Why Some Short-Term Rental Tech Vendors Are Turning Away from Independent Hosts

Skift Take

Blame it on economies of scale or other factors. But some startups that offer tech services to the short-term rental sector are doing more and more to woo professionals that manage multiple units. The vendors are losing interest in independent hosts because the so-called "long-tail" customers often turn out to be tougher sells.

We can define the long tail as consisting of independent hosts who tend to be hobbyists, owners of second homes, or small property managers. They present their properties on limited online channels — often only one, like Airbnb. Each host tends to run their property themselves without much outsourcing to operational providers like cleaning services or tech vendors like channel or yield managers.

At first sight, spurning independent hosts may not make sense. A commonly used figure by the sector's insiders is that independent hosts manage 60 percent of short-term rental property units. That's a big market. The advent of Airbnb has made hosting first or second homes without any professional help easier for amateur hosts and hobbyists.

Join us at Skift Short-Term Rental Summit in NYC on Dec. 5

But despite having a proportionally smaller market by one measure, professional managers may often be more motivated to buy digital tools than independents. They may also have bigger budgets, too.

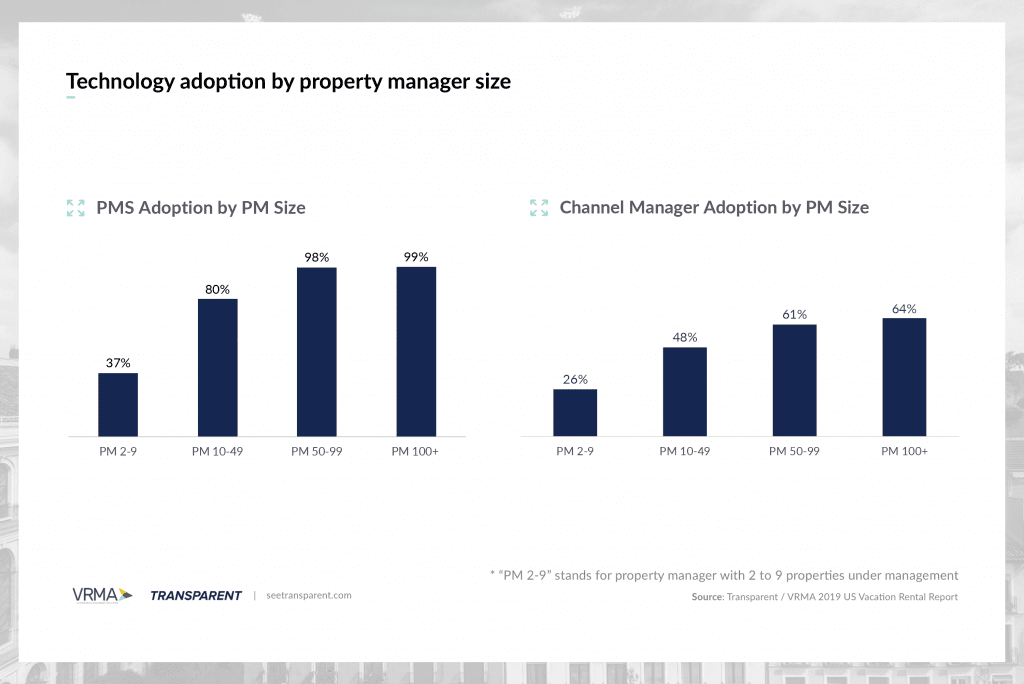

Survey data from Transparent, a data provider for the short-term rental sector, and the Vacation Rental Management Association, supports this, showing how the uptake of third-party property management systems and channel managers increases as the size of the managed portfolio increases.

The ever-expanding ecosystem

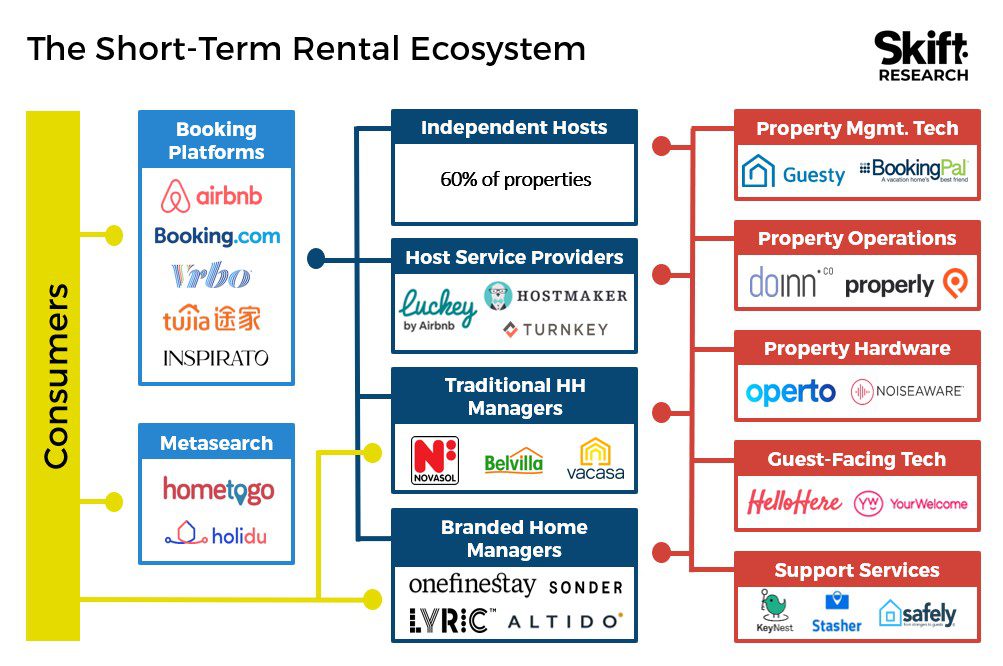

In a recent report, Skift Research highlighted the ever-expanding ecosystem that is forming around platforms like Airbnb and Vrbo.

As we look at this ecosystem, we see the prospects vary by the business model. For property management companies, independent hosts offer clear potential to increase supply and expand into new markets, but for tech providers, the opportunities are less clear cut.

It seems obvious that attracting property managers overlooking anywhere from 50 to 1,000 units allows for much faster scaling than going after independent hosts, but the competition is much fiercer for the small number of professional property managers.

History suggests that starting in the long tail can be very successful. Think of how Booking Holdings acquired and scaled up Buuteeq, a company that offered web marketing services to independent hoteliers.

But independent hosts will generally have less capital to spend on products that are not seen as core requirements for hosting. Property hardware providers and support service providers are seeing a strong uptake amongst independent hosts, but for property management tech vendors, this is a harder package to sell.

While professionals use tech like channel managers and revenue management systems to squeeze every dollar out of a property for its owner, independent hosts tend to make do with the limited resources offered by the channels, like Airbnb's basic pricing tools.

Fishing for Small or Large Fish?

Is it, then, worth it for tech vendors to chase the long tail in the short-term rental sector, or should they focus on the professionals?

After receiving considerable investment, the board of channel manager Rentals United decided to pivot away from targeting independent hosts and focus on enterprise clients.

"We realized that it's very hard to serve [independent hosts], and for them to feel they are spending their money well because what they are after is more bookings. Even if we place them on 60 channels, they may not get more bookings because of the type of [property they have]," said Vanessa de Souza Lage, chief marketing officer of Rentals United.

In contrast, de Souza Lage points out, professional managers place greater importance on saving time when managing different properties and channels, which is where a third-party channel manager comes into its own.

Beyond Pricing, a short-term rental revenue management system which recently raised $42.5 million in funding, also focuses predominantly on professional property managers.

Ian McHenry, the company's co-founder and CEO, said: "We built the algorithm so we could optimize single units since even when managers have hundreds of units, they typically have a single owner behind each listing. From a revenue perspective, though, 80 percent of our revenue comes from property managers. Property managers are our focus and where all of our growth is."

In a similar vein, other major tech vendors like BookingPal (which last month became Marriott's exclusive channel manager service) and Guesty (which streamlines online marketing and which raised $35 million in funding this year) — also focus predominantly on professionals. This is resulting in a crowded landscape, and some vendors are deciding to head in the other direction.

Quashing Stereotypes

Dennis Klett, CEO and co-founder of Lodgify, is one of them. His company’s software solution is “targeted at the long tail supply of the vacation rental industry.” He stresses that the long tail is not just the stereotypical host renting out their spare bedroom, and that many independent hosts today have a professional mindset.

Klett said he deals with many hosts who "started out with Airbnb or another online travel agent. They realize it's a great way to increase the return on a real estate investment, and they recognize that it might not be prudent to be reliant on one channel, so they come to players like us."

Another vendor taking the same route is BookingSync, a property management software provider that recently launched Smily, an all-in-one software solution for independent hosts which is “made to be as simple as possible,” according to the co-founder and CEO Sébastien Grosjean.

These players assert that chasing the long tail is not an easy game, but there is a lot of ground to cover and far less competition.

An analogy may be found in hotel technology. Hotel tech vendors have commonly focused on enterprise clients. A deal with a big hotel chain can mean quick scaling.

In the past, however, we have seen vendors shift their focus to smaller and independent hotels which have been traditionally underserved. New start-ups are bringing the latest tools to these hotel operators. Property management systems like Apaleo and Cloudbeds, or "middlemen" like Impala or Hapi, are leading the way.

In terms of the uptake of technology, the short-term rental sector is considerably behind the hotel industry. But as tech becomes more affordable, independent hosts are becoming more interested.

As far as product needs go, independent hosts have different demands than professionals do. Customers in this segment are price sensitive. Barriers need to be nearly non-existent. All tech needs to come in one nicely-packaged solution. The user experience needs to be slick, and training requirements must be kept to a minimum.

Independent Hosts Get Savvy

Overreliance on a single distribution channel is a standout mistake that independent hosts make, and here third-party tech vendors can provide a clear benefit.

"Any host trying to make the most money will at least be on two or three sites, like Airbnb, Vrbo, and Booking.com," said Ian McHenry of Beyond Pricing. "Having a pricing solution that only works on one doesn't make any sense. Hilton or Marriott don't use the pricing tool from Expedia for their bookings on Expedia, or the Booking.com tool for their bookings on Booking.com. If you are on multiple channels, you need a third-party tool."

As an independent host, it can be all too tempting and convenient to become completely reliant on Vrbo or Airbnb for bookings, and tech vendors continuously point out how their solutions can help tip the balance back towards the hosts.

"Without end-to-end automation tech, independent hosts can quickly run afoul of guests and OTAs [online travel agencies] because micro-businesses lack the resources to meet the evolving complexity of running a multi-channel, on-demand global company," said S. Philip Kennard, the CEO of Futurestay, which typically caters to the segment.

BookingSync's Grosjean put it this way: "Being a vacation rental owner now requires you to be a technology company, which is nonsense to me. We are changing this, so newcomers will no longer need technical skills to run their business. They will be able to do what they love and do best: welcome guests and offer them an outstanding experience.

It's hard to argue with that.

Competing Against the Big Guns

It is important for tech providers to argue the importance of channel diversification, but it is much harder to convince independent hosts to start paying for a service when Airbnb offers a slick solution with consumer-grade user experience. How do you compete against that?

In an effort to attract more supply, and to push exclusivity, tech behemoths like Airbnb, Booking.com, and Vrbo will increasingly offer and invest in their own tech solutions.

This is where players in the long tail are more vulnerable. Professionals will look for specialist third-party solutions, with an eye on performance over user experience. This is where tech providers can outplay Airbnb and its peers.

Independent hosts, meanwhile, need to see the clear value, be it in time saved or increased bookings, to make this switch. Convincing these hosts will be the ultimate test.

The End of the Long Tail?

As the sector continues barreling towards ever higher bookings, with ever-better funded companies professionalizing - or commercializing - the space, we will see the long tail shrink over the coming years. This, however, does not mean that the chasm between professional managers and independents hosts will close.

The long tail will remain large enough for players like Lodgify and BookingSync to continue their efforts, and we will increasingly see companies make a choice on whether to focus on the professionals or the independent hosts. There will be winners and losers in both camps.

Get your tickets for Skift Short-Term Rental Summit on Dec. 5, NYC