Google's Travel Gains Levy Pain at TripAdvisor and Expedia

Skift Take

The fact that Google is leveraging its dominance as a search engine into taking market share away from travel competitors is no longer even debatable. Expedia and TripAdvisor officials seem almost depressed about the whole thing and resigned to its impact. Is there any more room on the couch?

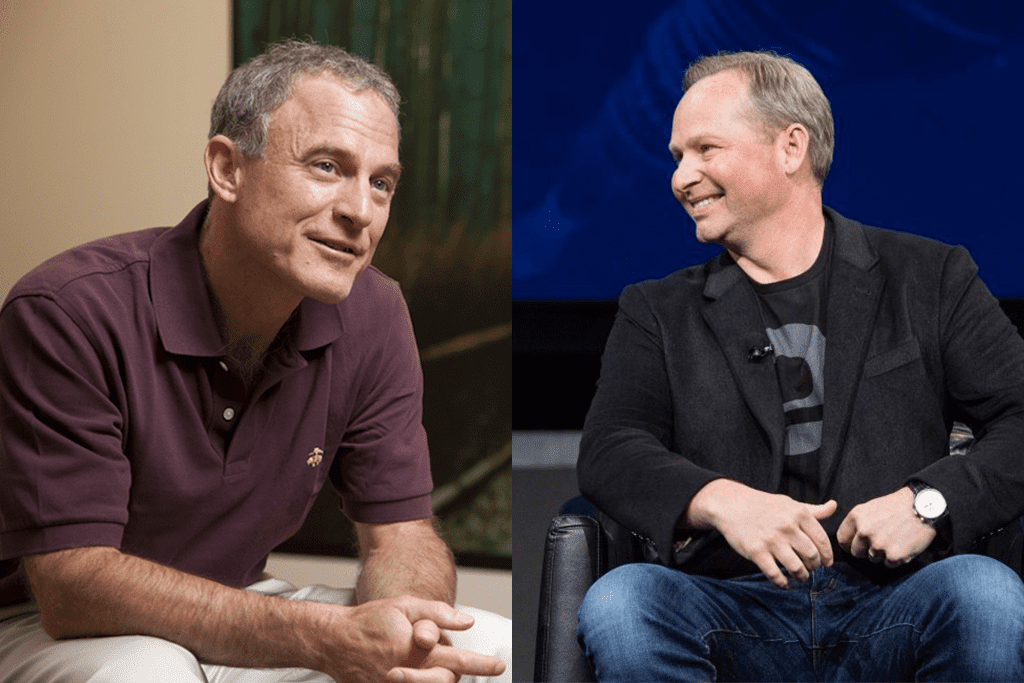

In an unintended duet, the CEOs of TripAdvisor and Expedia Group separately talked this week about how Google's increasing practice of directing search traffic towards its own travel businesses has adversely impacted their companies in the third quarter.

For its part, Expedia Group intends to push direct booking — it mentioned fledgling Instagram and Facebook influencer campaigns, as well as spending more on brand advertising — and bolster its loyalty programs. TripAdvisor plans cost-containment, to build hotel and media products that aren't based on click-based revenue, and to ramp up personalization efforts.

In prepared remarks Wednesday night, TripAdvisor addressed the fact that the revenue in the largest part of its business, officially known as Hotels, Media & Platform, declined 12 percent year over year in the third quarter to $238 million.

"We believe our most significant challenge remains Google pushing its own hotel products in search results and siphoning off quality traffic that would otherwise find TripAdvisor via free links and generate high-margin revenue in our hotel click-based auction," TripAdvisor stated.

In an earnings call with analysts o