Lastminute.com Group's Acquisition of WAYN's Assets Is Complicated

Skift Take

Lastminute.com group may have bought the assets of WAYN but the company behind it remains in insolvency proceedings in the UK. Clearly this isn’t a straightforward deal.

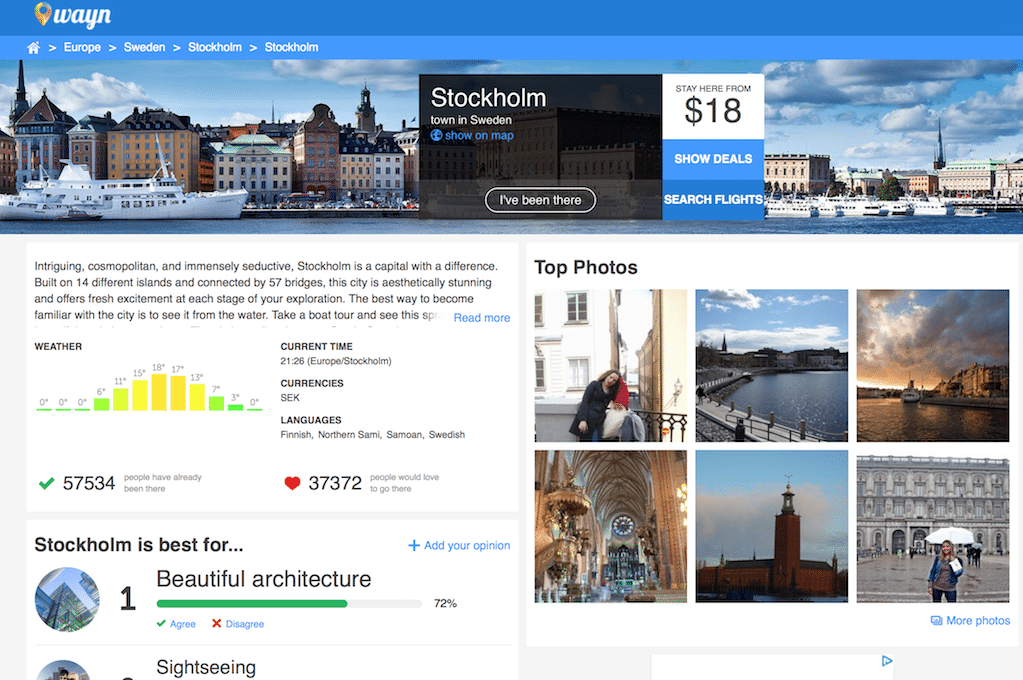

Strange goings on at WAYN, the social media platform that bills itself as the "world's largest travel club."

Yesterday Skift reported that the company that trades as WAYN (Where Are You Now? Ltd) had gone into administration – a form of insolvency in the UK. This remains the case.

The CEOs of Expedia, Commune Hotels, Upside, and More Are Speaking at Skift Global Forum 2016. Join Us.

Today, the recently renamed lastminute.com group (formerly Bravofly Rumbo Group) announced it had acquired some of WAYN's assets as part of its drive to move into the content business.

WAYN can trace its history to the pre