Eye-Popping $137 Billion in Lost Revenue: New Skift Health Score of 100 Travel Companies

Skift Take

Skift Research updated its Skift Health Score for August. This month takes a look at how publicly traded travel companies fared during their second quarter earnings.

The Skift Health Score is a proprietary metric that assesses the strengths of public travel companies. Our current version includes scores for 100 travel companies across hospitality, airline, cruise, and online travel and distribution sectors.

The Health Score ranges on a scale of 0–100, calculated by selecting and weighting 23 individual indicators that are core to a company’s overall strength. All the 23 indicators fall under three categories, each a crucial component for a company’s overall health.

- Survivability: how prepared each company is to weather the current Covid-19 crisis.

- Current Performance: how each company is operating at present.

- Future Prospects: how well-positioned each company is to return to growth in a post-coronavirus world.

Updating Skift Health Scores for 2Q Earnings

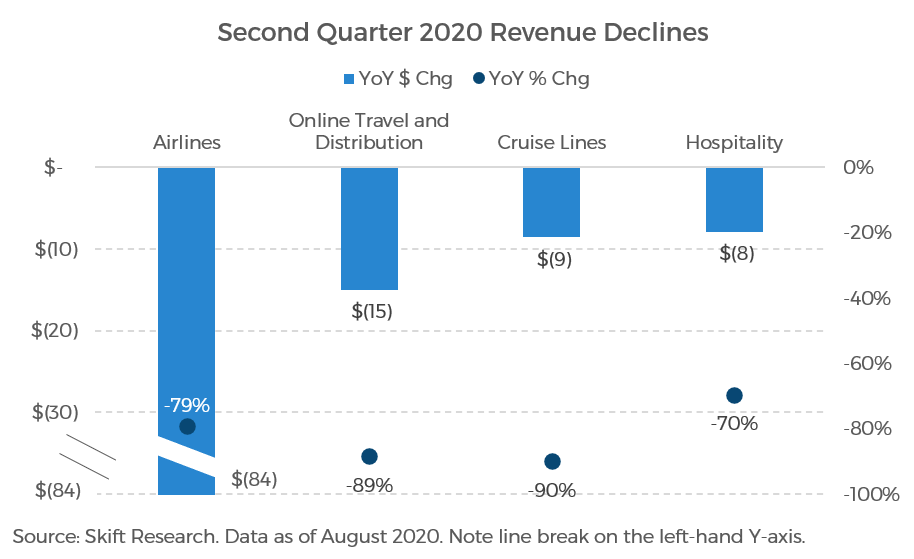

In the second quarter of 2020 compared to the same period last year, our data shows a loss of more than $137 billion in travel revenue. And that is just for this small sampling of public businesses; the industry-wide damage to travel in this quarter will have been much greater.

In dollar terms, the hardest hit sector was the airlines, losing more than $84 billion in revenue compared to 2019. The airline industry has in fact been incredibly hard hit as international travel has been effectively grounded and domestic travelers remain afraid to fly, most preferring to drive.

Keep in mind, this is just public company data and doesn’t represent the global industries. The airline industry is more concentrated than the hospitality industry, so a greater share of airlines are public and therefore our data is closer to representing the full scope of damage done to that industry. Structurally too, the airlines report gross revenue whereas online travel revenue is based off of commissions and the dollar figure represents just a fraction of the gross bookings these sites process. Similarly, with hotels, most public hotels are chains and their revenue comes in the form of franchise and management fees, again representing just a fraction of the gross room revenue these companies control.

Perhaps then, a more accurate approach would be to look at the percentage change in revenues. This adjusts for biases in how revenue is recognized and how many companies within an industry are public. By this measure, cruise lines are far and away the hardest hit sector in travel.

Cruise revenues declined an eye-popping 90 percent year-on-year in the second quarter of 2020. This is perhaps unsurprising though, given how cruise ships were at the center of the initial COVID-19 outbreak and no-sail orders have been put in place.

On a relative basis, hotels are performing the best, down only 70 percent. This is consistent with the data indicating that some people are still traveling, but shifting their mode of transit from flying to driving; in those cases the hotels still capture the demand that the airlines have lost.

You can find the top ten healthiest travel companies in August as well as health scores and sub-category scores for 100 different travel companies by visiting our Skift Health Score site.

Skift Research Subscribers Have Access To

100 Company Coverage

Total health scores as well as sub-category scores for all 100 public travel companies we track.

Deeper Analysis Reports

We will provide regular reports diving into specific sectors, scores, or companies moving forward.

Monthly Data Updates

We will incorporate new available data and update the Health Score on a monthly basis.

Quarterly Highlight Reports

We will publish quarterly reports to highlight key changes and trends as they appear.

Easy Access

The full data set is available as datasheets in PDF format and in an interactive format on our Health Score home page.