Business Travelers Rarely Use Virtual Payments In Another Sign of Companies' Slow Adoption

Skift Take

When it comes to business travel expenses, corporate credit cards are still the name of the game. While fully digital solutions, such as Apple Pay and Android Pay, have been developed, they're still used by only a fraction of business travelers.

The Global Business Travel Association Foundation polled 137 U.S. travel managers earlier this year about their company's policy on travel expenses for their Total Cost of Ownership – Payment Solutions report.

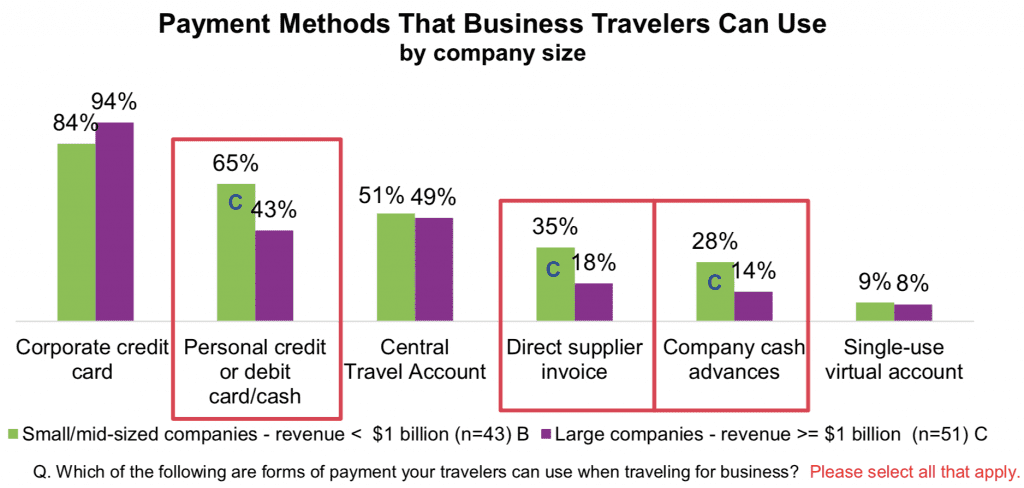

Corporate cards are, of course, widely used; 94 percent of large companies and 84 percent of small- to mid-size companies allow them. Many travelers still pay their travel costs upfront, however with 55 percent of companies allowing customers to use their personal cards or cash.

“The persistence of non-corporate methods like cash, supplier invoices, personal cards or company cash advances may reflect the prevalence of infrequent and non-employee travel,” said Monica Sanchez, director of research for the GBTA Foundation. “Regardless of the reason, these methods can pose problems including reduced spend visibility making it difficult to both track and enforce policy compliance and to perform back-offices functions such as reconciliation and reimbursement as well.”

This is problematic for organizations trying to limit spending on travel and other expenses. Many in corporate travel tout virtual cards as a solution for dealing with fraud, and retaining visibility into spending as it happens,

Instead, solutions have been adopted more often on the back-of-the-house payments end than the creation of solutions to ease this pain point for travelers themselves.

"More than half of travel programs use virtual payment," states the report. "Of these, four out of five (81 percent) only use corporate travel accounts, also known as lodge or ghost accounts, while 16 percent use corporate travel accounts and virtual card numbers. Surprisingly, adoption of virtual payment does not vary depending on company size."

Things seem to have developed slowly since the last time we took a look at this phenomenon. A breakdown of the size companies that allow which kinds of payments shows this dynamic:

"Small and mid-sized companies—which in this study are classified as those with revenue of less than $1 billion—use corporate payment products at similar rates as their larger counterparts," states the report. "However, they are more likely to use non-corporate methods including personal cards/cash, direct supplier invoicing, and company cash advances. These methods make it more difficult to have transparency of travel program spend and reconciliation."