HomeAway Buys Out the One-Third of Travelmob That It Didn't Already Own

Skift Take

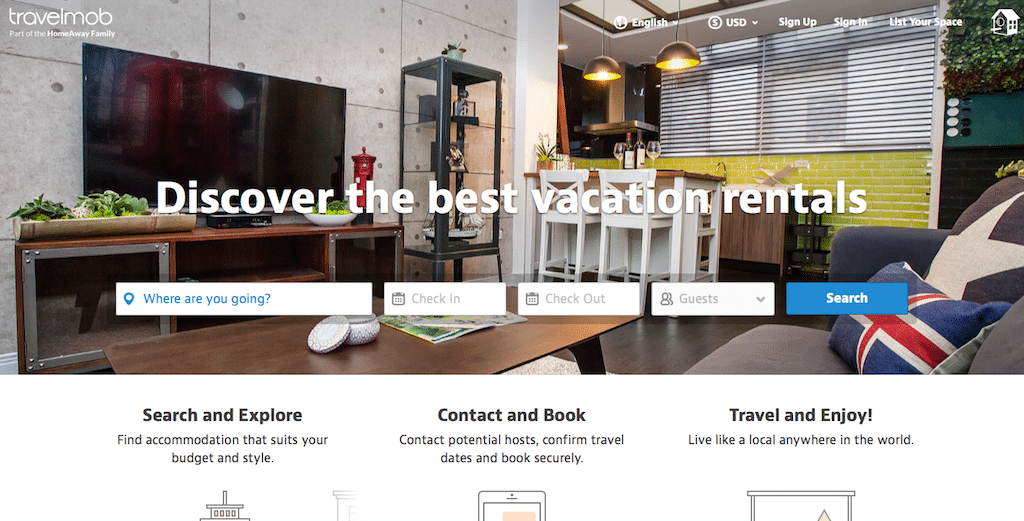

HomeAway already had a controlling 68.5 percent stake in Singapore-based Travelmob, acquired in 2013 for $11.5 million, and today revealed that it will rebrand the site as "HomeAway Asia" and acquired the 31.5 percent of shares that it didn't already own.

In the 2013 transaction, HomeAway actually acquired the whole company for $20 million but sold back 31.5 percent of the company to undisclosed parties for $8.5 million. HomeAway had options to acquire the shares it didn't own and exercised those options to acquire Travelmob outright.

In conjunction with the transaction, HomeAway stated that it has launched 14 HomeAway sites, including local sites in China, Japan, India, Indonesia and Korea.

Unlike HomeAway, which emphasizes how it is different from Airbnb because it offers "the whole house," Travelmob also offers apartments, houseboats and shared spaces plus luxury villas.

With valuations soaring, HomeAway hasn't done big acquisitions in the last two years, preferring to make minority investments in companies such as Gogobot, and make small acquisitions of apps, including Dwellable and Glad To Have You.

In contrast, in 2013, the year HomeAway acquired the controlling stake in Travelmob, HomeAway also acquired Bookabach in New Zealand and Stayz in Australia.