Technology for Hotel Revenue Management Set to Boom: New Skift Research

Skift Take

Hotel revenue management has come a long way over the past decades, but there is still a lot of potential for growth left. Since its first iterations in the 1990s, some form of revenue management is practiced in most hotels today, but as distribution costs soar and rate parity issues persist, revenue management needs to become more sophisticated.

In The Hotel Revenue Management Landscape 2019, we research the prevalence of revenue management tech in the industry, concluding that more than 80 percent of hotels worldwide do not currently use any sophisticated technology to help with pricing and setting revenue strategies. Our analysis of in-market revenue management systems provides clarity on product functionalities and differentiators, and we expect to see a sea change over the coming years, especially with the long tail of small and independent hotels moving toward the use of tech to enhance their revenue capabilities.

Last week we launched the latest report in our Skift Research service, The Hotel Revenue Management Landscape 2019.

Below is an excerpt from our Skift Research Report. Get the full report here to stay ahead of this trend.

Preview and Buy the Full Report

From Heuristics to Excel — The Lack of Revenue Management Tech in Hotels

There is no question about the lack of uptake of sophisticated revenue management systems among hoteliers worldwide. We would include the revenue management systems discussed before, as well as in-house systems like those produced by Marriott (One Yield), IHG (Concerto), Choice Hotels (ChoiceEdge), and Best Western (Best Rev) in the “sophisticated” bracket.

What falls outside it is anything from Excel spreadsheets to heuristics and gut feeling. This is not to say that a hotelier’s knowledge and gut feeling is not important, but it cannot do the millions of computations done by revenue management systems to come up with the best room price.

As Neville Isaac of Beonprice pointed out, “There are two speeds in the industry. The big chains and everybody else, and this needs to be addressed.” Alexander Edstrӧm of Atomize agreed, noting that the big three, IDeaS, Duetto, and EzRMS, have a sophisticated product, “but they are not able to scale throughout the long tail of the hotel market as they are too complex, and you need to employ a revenue manager to operate that RMS.”

The rise of the newer players is therefore not necessarily stealing customers away from the established players, but instead targeting the major market of small and independent hotels. As Florian Augustin of HotelPartner pointed out, “The independent sector needs to make sure that it has the know-how to apply distribution and revenue strategies, so they don’t lose ground to the chains or their competitors.”

For many hotels, then, acquiring an RMS is an additional expense they did not have to consider before. Most hoteliers will have done basic pricing for a long time, but with the ever-changing online landscape, and with technology becoming more affordable, revenue management systems are becoming seen as both more necessary as well as more affordable. As Matt Curry of Rainmaker said, “Believe it or not, the majority of hotels still use Excel and other manual processes.”

Klaus Kohlmayr of IDeaS, however, is starting to see a change in the industry, calling it FOMOR, “the Fear of Missing Out on RMS.” “As even the smallest hotels in the most remote locations become connected, the need for a more dynamic and automated approach [to pricing] is growing hugely,” said Kohlmayr.

While the “need is growing hugely,” penetration of revenue management systems is still at its infancy. According to Hotel Tech Report, only 7 percent of the hotel industry uses revenue management software to help with pricing decisions. Expedia Group’s research involving hotel partners that used revenue management systems concluded that the penetration was less than 3 percent (July 2017). The figure generally quoted in the industry is somewhere between 10 percent and 20 percent, once you take into consideration that some of the largest hotel chains have their own in-house tech.

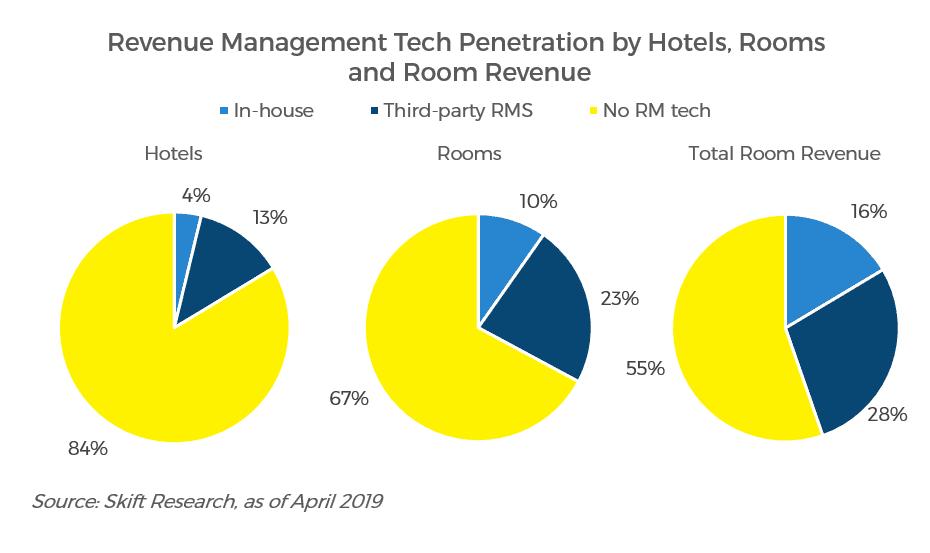

Research by Skift shows that 16.3 percent of global hotels use revenue management technology. With around 600,000 hotels in the world, this equals just under 100,000 hotels, leaving an enormous potential 500,000 hotels without sophisticated revenue management technology.

Skift Research estimates show furthermore that it’s mainly larger hotels that use revenue management systems, which is not at all surprising. The 16.3 percent of hotels with some sort of revenue management technology in place represent 32.9 percent of global hotel rooms and 44.7 percent of total room revenues.

Close to $270 billion in room revenues are priced using room revenue technology, of which 63 percent is overseen by third-party revenue management systems.

Preview and Buy the Full Report

Subscribe now to Skift Research Reports

This is the latest in a series of research reports aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.