Fly.com Buyers Reluctantly Identified as Owners of Airfare Wholesaler Mondee

Skift Take

In March, Travelzoo sold Fly.com, the Internet domain name it had used for a travel price-comparison search engine that had failed. But Travelzoo didn’t disclose the buyer’s name.

Skift has learned exclusively that the buyers are the owners of Mondee, a travel technology company headquartered in Forest City, California that is an airfare consolidator, the largest in North America.

Travel deals publisher Travelzoo received $2.89 million in cash for the domain, according to financial filings.

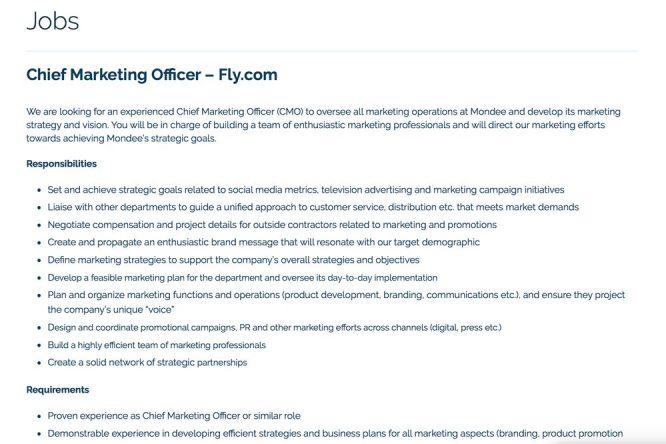

The new owner is Fly Holdings, which updated Fly.com’s privacy policy. Since then, Mondee posted a job advertisement for a chief marketing officer for Fly.com. The chief marketing officer would build a marketing team, refine a brand message and develop strategic partnerships for Fly.com.

When we contacted Mondee, a spokesperson said the Mondee operation did not own the domain name and that the want ad was a mistake. The company then removed the job posting from its site.

The spokesperson did not offer an explanation for why the ad had been posted on its careers section.

Skift circled back to officials at Travelzoo. A spokesperson declined to comment.

But a person with direct knowledge of Travelzoo’s decisionmaking said anonymously that the company did indeed sell Fly.com to Mondee’s owners.

Mondee is majority-owned by its co-founder CEO Prasad Gundumogula. Neither he nor co-founder, former CEO, and co-investor Vajid Jari would speak with Skift.

More on Mondee’s owners and Fly.com’s possible uses below. But first, an explanation of what the company does, its wild ride with private equity, and the broader industry trends it has been up against.

Consolidator 3.0: Rise of the Machines

Mondee is a technology provider to agents and does not — as a core business — sell directly to consumers.

Mondee owns a handful of brands that collectively give it the largest market share in North America among airfare consolidators.

A consolidator is a bit like how Costco offers wholesale rates on retail goods. A consolidator gets tickets from airlines in bulk at a deep discount and then distributes them to agencies, which are typically offline. These agencies often focus on specific ethnic markets such as India or China, for example.

Consolidator fares are cheaper because they come with restrictions. The most common catches are that the tickets are non-refundable and don’t let passengers earn frequent flyer miles.

Those restrictions used to put off some consumers, although the discounts can be very attractive.

But some consumers no longer mind the restrictions now that the tickets airlines sell directly on their own websites often come with similar restrictions.

Two examples: American Airlines’ new basic economy fares that do not allow a passenger to stow a bag in the overhead bin. Similarly, United’s new basic economy fares do not let the passenger earn elite status credit.

Mondee’s technology has made consolidator fares easier to buy and sell.

Years ago, agents had to use phones and fax machines to access consolidator fares an they often had to deal with delayed responses.

Today Mondee’s software allows the tickets to be processed instantly. The software syncs with an agency’s systems for ticketing, billing, and communicating with customers during and after a sale.

Last year, more than 100 airlines sold about 1.5 million tickets through Mondee’s various operations, the company says.

The digitization of ethnic travel

Consolidator fares are especially popular with travel agencies that serve ethnic communities.

Airlines may struggle to market to ethnic communities, such as immigrants to the U.S. or Germany who have family they visit back home in places like India, the Philippines, or Argentina. Ethnic communities sometimes prefer to book through agents that speak their language and offer culturally relevant marketing.

So airlines sometimes find it is more cost-effective to distribute tickets via consolidators that work with the agencies that have relationships with those communities.

Airlines like to sell long-distance flights to individuals who are “visiting friends and family” (or VFR, in the trade lingo).

What the airlines like is that the market is resilient through a crisis, and the discounts aren’t widely available to the general public. While recent economic downturns and scares related to SARS, bird flu, Zika, terrorism, and other headline-grabbing events caused plunges in business and leisure travel broadly, ethnic, or VFR, travel has remained fairly steady throughout.

Roll up, roll up

Mondee was created on the promise of transforming consolidator sales with technology. It has not quite lived up to that promise yet, according to the accounts of a few professionals who are familiar with the company.

In 2011, travel technology entrepreneurs Jafri and Gundumogula co-founded Mondee by persuading GTCR, a Chicago-based buyout firm, to bring to life their idea for a company.

In autumn 2011, GTCR and management executed equity offering of $208 million, according to financial filings.

From then through 2013, Mondee began a roll-up of consolidators.

Mondee acquired U.S.- and Canadian-based consolidators SkyLink, cFares, ExploreTrip, C&H International, TransAm, and Hariworld Travels. cFares was a consumer-direct website that had raised $13.6 million in funding but Mondee has since shut it down.

These acquisitions made Mondee the largest consolidator in North America, with about $1.2 billion in gross bookings combined.

In 2013, the company began to streamline its operations. Each of the consolidators had its own tech platform for reaching agents. Mondee brought all of the systems under one roof, creating a single data feed.

In 2014 Mondee invested in an operating platform that reduced transaction processing costs and would allow the company to scale, among other moves.

In March 2016, GTCR exited the investment.

The buyout firm may have been disappointed with its payday because it no longer highlights the investment on its website. The firm didn’t immediately respond a request for comment.

What went wrong?

No one we spoke with would discuss Mondee’s challenges on the record.

Here’s what appears to have happened: GTCR was caught off guard by how mergers in the airline industry enabled airlines to stabilize their business models and became savvier about using technology to boost direct-to-consumer sales.

This trend had the knock-on effect of cooling airline interest in the consolidator channel.

Mondee saw its margins squeezed. Airlines stopped being as generous with discounts on wholesale tickets. Meanwhile, performance-based incentives for offline agents had to rise due to competition.

Mondee’s spokesperson says the company parted from GTCR on good terms, and that, in 2016, the company increased its transaction volume by 30 percent, year-over-year, though it wouldn’t say off of what base. We couldn’t verify the claim.

Mondee says that even on occasions when consolidator fares cost about the same as tickets sold directly by airlines, its software still appeals to agencies.

Its technology platform is compatible with the most popular desktop reservation systems used by agents worldwide. This makes the sales process easier for agents.

For example, agents who use the Sabre Red workspace to book travel can use an application within Sabre’s system to access Mondee’s consolidator fares.

Mondee’s tools are compatible with the agency desktops run by Amadeus, Sabre, and Travelport, which serve 90 percent of the agency market worldwide. No other consolidator can say the same, Mondee claims.

Business-to-business growth plans

As noted, Mondee has focused on selling airline tickets so far. But it says it has recently piloted “stopover hotel reservations” as an additional product.

By end of the year, Mondee says it will release an enhanced version of its reservation platform that will make hotels available more widely.

It has a long-term goal of helping agents sell trip insurance, cruise sailings, and attractions, as add-ons and up-sells.

Fly.com’s potential uses

Fly.com’s fate remains a mystery, with no change to the website since Travelzoo sold it.

Mondee.com’s job posting for the new chief marketing officer position for Fly.com said the company is planning on television advertising and marketing campaigns for “branding and product promotion.” The CMO would also “build a highly efficient team of marketing professionals.”

Mondee’s owners did not offer further explanation of the (since-removed) want ad.

Is a direct-to-consumer play in the works for Fly.com?

Fly.com enables consumers to compare airfares and Mondee’s consolidator business could offer a competitive advantage if it can somehow get around restrictions and offer some of the fares publicly on Fly.com.

It’s notable that one Mondee company, ExploreTrip, which it bought in 2011, has long sold flights directly to consumers.

Most of the flights ExploreTrip offered in Skift’s random tests appeared to be consolidator tickets because they had restrictions like a lack of refundability and no accrual of frequent flyer miles.

Perhaps the ExploreTrip brand could be ported over to Fly.com and rebranded.

Another sign that Mondee’s owners may be wanting to emphasize retail ticket sales, and not just focus on consolidator fares, is that this year it has added its first direct connection with an airline.

This spring it began a test of connecting directly to Emirates Airlines’ host reservation system via Emirates’ business-to-business API. An API (application programming interface) is technology that companies use to share data with other companies.

This direct link enables Mondee-connected agents to see availability, issue tickets, and offer upsells such as checked-baggage fees, visas, and chauffeur services. Emirates built the connection primarily for retail, or public, fares, not consolidator fares.

New metasearch brand

Perhaps coincidentally, Vajid Jafri, co-owner of Mondee, has in the past year founded a new company on the side — a direct-to-consumer travel price-comparison search engine called OnVoya.

This brand, which appears to aspire to compete with price-comparison companies Kayak and Skyscanner, has hired 15 part- and full-time employees.

The site refers travelers to complete their bookings on online travel portals like FareStreet, which appears to resell consolidator tickets from Mondee, and other metasearch sites like fast-growing, Czech-based Kiwi, and direct from airlines like American.

OnVoya might be a natural fit for porting over to Fly.com. After all, Fly.com already has some positive search engine traffic for having been a travel metasearch site for since 2009.

Any direct-to-consumer play would face competition.

Rivals offering consolidator and similar fares include online travel companies like Australia-based Webjet, U.S-based CheapOair, Sky Bird Travel, and Dutch-based Travix, which runs Vayama.com and other sites.

So that might not be an appetizing fight to take on.