Airbnb Mulled Integrating Skyscanner for Flights and Buying Hopper

Skift Take

Airbnb has sold investors on a growth story based, in part, on adding flights and other products. But selling flights is extremely complicated.

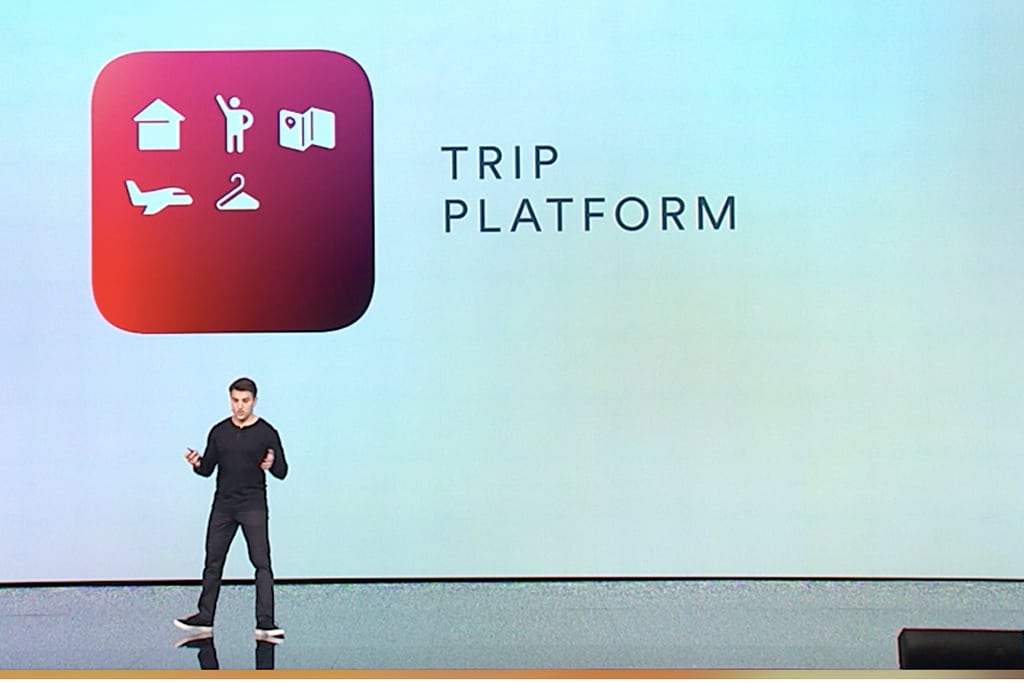

Is Airbnb going to put some "air" into its business on the road to an initial public offering? Speculation has mounted since CEO Brian Chesky teased the project in late 2016.

The Information reported last week that Airbnb "held preliminary talks" to buy or integrate with Hopper, the mobile-only fare prediction and flight-booking app that secured a $61 million financing round in December 2016.

In a separate move a year ago, Airbnb had "a team working on a potential flight-booking integration with Skyscanner, which was eventually scrapped," The Information reported.

The differences between the buy versus partnership strategies highlight periodic tensions between Chesky and Airbnb CFO Laurence Tosi, who favored the tie-in with Skyscanner rather than seeking a flight-search acquisition, according to the report.

When contacted by Skift, representatives of Hopper and Ctrip's Skyscanner didn't deny the reports.

"As you know, travel is a pretty consolidated industry -- it's not unusual for us to meet with others who share some commonalities," a Hopper spokesperson said. "That being said, we don't have any plans to partner or sell the company."

A Skyscanner spokesperson wouldn't address the specifics. "We have a dedicated team whose role it is to engage with many travel businesses within the ecosystem," they said. "Unfortunately, we are unable to comment on specific commercial conversations."

The Information report also said the Expedia had been in the running to acquire Luxury Retreats, but Airbnb outmaneuvered Expedia when it bought the upscale accommodations company.

Will and How Would Airbnb Add Flights?

It has been a year since we took the industry's pulse on the question of Airbnb adding flights. Here's an update.

Kayak CEO Steve Hafner is open to doing a deal with Airbnb and has broached the subject with the startup.

When asked, Hafner said, "I have a tremendous amount of respect for Brian and Airbnb. We've consistently offered to help them enter the flight space. Brian or LT [CFO Laurence Tosi] can call me anytime to restart discussions."

But other competitive factors might get in the way of his overture. Kayak's sister brand, Booking.com, recently added flights powered by Kayak. A more important roadblock to a Kayak-Airbnb deal would be the fact that Booking has been competing aggressively in alternative lodgi