Homesharing Will Take a Bigger Bite of Hotel Market Share: New Skift Research

Skift Take

As one of the largest travel sectors, accommodations will continue to grow as travel becomes an even more integral part of consumer lifestyles. On the other hand, the rise of the short-term home rental market has been eating away at traditional hotel stays and revenues.

Last week we launched the latest report in our Skift Research service, U.S. Accommodation Sector: Skift Research Estimates 2019. It presents our proprietary estimates on key operational and performance metrics for the U.S. accommodation sector. In addition to estimates and forecasts on the total accommodation market, we break down short-term home rental market share and top 10 hotel and resort brand market share.

Below is an excerpt from the report. Get the full report here to stay ahead of this trend.

Preview and Buy the Full Report

Traditional Accommodation Sector by Segment

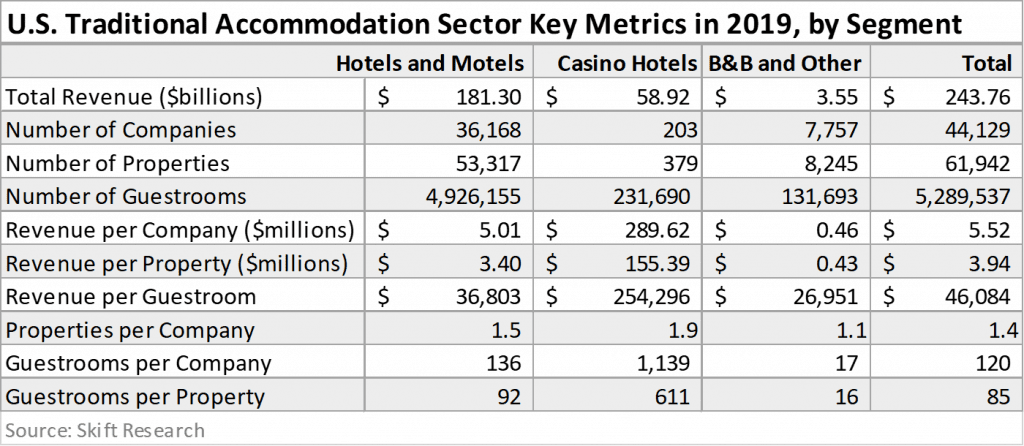

Hotels and motels, which include summer resorts and corporate-run timeshares and vacation rentals, make up about three-quarters of total revenues; casino hotels account for about 24 percent, and bed and breakfast inns and others accounts for only 1.4 percent of total revenue. These revenue shares have remained relatively stable over the past few years.

Traditional Accommodation Sector Key Operational and Performance Indicators

For 2019, we estimate that hotels and motels, the largest accommodation segment, will generate $181 billion in total revenue. Despite the concentration of the big public hotel companies, we see there are over 36,000 hotel companies in the U.S. On average, one company owns or manages 1.5 properties and 136 guestrooms. Average revenue per guestroom, including food and beverage and all other operating revenues, amount to nearly $37,000.

Preview and Buy the Full Report

Subscribe now to Skift Research Reports

This is the latest in a series of research reports aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.