Nearly a Third of U.S. Travelers Defer Plans as Uncertainty Grows: Skift Research Survey

Skift Take

The slow but steady drumbeat of coronavirus diagnoses is raising the anxiety of U.S. travelers this week. Trip cancellations rose as the situation in the U.S. deteriorated.

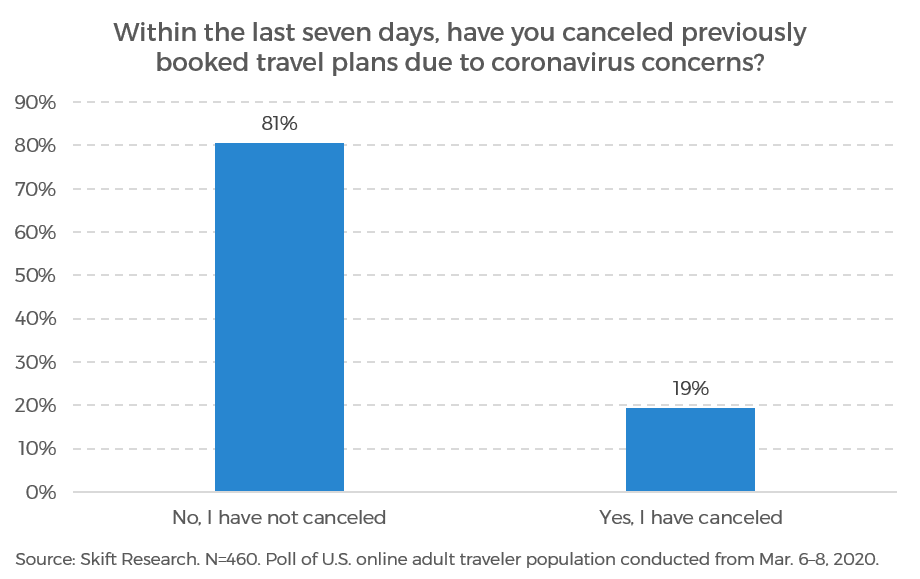

Still, most Americans refuse to throw in the towel on travel altogether and are waiting to see how the situation will evolve. Eighty-one percent of Americans with previously booked travel plans are still holding onto their reservations for now, down from 88 percent last week.

What's more, 29 percent said they had deferred travel plans.

Skift Research is continuing its data-driven approach to tracking the impact of coronavirus on the travel industry by updating our polling of the U.S. traveling public. Our second coronavirus cancellation poll of the U.S. online adult population was conducted from Mar. 6–8. We reached 460 Americans who had previously booked travel plans. Of that traveling population, 19 percent had canceled due to concerns around coronavirus.

Get the Latest on Coronavirus and the Travel Industry on Skift's Liveblog

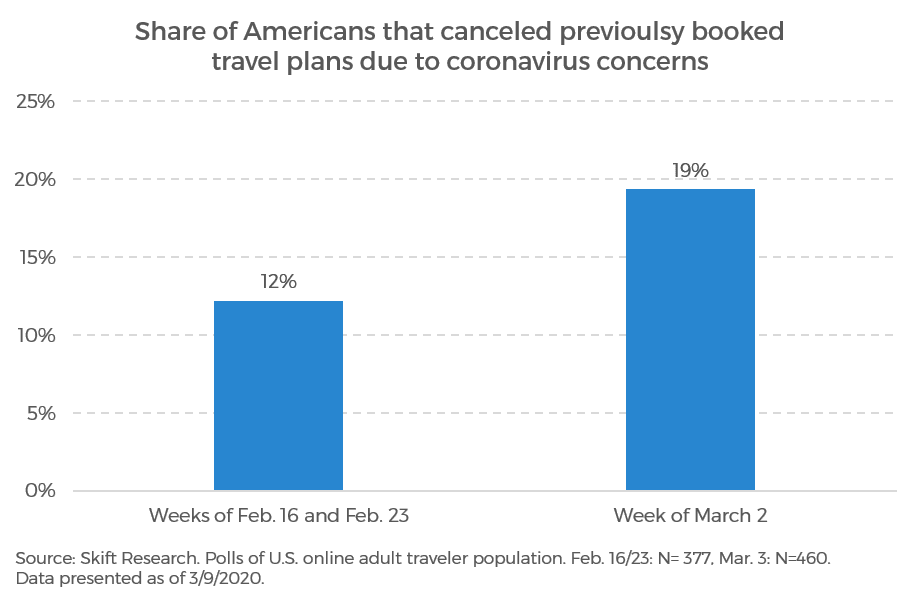

That is a fairly mixed result. On the one hand, we are seeing a steady creep higher in the pace of U.S. travel cancellations. Cancellation figures have risen since last week when 12 percent of respondents told us they had cancelled plans.

Taking the glass-half-full approach, even into late last week, four out of five Americans were still standing pat on their travel plans. For the time being at least, Americans remain hesitant to cancel plans en masse.

As we pointed out in our previous story, we suspect that for many Americans, there is not a pressing need to cancel future travel immediately. That’s because most trips are planned months in advance and are non-refundable, leaving little incentive to cancel at any time except the last possible minute.

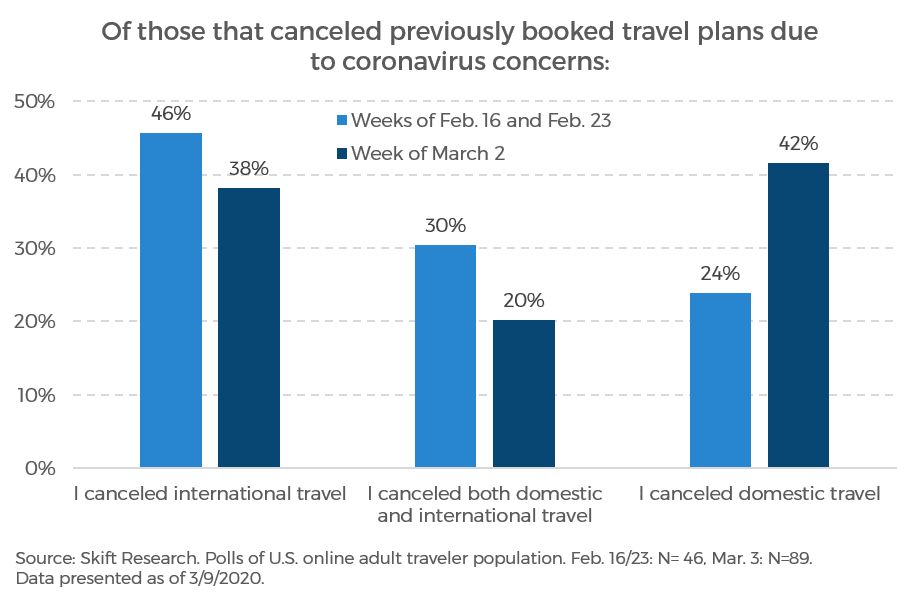

Looking under the hood of the cancellation data shows a notable shift in behavior as the virus hits closer to home. This week’s data seems to show a shift toward more domestic travel cancellations.

We caution that the sample sizes we are drilling down into are rather small at this point, so these results are less about the precise figures we report and more about the directionality of the data. But the trend shows 42 percent of those canceling travel this past week did so on domestic itineraries, up from 18 points from last week. This is in contrast to our findings from last week that most cancellations took place on international itineraries.

No doubt, this reflects a shift in the news flow toward covering more homegrown cases of coronavirus. This trend is likely to continue to deteriorate, both in terms of U.S. covid-19 diagnoses and travel cancellations. In fact, we would note that separate research conducted by Carola Binder, an assistant professor of economics at Haverford College, found that 28 percent of Americans had canceled travel plans, even higher than our sample indicates.

Damage to the U.S. travel industry will come from more than just cancellations. Travel businesses will also suffer from a drop in demand as Americans put off booking new travel that they would have otherwise taken.

In a separate online survey of 432 U.S. adults conducted from Mar. 6–8, 29 percent told us that they deferred making travel plans that, but for the coronavirus, they would have otherwise undertaken. Respondents were told to exclude cancellations of past bookings when answering so that we could specifically measure cases of foregone revenue.

This deferred booking figure is likely to impact the profitability of the spring break travel season this year.

Let’s recap the big picture numbers to see where we stand today. Over the last three weeks, 16 percent of Americans have canceled travel plans due to coronavirus (aggregating our two back-to-back surveys). And on top of that over the last four weeks, 29% of U.S. travelers have deferred trips they would have otherwise taken due to the virus.

For those Americans who have already booked travel, there is little pressure to cancel right away and most are waiting to see how long the virus lasts. Domestic travel previously seemed safe, but those routes are increasingly at risk.

An even larger share of U.S. travelers are putting off booking travel in the first place. This is likely due to uncertainty about what direction the virus takes next. Sadly it seems likely that the next step forward will be a series of new coronavirus diagnoses as testing kits get rolled out nationwide this week.

The silver lining in all of this is that the 29 percent of all Americans deferring travel due to the virus represent pent-up demand for travel, a growing source of potential energy. Assuming that long-term consumer preferences for travel don’t change overnight, then these travelers could become a deep reservoir for travel companies to tap into once public health concerns recede.

In sum, for the pessimist, trends are getting worse as more Americans cancel and defer travel. For the optimist, the figures are less scary than the end-of-the-world headlines on TV would have you believe. After all, a majority of U.S. travelers tell us they have neither canceled nor deferred their trips. Our data offers a little something for everyone.