Skift Take

High upfront costs remain a barrier to many travelers who can't make a large purchase all at once. Affirm is trying to remove that obstacle and other travel brands are warming up to the monthly payments model in the process.

Hundreds of the travel industry’s most technology savvy executives will gather for our first Skift Tech Forum in Silicon Valley on June 12.

Hundreds of the travel industry’s most technology savvy executives will gather for our first Skift Tech Forum in Silicon Valley on June 12.

Skift Tech Forum, which will take place at the United Club at Levi's Stadium in Santa Clara, will focus on tech disruptions in retailing, distribution and merchandising of travel as well as on timely debates such privacy versus personalization. Expect insightful conversations from a broad range of speakers, including CEOs and top executives from United Airlines, Southwest, Uber, Accor, Sabre Corp., Hilton Hotels, Alibaba, and Kayak.

The following is part of a series of posts highlighting some of the speakers and touching on issues of concern in the technology space.

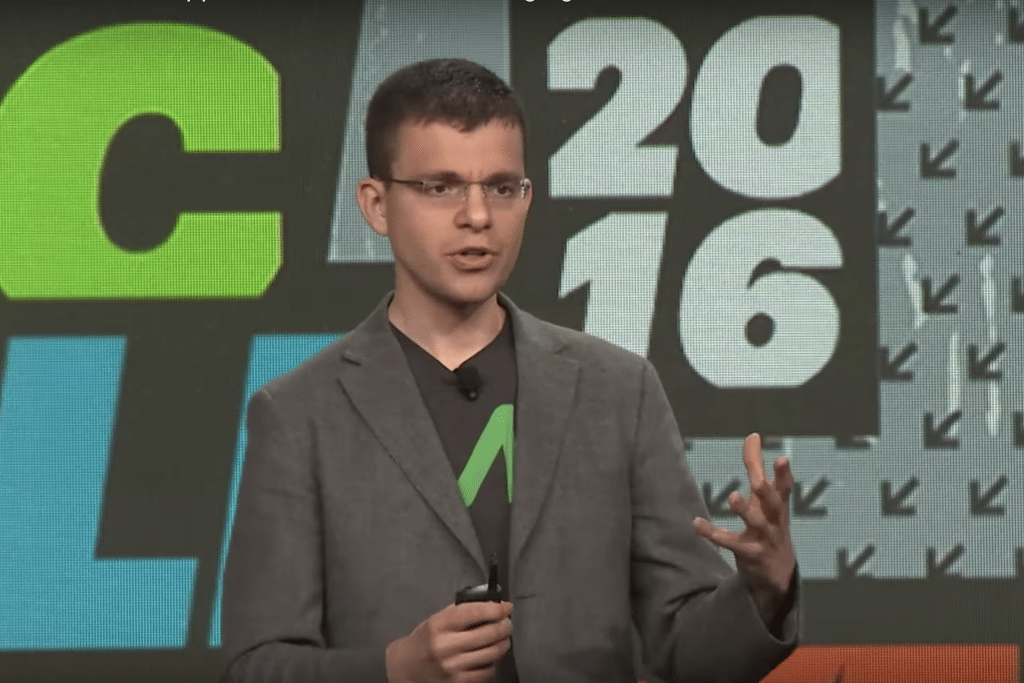

Many people’s lives are often defined by the risks they take rather than those they do not, and Max Levchin, a serial entrepreneur, investor, and CEO and co-founder of payments technology company Affirm, is no different.

Levchin, who co-founded PayPal in 2002 and has served on the boards of Yelp, Yahoo, and Evernote to name a few, founded Affirm in 2012 to change how travelers pay for trips by letting them use installments for flights, hotels, and other purchases.

Levchin gave the commencement address at the University of Illinois at Urbana-Champaign, where he is an alumnus, earlier this month where he told graduates to experience risk while they’re young and have nothing to lose, and embrace failure. It’s that kind of attitude that has helped Levchin successfully forge partnerships at Affirm and sell travel brands on a nascent payments model that’s still in question.

At the inaugural Skift Tech Forum on June 12 in Silicon Valley, Levchin will discuss why new forms of payment could be revolutionary in the travel industry as unbundling has expanded options for leisure travel to people at all price points.

What follows is an edited version of a recent Skift interview with Levchin.

Skift: Payments technology has evolved dramatically since Affirm was founded in 2012, only about six years ago. What do you consider as one or two of the most promising payments developments for the travel industry since you founded the company?

Max Levchin: The evolutions we’ve seen in payments over the past few years pair very well with the changes that have taken place within travel, especially with respect to unbundling and the increase of long-haul, low-cost travel options. The marriage of travel and e-commerce means OTAs, airlines, and hotels have had to worry about interchange, processing fees, and increased fraud risk. The ability to partner with Affirm eliminates those costs and obligations completely and turns the payments experience into a customer attraction and conversion tool.

From the perspective of the traveler, the world is becoming smaller as they’re now able to visit even more places than ever. The rise of alternatives to traditional credit to pay for travel makes it even more accessible. We hear different stories from travel customers all the time, from the couple that paid for a honeymoon using Affirm to the person who had to travel last-minute on a high-cost ticket to see a sick parent and was able to pay for it over time with Affirm. When I say Affirm provides honest financial products that improve lives, I think about stories like this and how we’re benefiting both our merchant partners and the individual travelers.

Skift: Many travelers begin researching and planning their trips several months before they actually travel, but may not book until a much closer window to the trip. How do you capture more of that segment of early planners and researchers to get them to put some money down on a trip early on rather than pay all at once a couple of weeks or days before departure?

Levchin: Affirm can help travel brands capture early planners by allowing them to lock in prices when they are low as they are still far out from the travel date, without having to pay the full amount at the time of booking. In many areas of travel, especially airfare, the price can increase significantly the closer you get to your departure date. Consumers who have to wait to save the full amount to make a purchase will probably run the risk of the trip becoming much more expensive than when they started. We’ve found that anything that costs over $250 can be beneficial when it’s broken up into payments over time.

Since launching travel financing, Affirm has seen advanced booking windows increase significantly when paying with Affirm versus other forms of payment. It has reinforced our belief that consumers want the opportunity to select and secure plans that are right for them with timing flexibility and complete transparency into how much it will cost each month to pay for a trip.

Skift: Companies like Booking.com don’t charge you anything until you check-in at a property, and Airbnb also lets you pay in installments. Many travelers book with these platforms for that very reason. How do you communicate your value proposition to travelers against companies like Booking and Airbnb, for example?

Levchin: What Airbnb and others have discovered is that any way you can reduce friction within the booking journey, including at payment and checkout, is a good thing, which I think aligns with what we’re doing at Affirm. Given the size and scale of these companies, they’ve taken on the challenge of developing these solutions in-house. But there are a lot of travel brands that prefer to partner with Affirm, where we can take on the repayment risk.

Airbnb’s approach differs from Affirm in that travelers can pay in installments but they have to finish paying before check-in. With Affirm, there is no advance purchase restriction and travelers who pay with Affirm can begin and end a trip even if they are still in the middle of the repayment term.

We’re seeing other OTAs, including Expedia, move towards an advance-payment model because it helps increase stickiness and reduce cancellations. Affirm complements that strategy nicely because we pay the merchant up front at booking and take on all repayment responsibilities.

Skift: How have people been using Affirm to book travel so far? Have you seen more airline bookings or hotel bookings, or another category that’s been more popular?

Levchin: As I mentioned, Travel with Affirm has origins rooted in our work with OTAs, which generally have more technology resources and a willingness to explore new partnerships. We were able to prove the value in travel generally with these partners and saw strong consumer interest in using Affirm when paying for travel that bundled several elements of a trip, like a hotel and a car or flight and hotel.

Consumers will often look for ways to bundle and save and the option of paying over time with Affirm has very strong consumer appeal. As we’ve grown, we’ve seen broader adoption for pretty much any aspect of travel above around $250. Paying over time with Affirm and knowing exactly how much someone will pay each month can help take financial stress out of a trip.

Skift: What was the process like in getting some travel companies to sign on to the idea of a monthly payments model? Did you come up against much resistance, or did brands immediately recognize the need for this?

Levchin: I wouldn’t describe what we’ve seen as resistance, but more generally the concept of a monthly payment alternative to a credit card was a pretty nascent concept until recently, and even more so with travel. When we began to explore travel partnerships, quick education was key.

Once we broke through the awareness barrier, we’ve seen significant interest from OTAs especially that have been early adopters of new technologies and embrace opportunities to integrate partnerships like Affirm that make booking painless and even enjoyable for travelers. Checkout and booking conversion in travel tends to be lower than other parts of e-commerce.

Affirm changes the actual nature of payments for travel retailers. Instead of being a cost center within the retailer’s e-commerce strategy, offering Affirm as a payment option actually acts as a customer acquisition tool and helps drive conversion.

Skift: There’s increasingly a lot of concern among consumers regarding data and privacy protection. How do you assure consumers their data is safe on your platform?

Levchin: Data security is our number one priority, but I’ve also been very vocal about data ownership. Consumers own their own data and they trust Affirm to use only what we need to offer them the best deal possible. Earning and keeping this trust is very central to what drives us as a company, doing what is in the best interest of our customers.

Skift: How do you plan to scale Affirm outside of the United States? How has this model worked in other parts of the world? Are there any markets you’re currently considering for expansion?

Levchin: One of the challenges of offering payments solutions in different regions is that the regulation, compliance, financial requirements and processes can vary wildly as you cross borders, and we would want to make sure we are offering the best-of-breed option anywhere we operate. For us right now, that means focusing on the U.S. and continuing to bring Affirm to merchants and consumers as the preferred payment option. Travel is an especially important part of our growth.

Don’t miss Affirm’s Max Levchin on stage at Skift Tech Forum.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: Affirm, digital payments, payments, stf2018

Photo credit: Max Levchin, CEO and co-founder of Affirm, will speak at Skift Tech Forum on June 12. Pictured is Levchin speaking at SXSW in 2016. SXSW