Trivago Is Spending Three Times More Than TripAdvisor on U.S. TV Ads

Skift Take

Will TripAdvisor be able to break through as it starts its TV campaigns around the world? Trivago has a big advantage. At this juncture in its life, Trivago is focused on gaining share while profit concerns take a back seat.

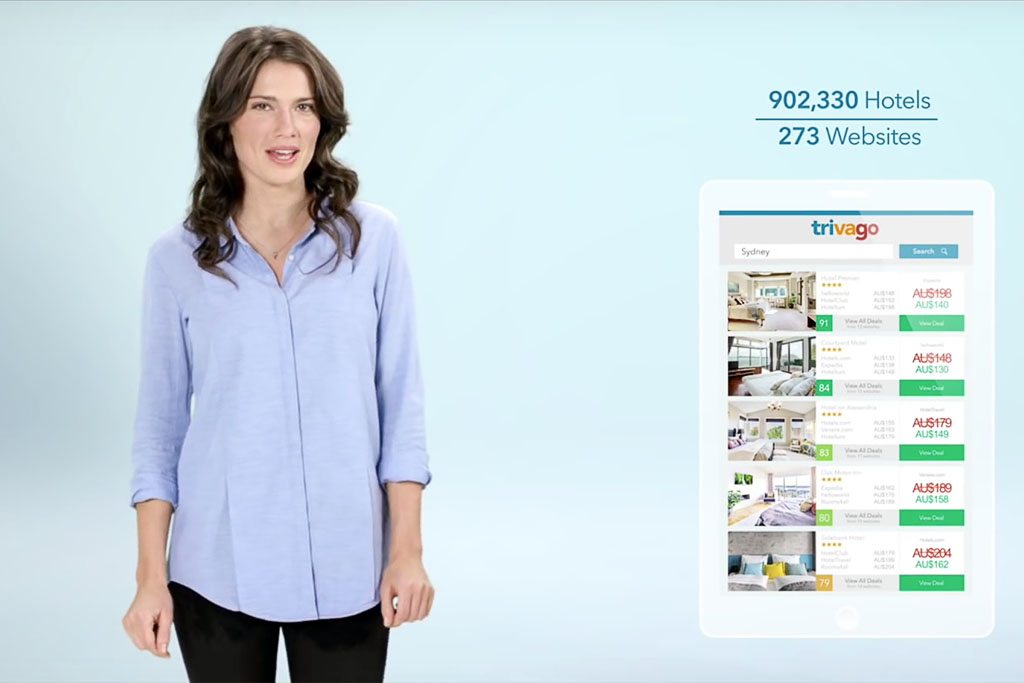

Fresh off returning to U.S. national TV advertising after a two-year sabbatical, TripAdvisor has been outspent by hotel-search rival Trivago over the last two weeks by a margin of nearly three to one.

That's according to an estimate by TV advertising analytics firm iSpot.tv, which pegs Trivago's spend at some $18 million in the U.S. from June 21 to July 4 compared with the second-largest spender, TripAdvisor, at nearly $6.8 million.

In contrast to TripAdvisor's bathrobe-clad owl as its central character, the alternating Trivago Guy and Trivago Woman are drawing more attention with an average view rate during the period that's some 7 points higher than the owl's.

As you can see from the following chart, which depicts iSpot.tv's top 10 booking-site spenders on U.S. national TV advertising, TripAdvisor's three ads are running about one-third as often as Trivago's 26 commercials.

Trivago's 26 spots seemingly have an advantage over TripAdvisor's trio of ads because viewers may get tired of so few spots running repeatedly. On the other hand, Trivago is airing its advertisements so frequently that Trivago is likely alienating some viewers, too.

Top 10 Booking Sites in U.S. TV Advertising Spend 6/21/2017 to 7/4/2017

Brand

Spots

Airings

TV Ad Impressions

Average View Rate

Estimated Spend