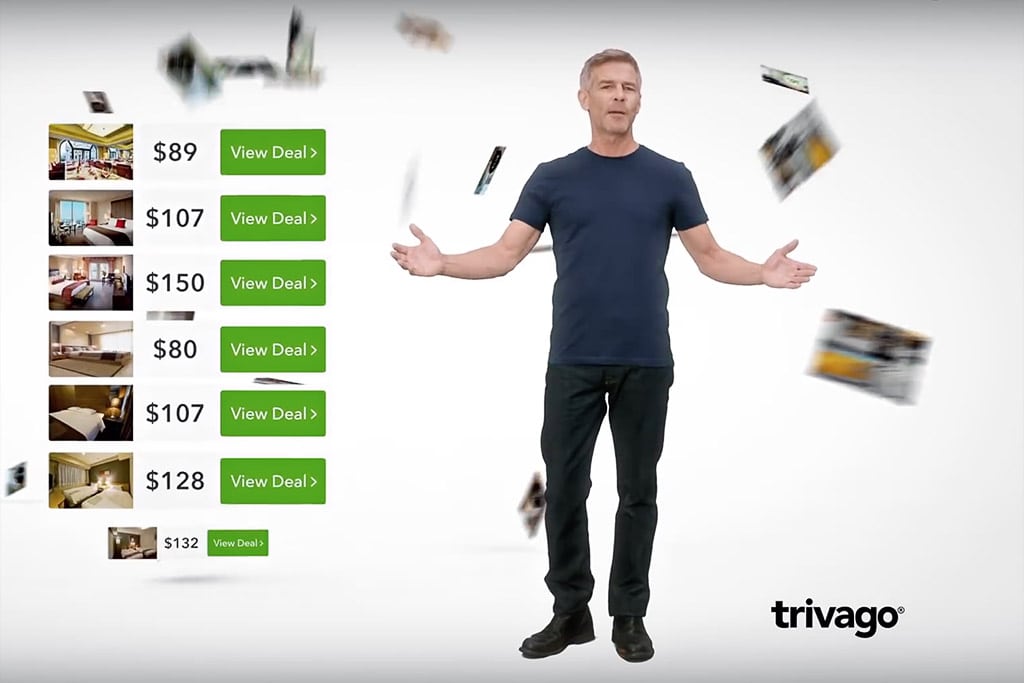

Trivago Files for an Initial Public Offering in the U.S.

Skift Take

The IPO that we all knew was coming is finally here.

European metasearch giant Trivago filed its long awaited initial public offering (IPO) in the U.S. today as parent Expedia tries to further monetize a fast-growing marketing vehicle in a manner that has similarities of its spinoff of TripAdvisor several years ago.

Trivago will be listed on the NASDAQ under the ticker symbol TRVG, using a holding company named Travel BV. Expedia Inc. owns a large chunk of the company after buying into 63.5 percent of Trivago for $628 million in cash and stock in 2012. Expedia plans to retain its stake in Trivag