Coronavirus Upheaval Prompts Independent Hotels to Look at Management Company Startups

Skift Take

The startup Life House has a new white-labeled full management service that doesn't require a costly rebrand or renovation. We expect only a few dozen hotels will sign up this year for it. But the new offering underscores the bigger picture, stark choices facing the owners of tens of thousands of independent hotels now.

Many owners of smaller, independent hotels may have less capacity to handle the coronavirus pandemic than owners of larger properties affiliated with major chains. The U.S. has about 22,000 independently owned and operated hotels, according to STR. But not all of them will survive months of low occupancy along with higher costs for new pandemic-related procedures for cleanliness and safety.

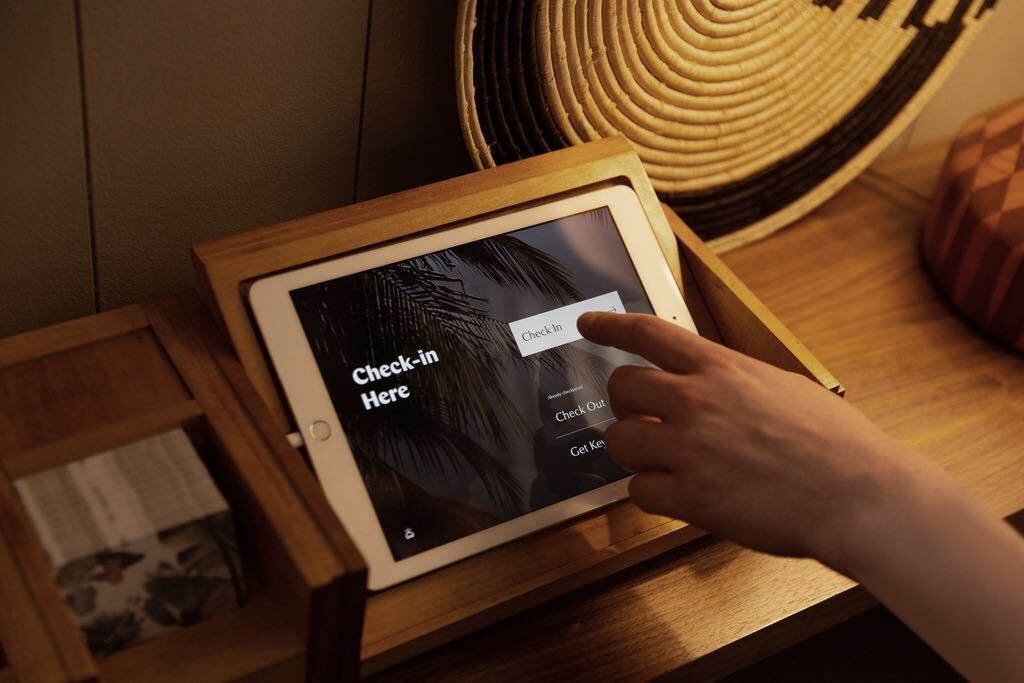

The crisis may present next-generation property management startups like Life House, Sonder, and Cosi a chance to compete with chains. The recession may be a proving ground for automation and centralization of financial reporting, pricing systems, and digital marketing, which are tasks that had been low on the priority lists of independent hotel operators before.

Exhibit A: Life House, a startup that began by running hotels under its own brand, said Monday it had launched a white-label management company. Called Life Hospitality, it provides owners with full management over their staff. It also offers a full set of operational software without the need for a property to change its brand or furnishings.

"The booming demand before the crisis masked operational challenges that are now more clear for a lot of independent hotel operators," said founder and CEO Rami Zeidan. "They've already sunk their blood, sweat, and tears into their properties, but they don't have the operational wherewithal to invest in what's nece