Google Flights Is Making Gains With Consumers

Skift Take

Just because your company is paranoid doesn't mean Google Flights is not out to get you. Google Flights is making gains, albeit incrementally and seemingly unceasingly.

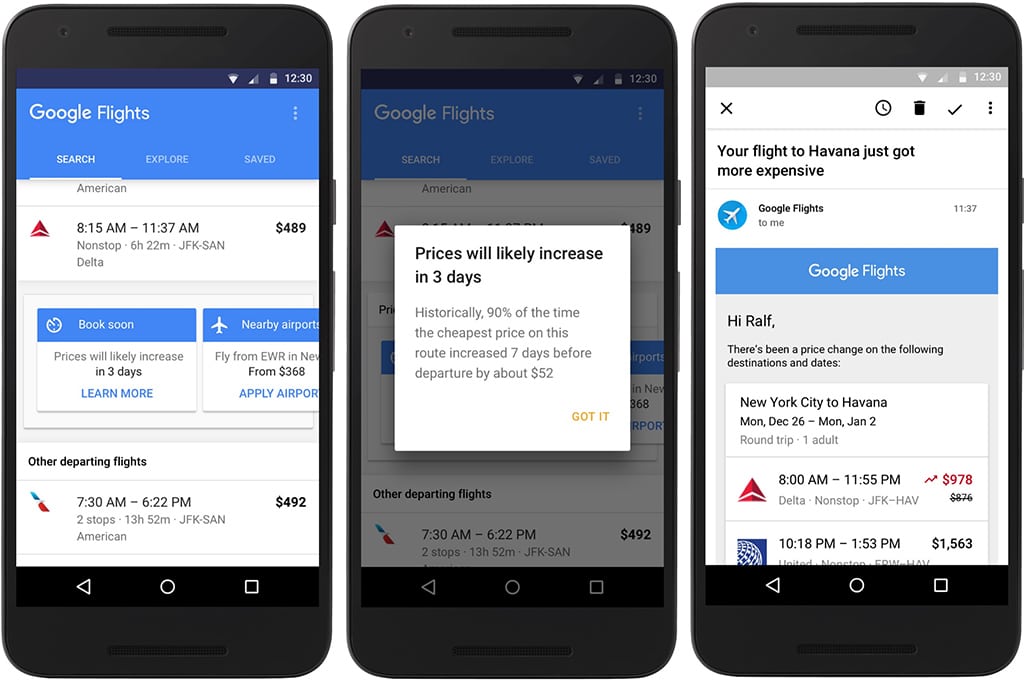

With a dominant search engine in its pocket and a fast-as-anything and excellent product, Google Flights is starting to really assert itself and is getting consumer traction.

But how much?

With travel advertising revenue that's already twice the size of Expedia's, Google, of course, won't share any market share or revenue data about Google Flights or Hotel Ads. There are many reasons for Google's reticence, including that this is just Google being Google and the fact that the company doesn't want to alienate its largest online travel agency advertisers.

But in a LinkedIn post, Mario Gavira, managing director of Paris-based metasearch site Liligo.com, crunched data from Google Trends and stated that Google's gains are contributing to likely consolidation fervor in Europe.

"The reason for this sudden rush might well be spurred by the increased interest of search giant Google in expanding its presence in the existing online travel ecosystem," Gavira wrote. Ctrip's acquisition of flight metasearcher Skyscanner is a big contributing factor as well, he says.

We looked at similar Google Trends data as reflected in the two charts below. The first chart compares Google Web searches related to travel in the U.S. from 2004 to the present for search terms "Google flights," "Kayak," "Skyscanner" and "Momondo."

You can see that Google Flights has been the leader among the four metasearch offerings in term