Airline Services Leaders Accelya and Mercator Announce Merger

Skift Take

Piece by piece, private equity firm Warburg Pincus is building Mercator into a rival to Sabre and Amadeus -- two travel technology providers that provide overlapping software and operational services to commercial airlines (and that recently went public after restructurings by buyout experts). Expect the Mercator merger with Accelya to spur an acquisition spree.

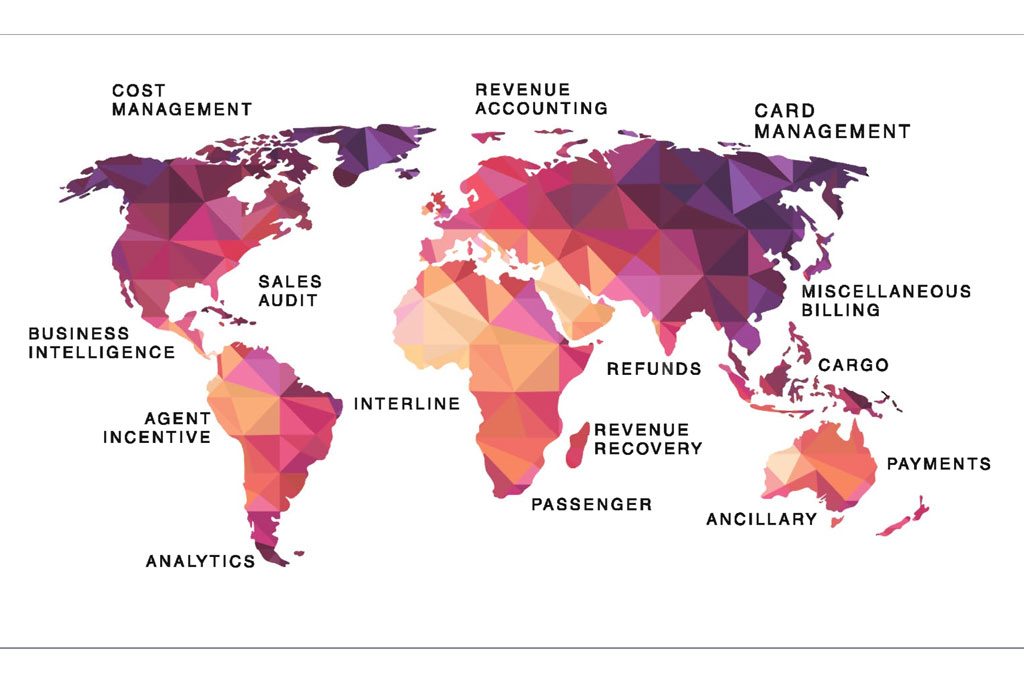

Barcelona-based airlines services company Accelya, which helps airlines like American Airlines and British Airways manage costs, is merging with Mercator, a Dubai-based travel services company. As of now, the combined companies will retain their separate brands, but the pattern of other similar mergers (such as Sabre's acquisition of Abacus) suggests that Mercator will become the main brand over time.

Warburg Pincus, a U.S. private equity firm that has a majority stake in Mercator, led the deal. The terms of the transaction were not disclosed. The combined company will have pro forma an