — including hotels, but also vacation rentals which have been increasingly popular.

We put together two reports to tackle this crucial element in hotel operations. In this first report, we provide a greater understanding of which issues have shaped the distribution landscape and how this might change moving forward.