Skift Take

Airlines are using new channels, such as Facebook chat and other airlines' websites, to sell their seats and other products. Some are turning to startups for help, rather than rely only on establishment vendors.

Airlines have tended to only use IT systems that have been around for decades. This has been particularly true of the booking engines on their websites that consumers and corporate travel managers use to buy tickets.

When it comes to their internet booking engines, airlines have typically turned to established technology developers like Amadeus (for its e-Retail system), Datalex, and Open Jaw (owned by Travelsky).

Yet today airlines are experimenting with new ways to sell tickets. They are trying new channels, such as chat-based interfaces like like Facebook Messenger and the websites of airlines that they have co-marketing partnerships with.

In the past several years, a few startups have sprung up to tackle these specialized challenges.

And a handful of airlines — including Icelandair, Nok, and Lufthansa — have experimented with hiring these newcomer tech companies.

Here’s a snapshot of some of the “next wave” vendors, who claim to have skills at both handling transactions and digital marketing.

Loyalty innovation

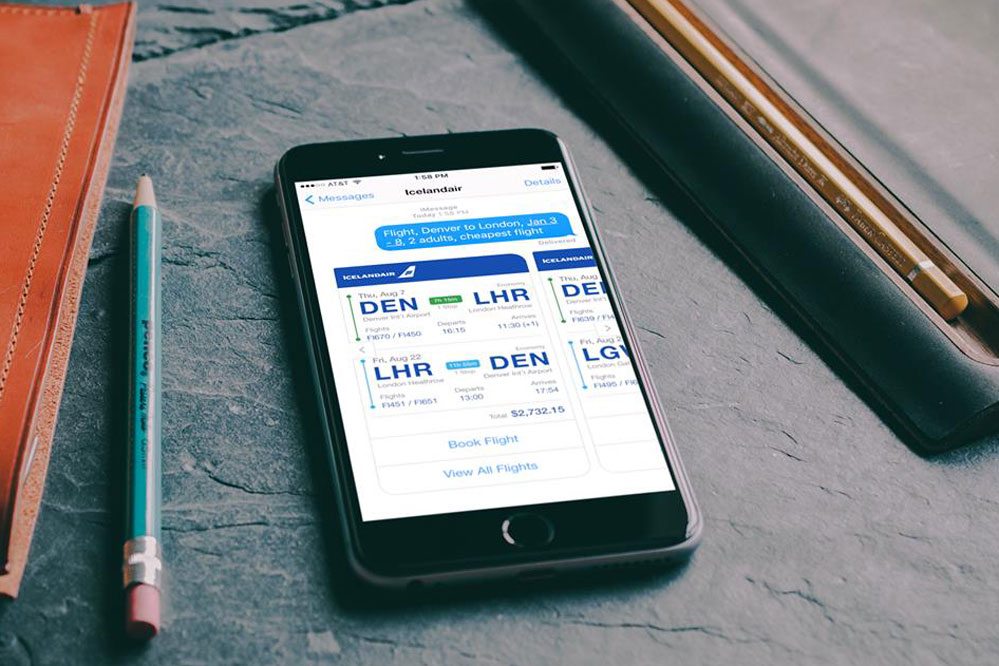

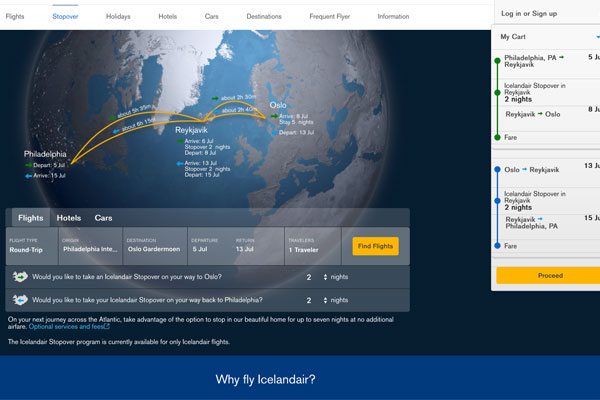

Travelaer is a travel technology startup based in Sophia Antipolis, France. Icelandair is the best known name among the airlines that have tried its services. The airline had the startup create a reservation engine that integrates its stopover program — which lets people add a visit to Iceland to an itinerary for free.

Travelaer’s twist has been to use this engine to power a map-based interface that is more visually dynamic than the typical airline reservation webpage.

Next week Icelandair expects to begin testing a revamp of its booking engine in its home country. The new design allows travelers to pay for a ticket with any mix of loyalty points and money they want, on a sliding scale. For example, a customer could book a $1,000 ticket with, say, 5,000 miles and $300 in a credit card payment.

Customers see the option in the main search results on the site. That’s different from the typical airline website design. Ordinarily a customer who wants to redeem their frequent flier miles for flights has to go to a separate booking engine in a different corner of their site and can only use miles to pay.

A tool for mixing loyalty and cash for redemption is not offered as a standard product by legacy technology players, giving an opening to vendors like Travelaer.

Other tech companies, such as Switchfly and Points.com, have developed cash-and-points mixed redemption tools. Switchfly, for instance, has let JetBlue, LATAM, and other clients offer mixed cash and points redemption for some time.* But these tech companies don’t build all-purpose booking engines for airlines, as Travelaer does.

A separate Travelaer product lets customers book a flight in one text or chat via Facebook Messenger and other conversational channels. While legacy technology players have experimented with chat-based platforms, they have stepped away from consumer-facing interfaces, bringing in other vendors, such as Accenture, to service such functions when an airline client requests it.

Founded in 2013, Travelaer has gained some traction with airlines like El Al and Azores. This month it raised $4.73 million (€4.3 million) in funding in a round led by Entrepreneur Venture. Pléiade Venture and others also participated.

Cross-marketing among airline sites

Air Black Box is an internet booking engine founded four years ago to offer a “middleware” tech solution for any pair of airlines that wants to cross-sell their products on each other’s airlines.

Until now, the website of the typical small or mid-sized airline didn’t have the technical ability to cross-sell tickets or upgrades from another airline that’s a marketing partner the way giants like American Airlines and British Airways can, to a certain extent, cross-market each other’s products (but not, say, seat assignments or upgrades).

Air Black Box provides these services, with branding, marketing detail, and transaction fulfillment, whether the transaction is direct with an airline or routed via a third-party marketplace.

Air Black Box’s “connection engine” is a fresh take on interlining carriers, a process of creating tickets served by more than one airlines. Until now interlining has required the involvement of legacy travel technology marketplaces due to the complexity involved. The startup’s retailing system enables a workaround that it says plays nicely airlines’ existing IT infrastructure.

Its 45 employees are now helping airlines like Nok and Tigerair Australia cross-sell on each others’ sites as part of a marketing effort called the Value Alliance.

The company has received undisclosed investment from ANA Holdings, Cebu Pacific, Scoot (part of Singapore Airlines), and Nok Airlines.

Popularizing direct connections

DCS Plus isn’t new. The travel technology company was founded in Romania in 2002, and it has gone on to process billions of euros of transactions for hundreds of travel companies. But it has only been in the past few years that it has gained prominence with major airlines, after an investment from German venture capital firm Earlybird.

In 2015, DCS Plus doubled its revenues, making it one of the 500 fastest growing technology companies in Europe, Middle East & Africa (EMEA) according to Deloitte.

One of DCS Plus’s new products has caught airline interest. The system enables travel management companies, online travel agencies, and wholesalers to book tickets directly from airlines. That process avoids the usual route of going through distribution systems, which charge large fees.

DCS Plus is one of the vendors Lufthansa has certified for providing direct connections. It is not the only company enabling agents to connect directly to LH Group inventory. But it is among the ones attracting broader airline interest. Emirates, for instance, has also been experimenting with its direct connect product.

Last year, having seen the appeal of its services to airlines, two of the distribution systems — Sabre and Travelport — signed strategic partnerships with DCS Plus.

The number of airlines hiring startups in this “middleware” sector shouldn’t be overstated. Airlines remain conservative about technology investments and tend to prefer vendors with long track records of building products that seamlessly cooperate with their other IT infrastructure.

Yet the early traction experienced by the above companies suggest that airlines may, over the next several years, take more chances with smaller vendors. Looking beyond just internet booking engines to the marketing of direct ticket sales, some companies and organizations to watch include Boxever, Conztanz, Farelogix, Flyiin, FLYR, Plusgrade, and Vayant, to name a few. Airline-backed incubators and accelerators Ryanair Labs, Founders Factory, JetBlue Technology Ventures, and Cockpit Ventures are also supporting some new wave travel tech companies.

*UPDATE: Article amended to spell out that Switchfly has offered mixed-point redemption for JetBlue and LATAM for some time.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airlines, booking engines, icelandair

Photo credit: Skift Take: As airlines experiment with new channels for selling their products, such as Facebook chat and other airlines' websites, they are increasingly turning to a wave of young startups for help. Travelaer