U.S. Travel Arrangement and Reservation Sector to Top $57 Billion in 2020: Skift Research Forecast

Skift Take

Consumers might not know the differences between a travel agent, a tour operator, and an online travel agency. And indeed, the travel arrangement and reservation services sector is a complex one, with increasingly intertwined services.

While online travel agencies revolutionized the travel industry by making travel the first consumer sector to shift to online commerce, a large portion of the rest of the travel arrangement sector is at the bottom of digitalization across all major travel verticals. We believe this is about to change.

Last week we launched the latest report in our Skift Research service, U.S. Travel Arrangement and Reservation Services sector: Skift Research Estimates 2020.

Below is an excerpt from this report. Get the full report here to stay ahead of this trend.

Preview and Buy the Full Report

Positive Market Outlook for 2020

In our year-end Skift Global Travel Economy Outlook 2020 report, we forecast 2020 to be another solid year of growth for travel, both in the U.S. and globally. While acknowledging the downside risks that might lead to the economic slowdown, we believe the fundamentals remain strong for the global economy. Translating into travel, we anticipate further expansion across the board in hospitality, online travel, and airlines.

However, as we were working on this report, the impact of the coronavirus outbreak has just started to show in global travel. Flights are canceled and borders are closed. The long-term effect of this depends on how the epidemic plays out in the coming weeks or months.

Our 2020 forecast doesn’t factor in the impact of coronavirus. As more information comes in, we will evaluate the short-term and long-term effect of it in our future reports.

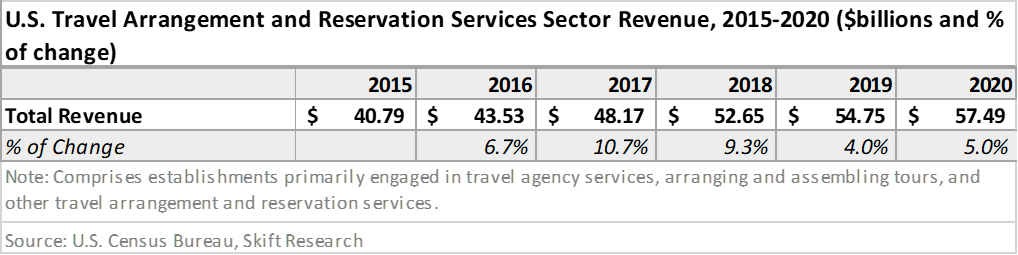

Overall, the travel arrangement and reservation services sector has experienced strong growth for the past few years and outperformed other major sectors. We believe this trend will continue in the next few years. After near double-digit growth for two years, we estimate that the sector generated $54.8 billion revenue in 2019 and will add nearly $3 billion in 2020 and bring total revenue to $57.5 billion.

Core Segments

Unlike other major travel sectors, the travel arrangement and reservation services sector is comprised of a wider array of sub-sectors, some of which provide services that cut across different sectors, while others are more niche and focused.

We follow the North American Industry Classification System (NAICS) in categorizing and estimating market sizes for these sectors.

Travel agencies are companies primarily engaged in acting as agents in selling travel, tour, and accommodation services to the general public and commercial clients. The traditional brick-and-mortar travel agencies and the online travel agencies (OTAs) such as Expedia.com and Booking.com all fall under this sector. This is the largest sector under travel arrangement and reservation. With an estimated total revenue of $22.1 billion in 2020, travel agencies accounted for 40% of the total market.

Ticket and reservation services are companies primarily engaged in ticket selling, reservations, and booking services. This is another big sector not far behind travel agencies. We forecast the ticketing and booking services to generate $17.1 billion revenue in 2020, making up 30% of the total sector revenue.

Tour operators are companies primarily engaged in arranging and assembling tours, including tours that are sold through travel agencies and wholesale tour operators. As the third-largest sector, tour operator companies are expected to bring in $8.3 billion revenue in 2020, a 5.7 percent increase over 2019.

Convention and visitors bureaus are companies and organizations primarily engaged in marketing and promoting communities and facilities to businesses and leisure travelers through a range of activities, such as assisting organizations in locating meeting and convention sites, providing travel information on area attractions, lodging accommodations, restaurants, providing maps, and organizing group tours of local historical, recreational, and cultural attractions. We forecast this sector to generate $2.7 billion in 2020, a 2.8 percent increase over 2019.

Subscribe now to Skift Research Reports

This is the latest in a series of research reports aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.