Priceline Group’s Earnings Reveal Its Alternative Accommodations Ambitions

Skift Take

The Priceline Group is looking for a CEO who can handle disruption and big changes in technology and market conditions in coming years. Just look at the changes in the Group's accommodations mix as lodging alternatives are approaching half of the company's roster of properties.

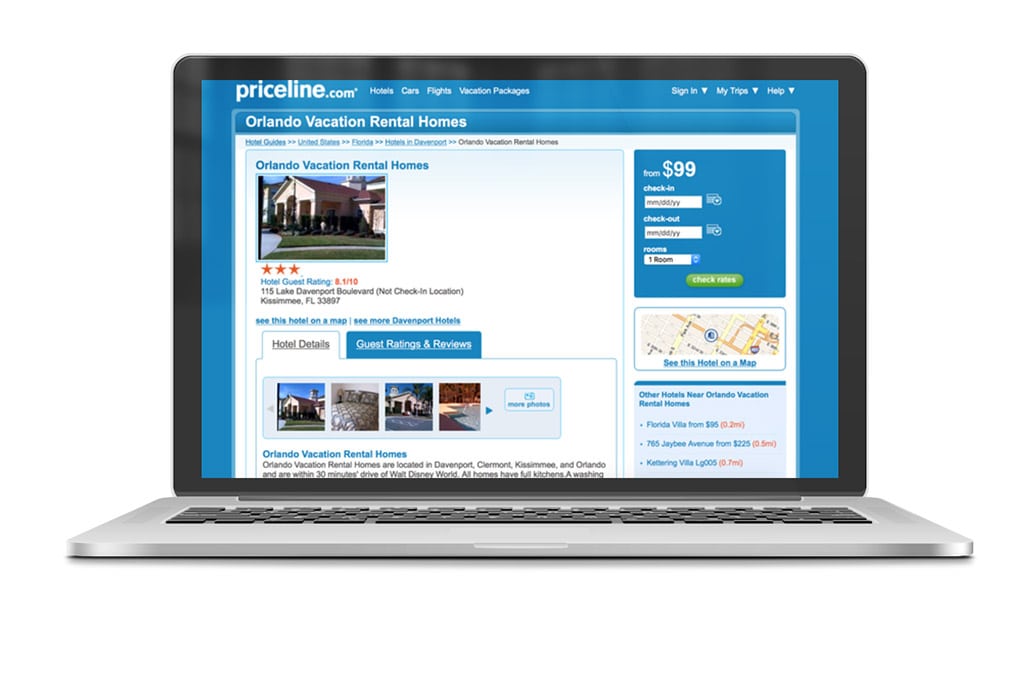

The Priceline Group’s alternative accommodations, including vacation rentals, apartments and short-term rentals, are growing faster than hotels and are approaching half of the company’s overall inventory.

The Group currently lists 423,285 alternative accommodations, or 47 percent of its overall property roster.

In the first quarter, officials said during the company’s earnings call today, Priceline's number of accommodations jumped 30 percent to more than 900,000 properties. The Booking.com site now says it has 900,364 properties.

Interim CEO and chairman Jeffery Boyd, who reassumed the