Priceline's Boyd Says Company Has the 'Muscle' to Offer Private Rates Like Hotels Do

Skift Take

Priceline Group executives say their relationships with the major hotel chains are good and the impact of their direct-booking campaigns isn't acute. Then why is Jeffery Boyd, the Group's executive chairman, talking about taking remedial actions?

What's good for the goose is good for the online travel agencies, too.

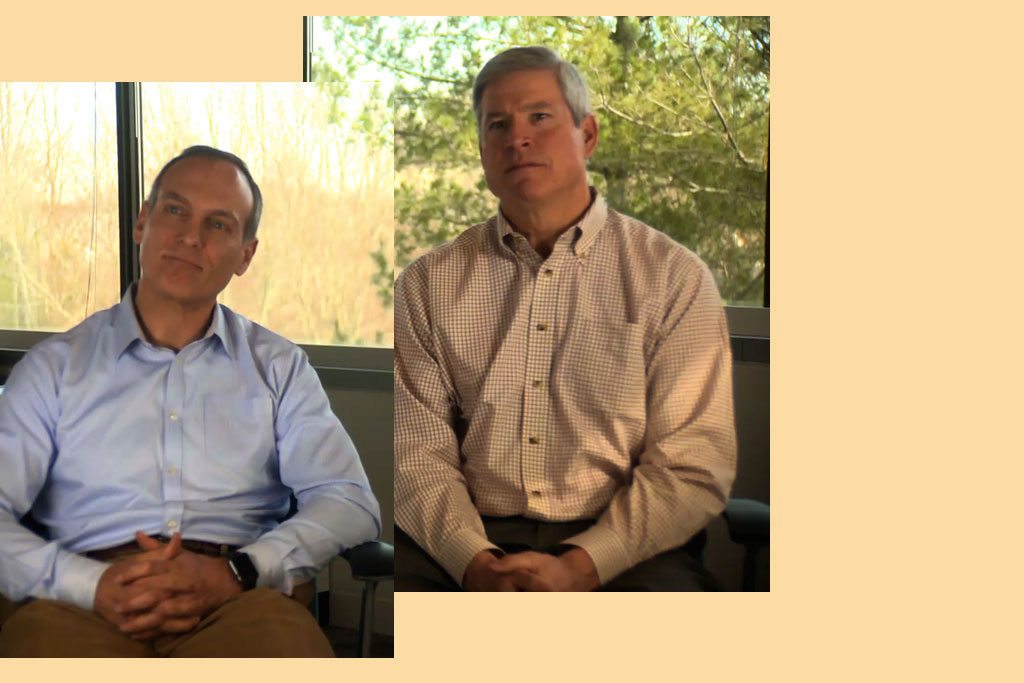

Commenting on major hotel chains offering exclusive loyalty rates to their members in an effort to undercut online travel agencies, Priceline Group executive chairman Jeffery Boyd said his company has the "muscle and technology" to do something similar for its own customers.

Boyd, speaking along with CEO Glenn Fogel at the Bank of America Merrill Lynch Consumer and Retail Technology Conference in New York City Wednesday, said hotels have opened these sorts of loyalty tools for their guests, and online travel agencies likewise are capable of enticing customers to register on their own sites and make prices available that are lower than the published rates generally available to the public.

Booking.com has been experimenting with a loyalty program, Booking.com for Business, but hasn't emphasized it in marketing.

The Priceline Group is "doing better" with major international hotel chains and has a "solid position," Boyd said. Prevailing wisdom has been