Priceline CEO to Hotels: We Can Offer Discounted Rates, Too

Skift Take

Priceline Group Interim CEO Jeffery Boyd is too much of a gentleman and a professional to get into a public shouting match with his hotel-chain partners. Still, behind the scenes, he doesn't intend to sit back and let hotel chains withhold their lowest rates without taking retaliatory steps.

Priceline Group Interim CEO Jeffery Boyd wanted to appear reasonable and measured so in discussing the hotels chains' efforts to push direct bookings on their own websites, he declined to get into a tit for tat discussion.

"I wouldn't express it as if they do this then we'll do that," Boyd said during the company's second quarter earnings call August 4. "This is a partnership." He characterized the chains' activities as an "evolution" of goals they've had for a long time.

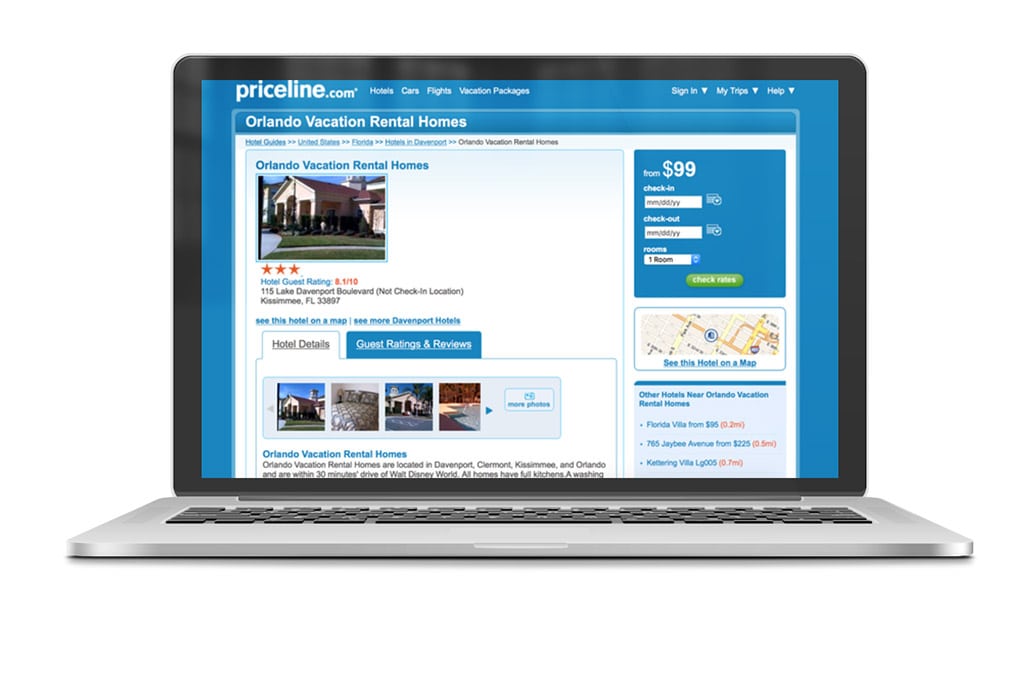

Still, Boyd said, "it's a reasonable ask" for "the largest player in the space" to expect to get the chains' most-competitive rates because that's what Priceline's customers' expect. Priceline now offers more than 1 million properties, a 30 percent increase over the second quarter of 2015, and this includes some 493,000 vacation rentals and apartments, he said.

Boyd said the Group will continue to "press" the chains for their lowest rates and noted that Priceline is equipped to advertise substantial discounts, too.

"It might not be a