Travel Stayed Stagnant in October After September Decline: New Skift Recovery Index

Skift Take

In the space of two weeks, the U.S. elected a new president who is widely expected to deal better with the current pandemic and offer more support to the travel industry and wider economy, and news broke about two preliminarily effective vaccines that could be ready for a mass rollout next year.

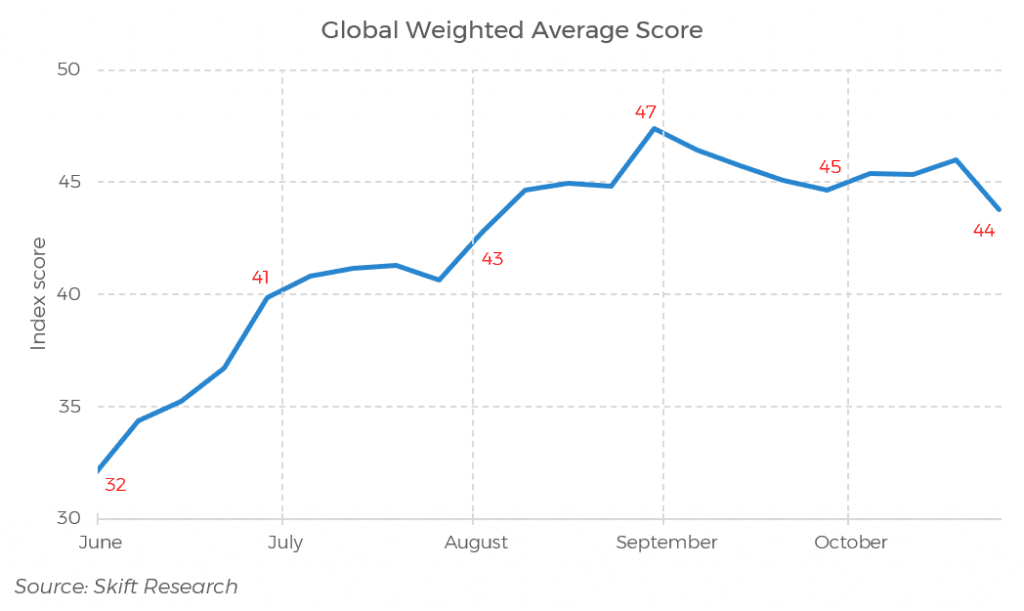

October, then, almost feels like an inconsequential month, wedged between September, a month of decline in travel performance after months of strong growth, and November, with the arrival of some positive news that rekindles hopes that we can return to strong growth as early as the beginning of 2021. This is backed up by the Skift Recovery Index, which saw little concrete movement up or down during October.

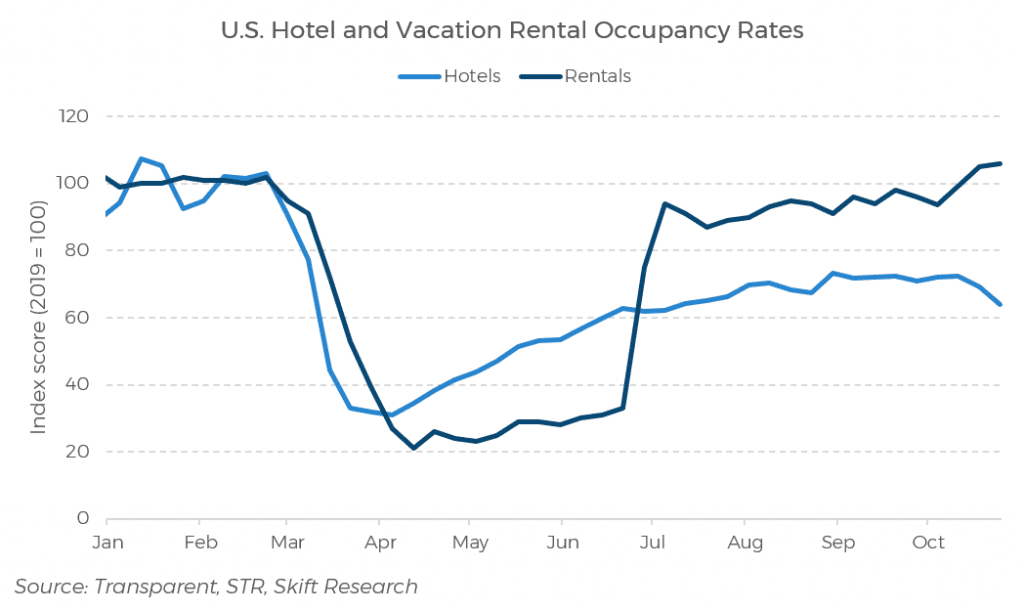

That's not to say that we did not see any improvement in October. One milestone that deserves a mention here is that in the U.S., vacation rental occupancy rates moved above 2019 levels according to data provider Transparent.

Hotels are still at only about 70 percent of last year’s levels according to STR. A main reason for this discrepancy is that vacation rentals, in normal times, are much more seasonal than hotels. Many vacation rentals are only operating during the summer months, when demand for family rentals is highest. Hotels, in contrast, operate all year round. With normal demand out of the window, vacation rentals continue to be in higher demand than last year, even outside the normal high season.

The Skift Recovery Index is a real-time measure of where the travel industry at large — and the core verticals within it — stands in recovering from the COVID-19 pandemic. We work with 18 data partners to track how different sectors and countries are recovering from the current pandemic.

The index provides the travel industry with a powerful tool for strategic planning, of utmost importance in this uncertain business climate. Skift Research members have access to all data and reports.