7 Charts Forecasting the Behavior of U.S Luxury Travelers in 2016

Skift Take

With luxury travelers, having the most exciting experience to brag about to their peers carries more weight than possessing the latest iPhone or Lamborghini.

In fact, some 80% of U.S. luxury travelers would choose a luxury experience over a luxury item, according to a new report from Martini Media. The report details the online behavior of three key segments of the affluent/luxury traveler market: the hyper affluent, 3% of Americans with at least $250,000 in annual household income; the mass affluent, one quarter of the U.S. population who falls in the $100,000-$249,000 income range; and the emerging affluent, aged 18-39, with household income in the $75,000-$249,000 range. The report is based on an online survey conducted by Martini Media, Evolve Media and Ipsos Media during April 2015 with 875 respondents.

“The memories made from one-of-a-kind travel experiences are something that money cannot buy,” said Vincent Krsulich, senior VP of sales at Martini Media, an Evolve Media company, in a statement. "Affluents would rather spend money on vacation than on material possessions, and the amount of time and money they plan to spend is expected to increase over the coming year.”

The following seven charts from the report reveal some surprising findings, including the amount of time older versus younger luxury travelers spend researching travel on mobile devices as well as the most important hotel selection drivers for luxury travelers.

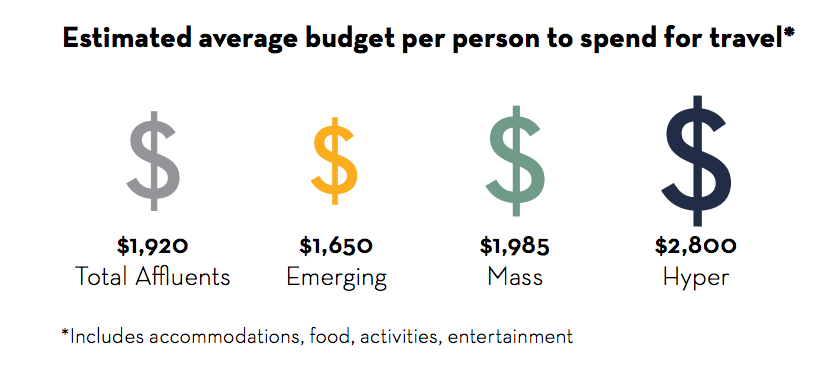

Chart 1: There's a broad window for luxury travelers' budgets, ranging from $1,650 to $2,800 per trip.

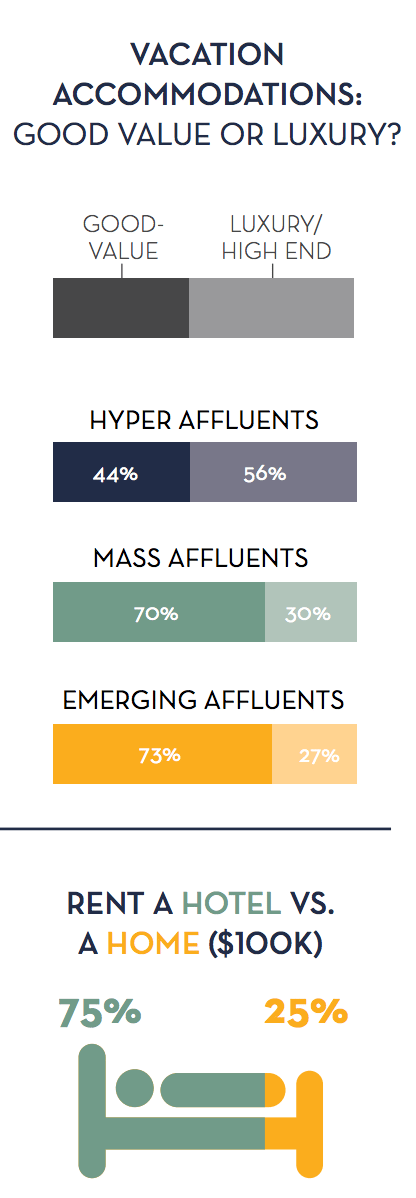

Chart 2: Unsurprisingly, older luxury travelers are looking for more "luxury/high end" accommodations than "good value" accommodations. But it's the opposite case for emerging, or millennial, luxury travelers.

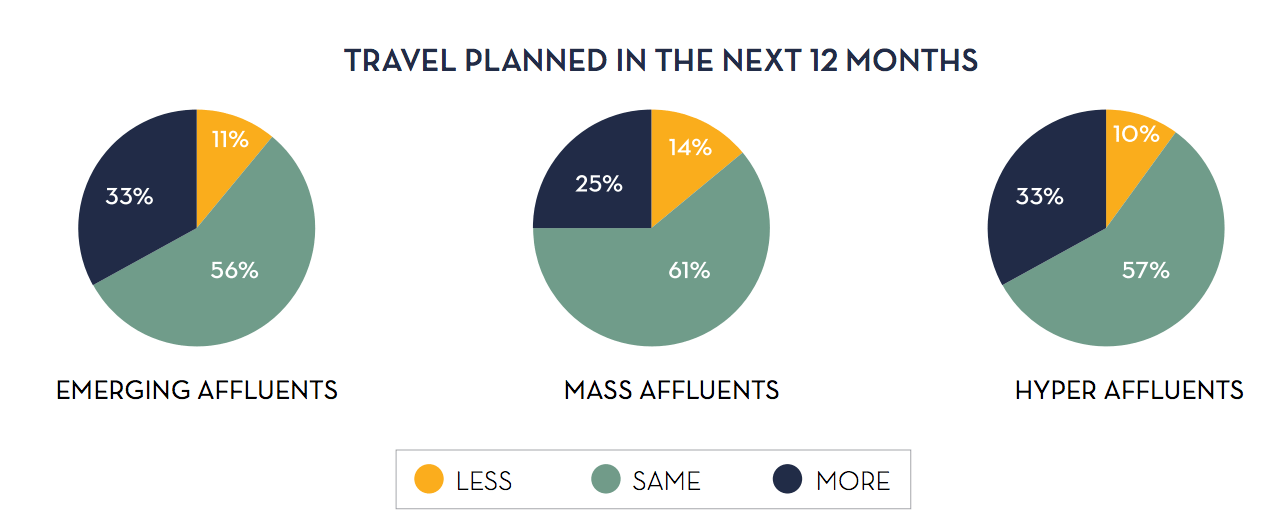

Chart 3: More than half of the three luxury traveler types say they're planning the same amount of travel for next year compared to this year.

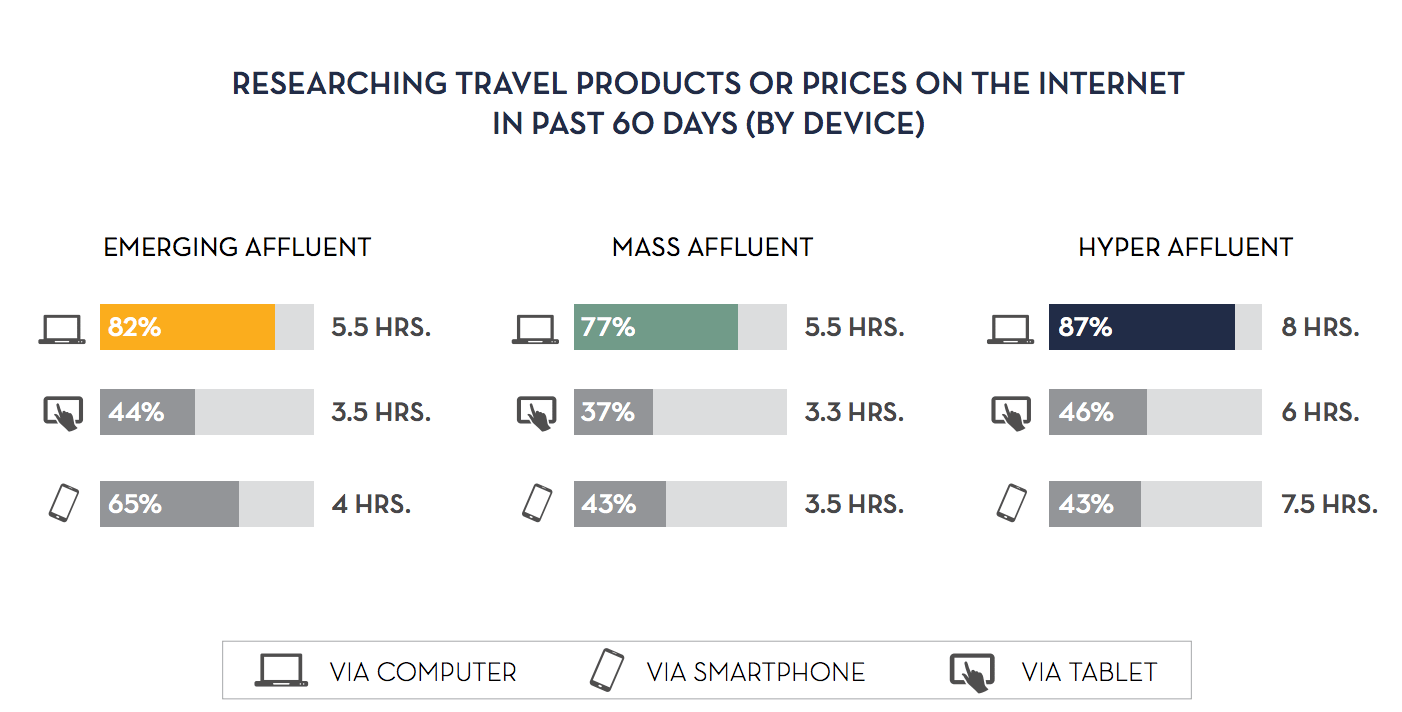

Chart 4: Interestingly, even though more emerging, millennial luxury luxury travelers research travel on smartphones than hyper, older luxury travelers, the latter still spend 3.5 hours more on average researching travel on mobile devices than their younger counterparts.

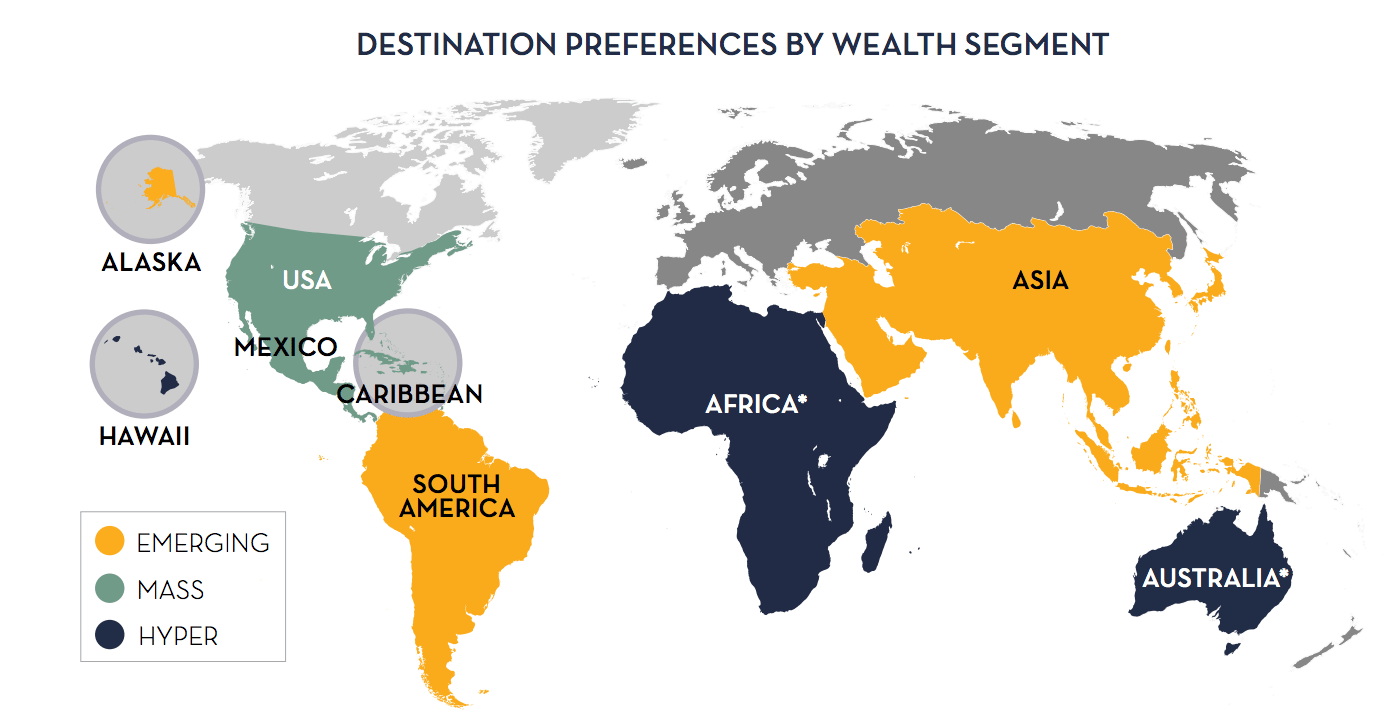

Chart 5: Luxury travelers are all over the map, with the emerging group preferring South America and Asian destinations vs. the hyper group which prefers African and Australian destinations.

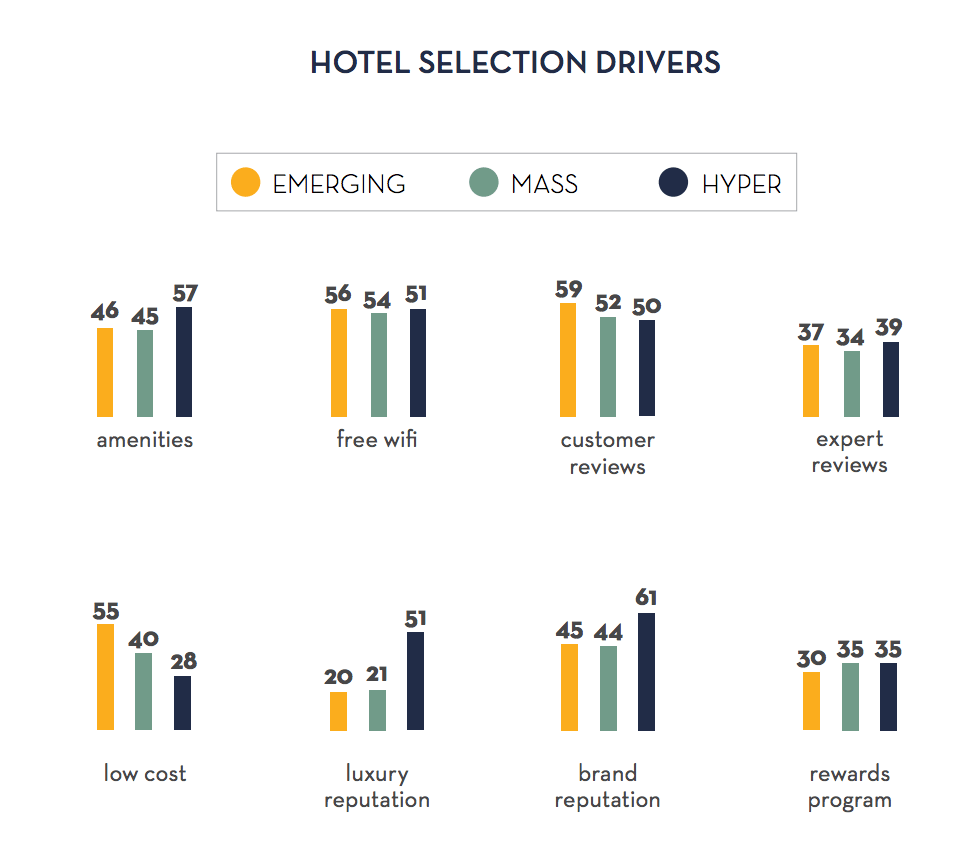

Chart 6: Selection drivers such guest reviews and low cost are more important to emerging luxury travelers and luxury and brand reputations are more important to hyper luxury travelers. When it comes to free Wi-Fi and expert reviews, for example, there's not much variation among the three groups.

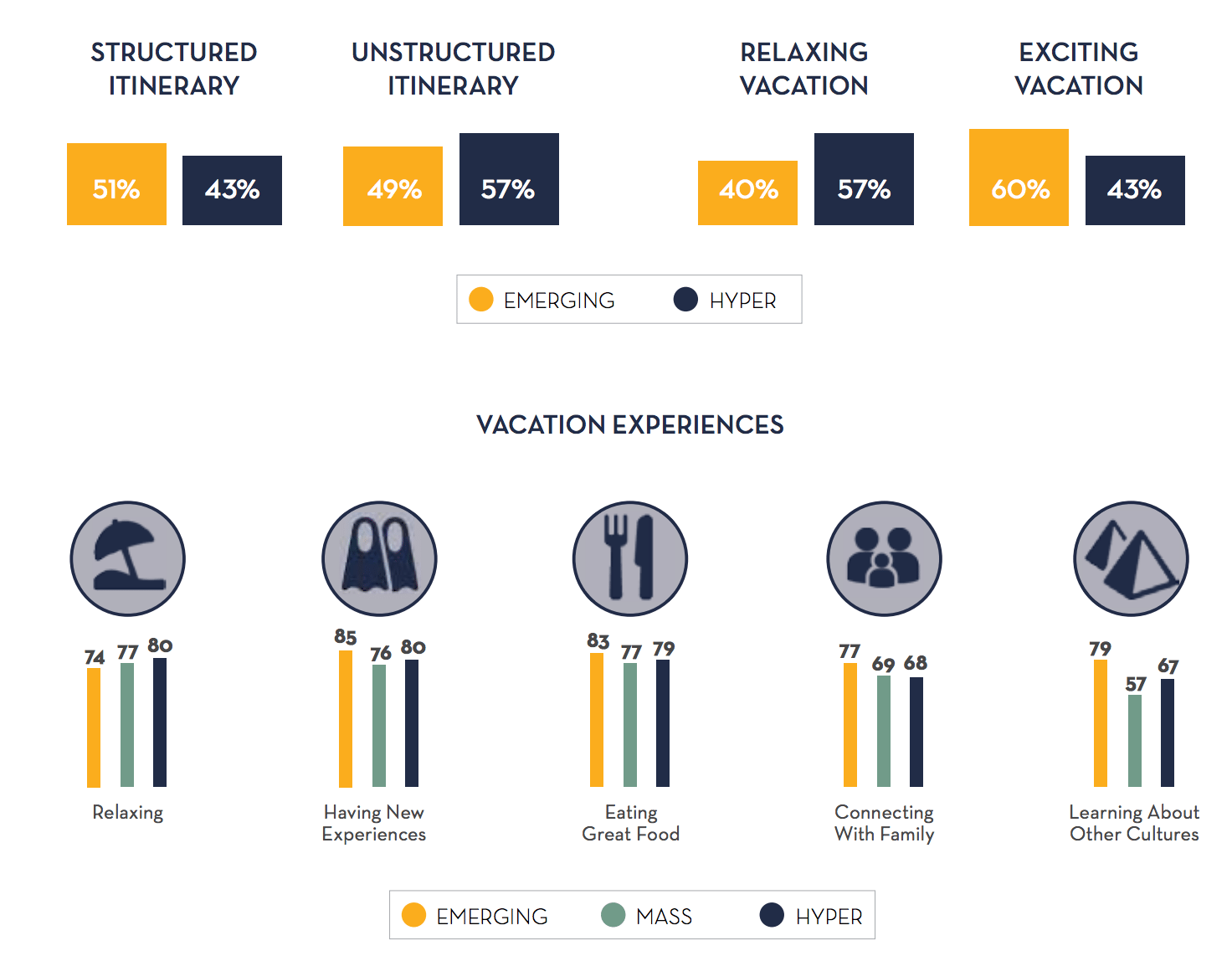

Chart 7: There's less of a gap with emerging and hyper luxury travelers when it comes to structured or unstructured itineraries, but a larger gap for preferences related to relaxing or exciting vacations.

Source: The Martini Report