TripAdvisor Instant Booking Shows 'Slight' Improvement But It's Still Ugly

Skift Take

When a CEO talks about "playing the long game" in characterizing quarterly results, then you know what's next.

TripAdvisor released its second quarter results August 3 and missed analysts' expectations on both earning per share ($.038 actual versus $0.42 expected) and revenue ($391 million in reality versus $402.5 million that was the consensus estimate).

On the key metric that TripAdvisor has identified regarding 2016 goals, the company saw its revenue per hotel shopper, which includes click-based advertising from metasearch and commissions from Instant Booking, fall 19 percent year over year in the second quarter.

That decline compares somewhat favorably to the 24 percent year over year revenue per hotel shopper falloff that TripAdvisor notched in the first quarter of 2016.

“We took important steps along our key initiatives during the second quarter,” said TripAdvisor CEIO Steve Kaufer in a statement. “Hotel instant booking is now live to users around the globe. We also continued to build a more end-to-end travel experience through our attractions, restaurants and vacation rental businesses as we grew bookable supply and improved our consumer offering on all devices, especially on mobile. We continue to play the long game as we navigate our business to deliver the best user experience in travel.”

Some observers thought there might be more significant improvement in revenue per hotel shopper because CFO Ernst Teunissen said in February that he thought "later in the year, we believe that growth will improve similar to what we saw in our metasearch rollout in 2013."

Some of the weakness, though, TripAdvisor stated, could have been due to terrorism and Brexit.

"Similar to the first quarter, year-over-year revenue and revenue per hotel shopper performance in the second quarter was impacted by our global instant booking launch, which includes both lower monetization as well as a higher percentage of revenue recognized at stay, as opposed to being recognized at the time of a click," TripAdvisor stated in prepared remarks that coincided with the second quarter earnings release.

"The ongoing user shift to phone continues to dilute our revenue per shopper growth, since phone monetizes at significantly lower rates compared to desktop and tablet. Throughout the first half of the year, we have also been up against a tough metasearch auction compare from last year. Additionally, the increased number of macro events in recent months, and quarters, have also generated headlines and we believe these events dampened normal travel seasonality in the quarter."

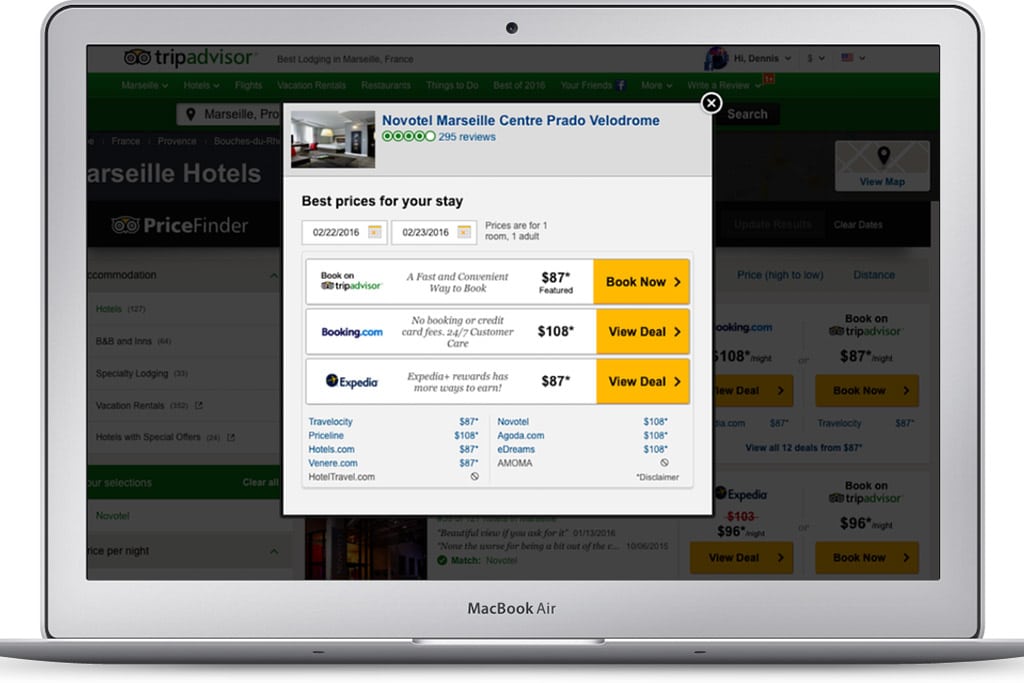

After using pop-ups to monetize users' hotel research in its early days and launching metasearch lead-referrals in 2013, TripAdvisor has now fully rolled out Instant Booking globally in partnership with Booking.com and major hotel chains and sees the latter as a way to more efficiently stem the leak of consumers who click away from TripAdvisor and never end up -- or only later end up -- booking on the TripAdvisor hotel or online travel agency partner site.

"Instant booking is a key piece, since it gives TripAdvisor users a more seamless way to plan, compare prices and book hotels," the company stated. "It also uniquely positions us to address the significant monetization leak inherent to our click-off model. We are early days, but during the quarter we made a lot of progress along this four-phase initiative."

As of this writing, TripAdvisor's share price was down 8 percent in after-hours' trading.