Google's Customized Travel Search Features Receive Massive Traffic in the U.S.: New Skift Research

Skift Take

This report explores the impact of Google across the travel supply chain, from rivals in the metasearch space to uneasy allies at the online travel agencies and brand clients that can use Google tools to reach their audiences.

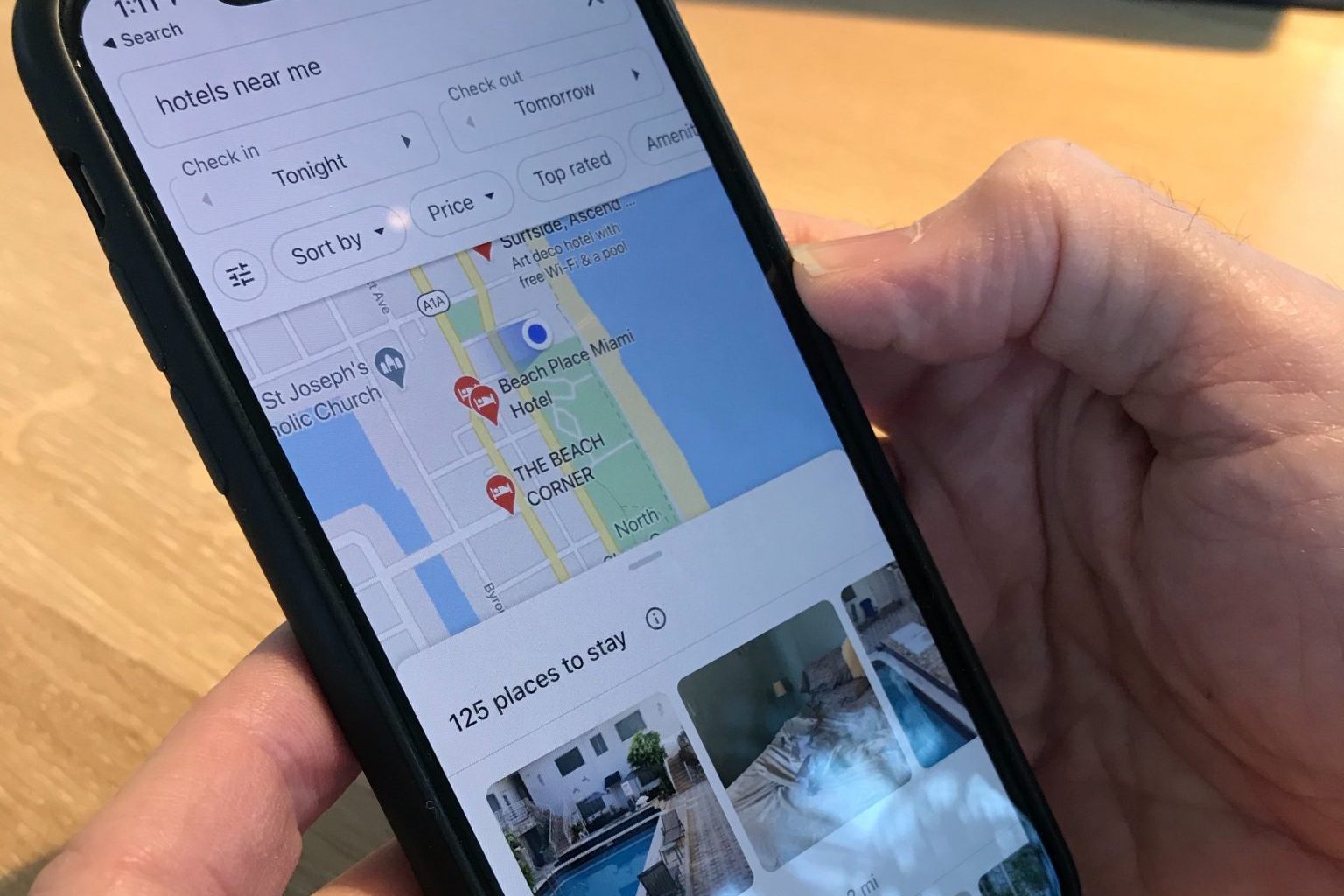

In our latest report, Skift Research takes a deep dive into Google and its impact on the travel industry. Google is easily one of the largest businesses that influence how travel companies and consumers behave.

The company has a strong position at the top of the funnel, able to reach customers considering travel through its products that run the gamut from YouTube to the traditional blue search links. It's travel-specific vertical search modules generate nearly as much traffic as expedia.com and booking.com, combined, do in the U.S. We estimate that its any ad offerings may have raked in as much as $16 billion from travel companies in 2019.

Below is an excerpt from our Skift Research Report. Get the full report here to stay ahead of this trend.

Preview and Buy the Full Report

Google’s Vertical Search Products Google’s horizontal s