TripAdvisor Sees Booking Site Spending Hit 4-Year Low

Skift Take

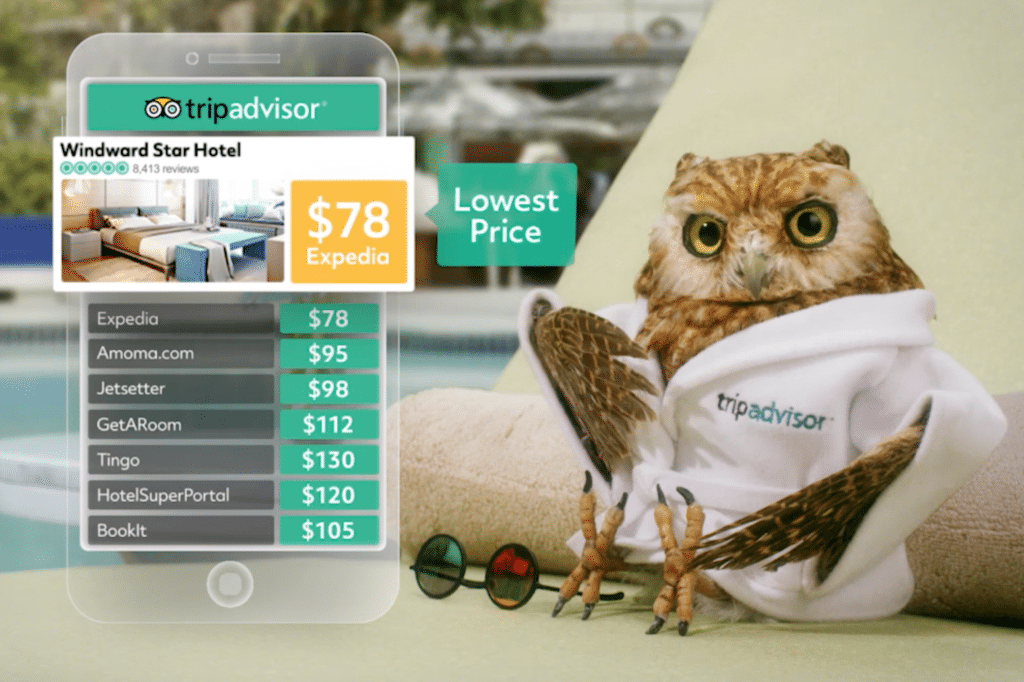

The fact that Booking Holdings and Expedia Group are leaning away from TripAdvisor is a wake-up call for many metasearch sites. However, travelers still love to use the damn things for comparison shopping, so there's that.

The golden age of major online travel agency marketing spend through TripAdvisor and other metasearch engines has lost some of its shine as they increasingly divert more of their resources elsewhere, particularly toward brand advertising.

For example, the collective marketing spending of Booking Holdings and Expedia Group through TripAdvisor reached a four-year low in 2018, and their contribution to TripAdvisor as a percentage of its total revenue hit rock bottom since it became a public company in late 2011.

In fact, in 2018, as reported in TripAdvisor's year-end financial filing, Booking Holdings and Expedia Group's contribution to TripAdvisor's total revenue fell to 37 percent, or $597.5 million, compared with 43 percent, or $669.1 million, in 2017.

We detail the trajectory of Booking Holdings and Expedia Group's marketing spend in TripAdvisor in the chart below. That collective marketing spend peaked in 2015 when TripAdvisor and Booking Holdings announced an instant booking partnership, and has trended downward ever since for a variety of reasons. Chief among them are that the major online travel agencies have seen a reduction of their marketing efficiency in performance, or search engine, advertisin