Exclusive: Major Hotel Chain Won Financial Protections in TripAdvisor Instant Booking

Skift Take

As TripAdvisor Instant Booking kicks into gear it appears as though it is breaking new ground and becoming a hotel-friendly channel -- for chains that sign up, that is. Chains such as Hilton Worldwide and InterContinental Hotels Group, which have not hopped on the bandwagon, can probably afford to sit on the sidelines for awhile to gauge how the whole thing shakes out.

TripAdvisor Instant Booking may turn out to be a hotel-friendly channel after all.

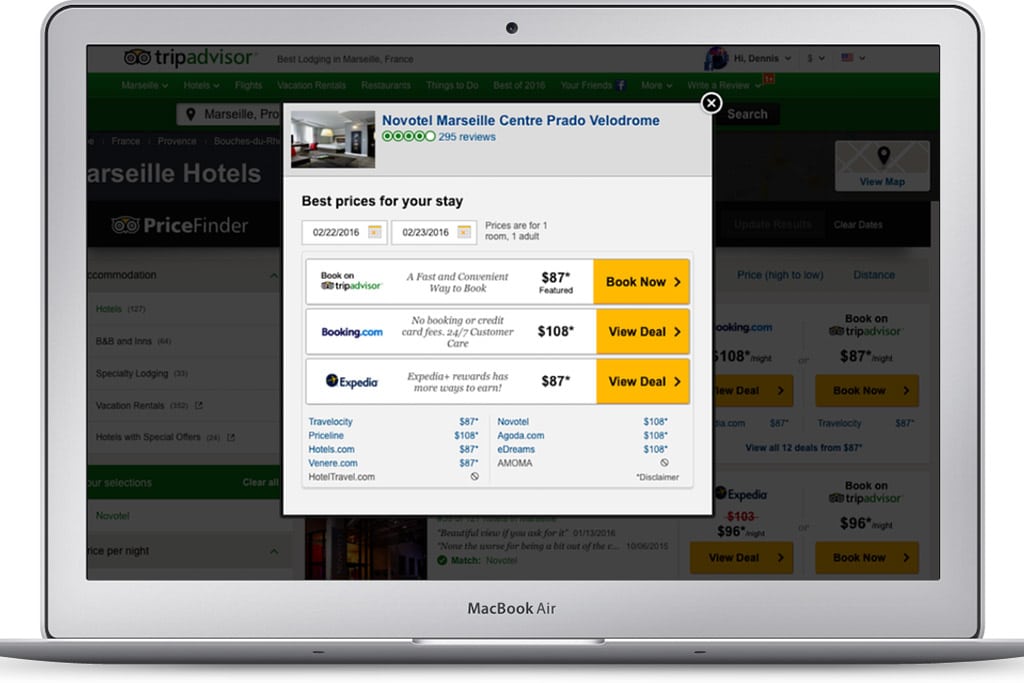

In other words, it appears as though it is trending toward not being merely a metasearch replay, which saw online travel agencies such as Booking.com and Expedia, with their vast resources and comprehensive hotel inventory, dominating the channel.

To date, in addition to a landmark partnership with the Priceline Group, TripAdvisor has notched Instant Booking partnerships with Accor, Best Western International, Carlson Rezidor, Choice Hotels, Hyatt Hotels, Langham Hospitality, La Quinta Inns & Suites, Mandarin Oriental, Marriott International, Starwood Hotels & Resorts, and Wyndham Worldwide. Hilton Worldwide and InterContinental Hotels Group are two notable holdouts.

Although Booking.com is scooping up bookings on TripAdvisor for many hotels, such as brands that belong to InterContinental Hotels Group and Hilton Worldwide, which have not partnered with TripAdvisor, and occasionally for properties that have (see details below), one chain that is a TripAdvisor Instant Booking partner told me that it negotiated protections with TripAdvisor that safeguard the chain's KPIs (key performance indicators) within TripAdvisor Instant Booking and metasearch.

If Booking.com or another online travel agency occasionally gets a TripAdvisor Instant Booking for one of its properties, the chain isn't overly concerned.

"We agreed on success metrics," the official said of the chain and TripAdvisor. "We are not freaking out."

If one major chain negotiated such protections with TripAdvisor, it stands to reason that some of the others did, as well.

If TripAdvisor Instant Booking, which is now live in the U.S., UK, Australia, Canada, India, Ireland, Malaysia, New Zealand, Philippines, Singapore and South Africa, gains consumer traction, then the chains at risk would appear to be Hilton Worldwide and InterConti