Skift Take

Muslim travelers are one of the largest visitor markets for the U.S. but few brands are marketing to them and taking their needs into account. U.S. travel and airline laptop bans create confusion and mixed messages.

From a U.S. travel ban impacting six Muslim-majority countries and populist sentiments sweeping Europe, many Muslim travelers aren’t sure what to expect at airports or in destinations in either region.

But while the U.S. and Europe often present big challenges for Muslim travelers, there are global improvements in Muslim-friendly travel offerings, including the availability of halal meals.

In other developments, Muslim arrivals to the U.S. reached a record high in 2016 — before the travel bans.

That’s according to MasterCard and CrescentRating‘s 2017 Global Muslim Travel Index, which gave the U.S., for example, an overall index score (0 to 100) of 48.6 for 2016 while the global index score average for 130 countries in the index was 45.9. For 2015, the overall global index score was 43.7 while the U.S. scored slightly higher at 48.9.

Still, CrescentRating’s global index score for safety and locals’ attitudes toward Muslim travelers has been declining for the past two years, falling from 86.1 in the 2015 index to 78.3 in 2017 for non-Organization of Islamic Cooperation (OIC) countries, or those without predominant Muslim populations, and from 89.9 in 2015 to 81.9 in 2017 for OIC countries.

The U.S. scored 62 in this year’s index for the general safety of Muslim travelers. CrescentRating projects an 18 percent drop in Muslim arrivals to the U.S. this year, given recent actions by the Trump administration and perceived safety threats to Muslim tourists.

“Externally, things look bad in the U.S. for Muslim travelers,” said Fazal Bahardeen, founder and CEO of CrescentRating and HalalTrip, a company that helps Muslim travelers plan trips and vacation packages. “But internally and below surface level, things are improving and things like halal food availability are getting much better.”

Index scores are derived from a variety of criteria, including how travel brands cater to Muslim travelers, safety, visa requirements, access to prayer spaces and accommodations options. CrescentRating tested its criteria in the most populated cities in each country to assign index scores, which don’t reflect every destination in every country.

The three criteria where the U.S. scored higher than average that helped it receive an above average score were the number of Muslim visitor arrivals in 2016, family friendliness and air connectivity to Muslim-majority countries.

Many U.S. travel brands give little or no attention to marketing efforts towards Muslims. “I can’t think of any U.S. travel brands that are doing a particularly good job with marketing to the Muslim market,” said Bahardeen. “Korea and Japan, however, are doing a lot of marketing for Muslim travelers. They really understand the market because they know how important it is for them.”

Scores for halal dining options, access to prayer spaces, airport facilities, accommodations options, ease of communication, air connectivity and visa-free travel have increased for each of the past three years for both Muslim-majority and and non-majority countries.

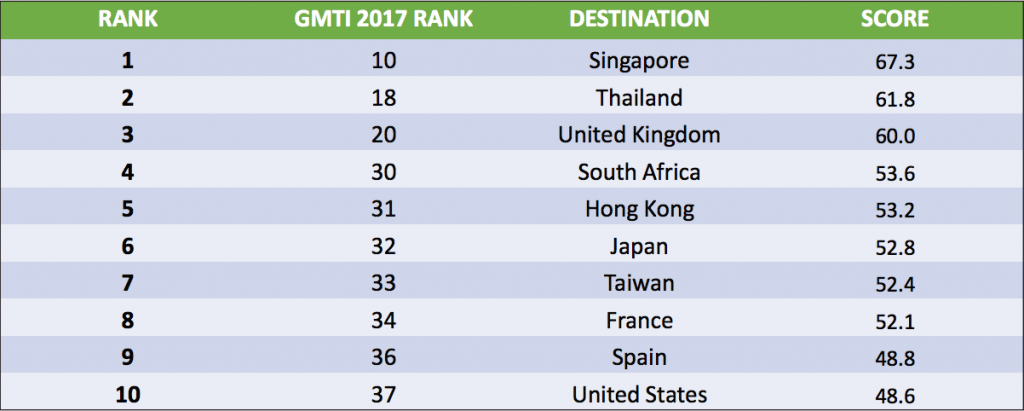

The U.S., the UK, France and Spain, for example, all rank in the top 10 in countries where Muslims are not the majority. The UK scored 60 (versus 59 in 2016), France scored 52.1 (versus 51.6 last year) and Spain scored 48.8 (same as last year).

Global Average Index Scores For Different Criteria, by Region

Source: CrescentRating and MasterCard

For perspective, about 2.3 million Muslim travelers visited the U.S. last year compared to about three million Chinese travelers — the world’s largest outbound travel market and the U.S.’ third largest international market.

Bahardeen said the growth of the Gulf carriers in the U.S., especially Emirates, deserves credit for growing Muslim visitation in the U.S. Emirates, however, recently said it’s cutting capacity on some of its U.S. routes because of a U.S. laptop ban impacting flights from 10 Middle Eastern airports including Dubai. “Emirates flies to almost every destination that Muslims want to travel to,” said Bahardeen.

“Personally, if I’m traveling from Europe to Singapore, I’d rather stop in Dubai than Frankfurt, for example, because I know things will be easier in Dubai,” he said. “There will be more halal dining options and better facilities. And I know a lot of Muslim travelers who would do the same.”

Muslim Travelers Rival Chinese in Size and Spending

Many destinations and travel brands are actively marketing to Chinese travelers and boosting market shares but Muslim travelers shouldn’t be ignored, said Bahardeen.

In 2016, 121 million Muslims crossed international borders, according to CrescentRating, compared to 135 million Chinese travelers who spent $261 billion abroad last year, for example. By 2020, CrescentRating projects 156 million Muslims will travel internationally each year and spend $220 billion and by 2026, they’ll spend nearly $300 billion per year on foreign travel.

Some 70 percent of Muslim travelers were aged 18 to 34 last year, said Bahardeen, as the global Muslim population continues to trend younger and is already one of the world’s youngest population segments.

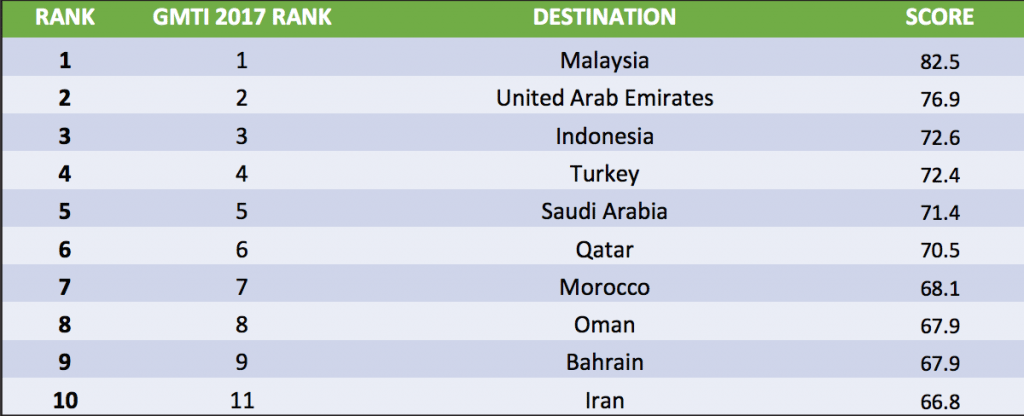

Below are two charts highlighting the top 10 countries with the highest index scores for both OIC and non-OIC categories.

Top 10 non-OIC Countries With Highest Index Scores

Top 10 OIC Countries With Highest Index Scores

Source: CrescentRating and MasterCard

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: halal, Mastercard

Photo credit: More than 121 million Muslim travelers went abroad in 2016. CrescentRating