Contrarian Flight-App Hopper Attracts $61 Million in Series C Financing

Skift Take

Is there a big enough market for travelers to track flights through push notifications and wait weeks or months to buy instead of going to a website and entering their itinerary details? Hopper, Hitlist, and others think Millennials and others will shop this way but there is skepticism about how large these businesses can become.

Consider the $61 million bet that investors have made this year in app-only flight-booker Hopper, a nine-year-old "startup" that appears to be finally finding its footing.

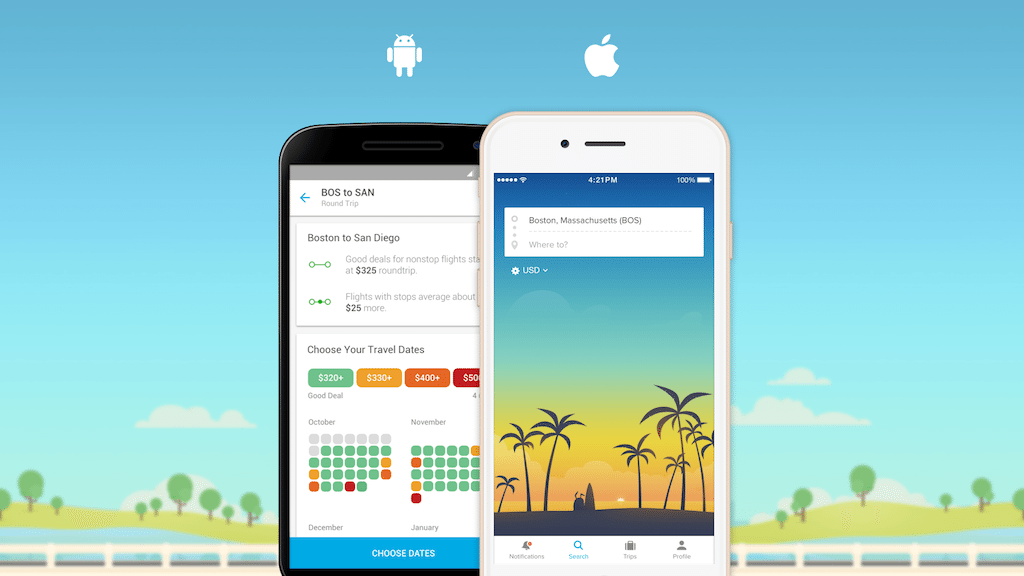

The iOS- and Android-only flight app, which counsels travelers to buy now or wait to purchase a ticket, markets itself in social media and messaging apps only, says founder and CEO Frederic Lalonde, charges booking fees when just about everyone else long ago abandoned them, and bases its strategy on the desktop and mobile Web being on their last legs five to 10 years from now.

On top of that, Hopper, like its smaller rival Hitlist, faces the uphill battle of trying to change consumer behavior and the traditional way travelers shop for flights. The premise is that they will be content to start searching for flights months or weeks in advance, and then wait for Hopper to surface the deals and keep updating them, alerting consumers through a stream of push notifications on their phones.

Hopper thus targets price-conscious flyers and not brand-loyal or business travelers who might ordinarily book on United.com or Delta.com to accrue rewards. Lalonde claims that more than half of Hoppers users are Millennials, and the company markets to them through social media and message apps. No Google Adwords or metasearch, he adds.

Conversational Commerce?

If all of these elements weren't contrarian enough, Lalonde says Hopper is engaged in a for