JetBlue Airways Drops a Dozen Online Travel Agencies in Cost-Cutting Move

Skift Take

In a cost-cutting measure and the first part of a strategy to push passengers to its website, JetBlue Airways said Thursday it has stopped selling tickets through a dozen less-known online travel agencies, though it remains on larger ones, including sites owned by Expedia Inc. and Priceline Group.

The sites dropped by JetBlue represent a "very small percentage" of overall ticket sales, according to the airline. Sites no longer selling JetBlue include SmartFares.com, FlightSearch.com, VacationExpress.com, FlyFar.ca, FlightNetwork.com, and Vayama.com. JetBlue calls them "lower-yield" online travel agencies.

"We looked at the cost structure and recognized that we had a intersection of a relatively high-cost channel and some relatively low-value customers," Marty St. George, JetBlue's, executive vice president for commercial and planning, said in an interview. Passengers who bought tickets through the sites not only chose cheaper fares, but also spent less on ancillary items, he said. "They just weren't profitable customers for us."

While JetBlue called this "phase one" of a new distribution approach to steer more travelers to JetBlue.com and "select" third-party channels, St. George said executives haven't decided how to proceed next. He said the airline might bar another group of low-performing sites from selling JetBlue tickets, or it could take more drastic action.

One more aggressive option, he said, is to assess fees on tickets not sold directly through the airline. In Europe, Lufthansa Group began assessing a €16 ($19) fee in 2015, and next month British Airways and Iberia Airlines will levy an £8 ($10.50) charge to many online travel agency customers. No U.S. airline has followed, but St. George said U.S. carriers may eventually take similar action.

Additionally, JetBlue could negotiate new contracts with the global distribution systems, so online travel agencies might not have access to all of the airline's fares.

"We are not done managing our distribution costs," St. George said. "We are going to go channel by channel and partner by partner and make sure we are getting the most value."

Not an Unprecedented Decision

JetBlue is far from the first airline to take an aggressive approach with online travel agencies.

Over the past 15 years, some carriers, including American Airlines and US Airways, even have removed flights from sites like Expedia and Orbitz over contract disputes. They later returned — the big sites provide major business to the airlines — but smaller online travel agencies like the ones JetBlue dropped have not always been so fortunate.

Several years ago, Delta Air Lines quietly removed its flights from about 30 sites, including larger ones like CheapOair, OneTravel, Hipmunk, and Momondo, and less popular sites such as CheapAir, Air Gorilla and Globester. Many have not returned.

Some airlines do not participate on online travel agencies at all. Most famous is Southwest Airlines, which sells tickets through its website. For decades, this has been a successful strategy, though in recent years, some analysts have wondered whether it is hurting Southwest in Latin America and the Caribbean. In countries like Mexico and Costa Rica, where Southwest only recently began flying, prospective customers have not been trained to look for fares on Southwest.com.

Focus on JetBlue.com

Many online travel agencies, particularly less sophisticated ones, have not kept pace with industry trends that now value customer choice.

Some sites, St. George said, do not display fares as the airlines want, so customers are not able to decide between lower-priced fares, with fewer options, and more expensive bundled fares. In 2015, JetBlue introduced three economy class fare families — Blue, Blue Plus and Blue Flex — all with different rules and perks.

Also on third party sites, JetBlue at times cannot sell customers ancillary products, such as extra legroom seats, or even pet booking. And sometimes, St. George said, the third-party sites not not share basic customer information with the airline, making it tough for JetBlue to contact customers if flights are delayed or canceled. Customers may also have trouble rebooking their flights when required.

The largest online travel agencies, like Priceline and Expedia, do a better job of pushing fare options and ancillary items JetBlue wants to sell. But it is still costly to JetBlue, which must pay a substantial fee every time a customer books through them.

That may be less of an issue on a marginal flight, with limited demand, on which the airline is trying to fill seats. But the issue is vexing on more popular flights, such as a 5 p.m. Friday nonstop from New York to Fort Lauderdale. JetBlue could easily sell every seat on its own website, but some passengers instead buy on Expedia, costing the airline revenue.

"Those are customers that could be replaced at a much lower cost," St. George said.

But as for how to persuade customers to book those tickets at JetBlue.com, St. George said he's not sure of the answer — short of turning off all third-party sites.

"Every travel provider is having that same existential crisis right now," he said.

Here is the full list of sites JetBlue is dropping:

SmartFares.com

MyFlightSearch.com

VacationExpress.com

FlyFar.ca

FlightNetwork.com

Vayama.com

WhatsCheaper.com

Vegas.com

JetsetVacations.com

CheapFlightsFares.com

QuickTravels.com

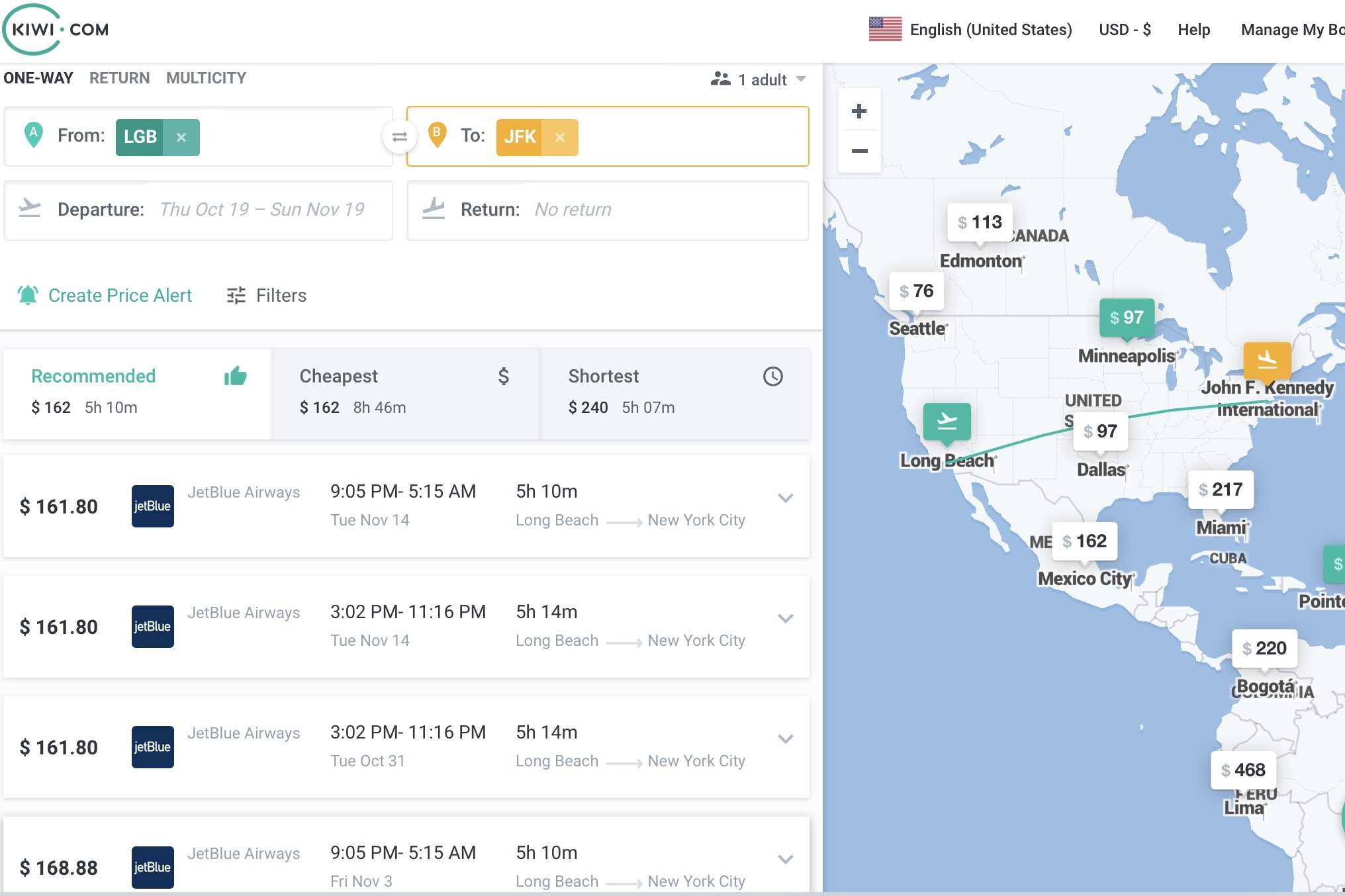

kiwi.com