Exclusive: Pegasus Solutions Spins Off Reservations Business to Regent Equity Partners

Skift Take

Pegasus Solutions, the hotel central reservations system and distribution services switch provider, has spun off the reservations portion of its business to private equity firm Regent Equity Partners, Skift has exclusively learned.

While Regent Equity Partners, with offices in Los Angeles, acquires the hotel-facing Pegasus Reservations Services, Pride Capital-owned Pegasus Solutions keeps the distribution side of the business, and presumably its debt, in the form of the Pegasus Solutions brand.

Skift learned of an imminent acquisition involving Dallas-based Pegasus in late September, and the company today provided Skift with a statement about the transaction, although some of the details are still sketchy. Pegasus' employees and clients received messages about the deal over the last few hours or days.

In the transaction, Regent Equity Partners essentially gets Pegasus' CRS business and related offerings, while the Pegasus Solutions brand will continue to provide distribution-related services connecting hotel CRSs to global distribution systems such as Sabre, Amadeus and Travelport, channel managers and other distribution companies.

While Pegasus Solutions' CRS business has been in a state of decline in terms of market share, the distribution side of the business, which it retains, is said to be holding its own. The CRS business is said to have generated roughly $100 million in revenue in 2013.

Importantly, Regent Equity Partners' Pegasus Reservations Services will be a customer of the Pegasus Solutions distribution business, and there are likely other aspects to the intertwined relationship, as well.

The Pegasus statement did not provide information on the financial terms of the transaction or how the management lineup of Pegasus Solutions, including CEO David Millili and his team, will be impacted.

"Pegasus has established an extremely productive relationship with the Regent team, which works closely with the management teams they back," Pegasus Solutions states. "Regent’s partners have been involved in acquiring, operating and improving more than 50 businesses that have generated billions of dollars in sales over the last two decades."

The Pegasus Sale

Pegasus or, as it turns out, parts of the business have been for sale for some time as the CRS business that Regent Equity Partners acquired has been in decline for several years.

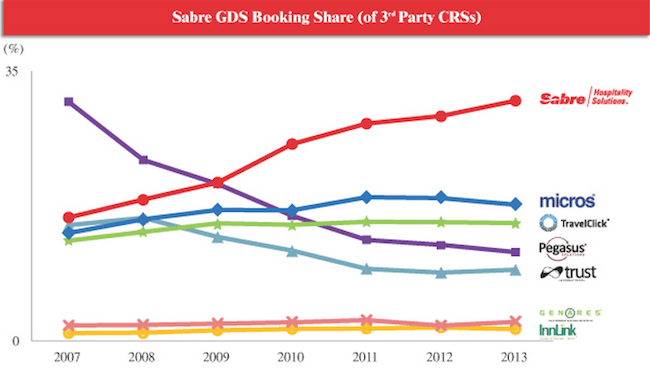

While Pegasus was the outright global market leader in its CRS business in 2007, by 2013 its market share, hampered by what many feel is legacy technology, fell to fourth behind Sabre, Micros and TravelClick, according to an analysis that Sabre published in connection with its April 2014 IPO.

Sabre claimed to be the largest third-party CRS provider in 2013 in terms of the number of rooms it handled, with a 27% global market share.

The fate of Pegasus and where all the pieces of its business ultimately land is impactful in the hotel industry and for the company's clients as Pegasus Solutions provides connectivity, distribution and digital marketing services to some 100,000 hotels through its 18 offices in 10 countries. Pegasus says that it processes $14 billion in hotel industry transactions annually.

The fate of Pegasus and where all the pieces of its business ultimately land is impactful in the hotel industry and for the company's clients as Pegasus Solutions provides connectivity, distribution and digital marketing services to some 100,000 hotels through its 18 offices in 10 countries. Pegasus says that it processes $14 billion in hotel industry transactions annually.

Who Got Stuck with the Debt?

A big issue in the fate of Pegasus is what would happen to its debt, which two years ago stood at around $100 million, but that number might have been reduced in the interim. It is believed that Pegasus and its note holders reached an agreement to delay some of the debt repayments until a transaction, such as the spinoff to Regent Equity Partners, could be completed.

The Pegasus Solutions statement today indicates that Regent Equity Partners inherits no debt in acquiring the reservations/CRS business, which presumably means that Pegasus Solutions retains the debt, and at least now gets a boost in paying down some of the debt.

"Pegasus’ Reservations Services business has no debt, and is now completely financed by Regent Equity Partners," Pegasus Solutions states. "Regent’s investment mandate adheres to a very conservative capital structure so a business should rarely, if ever, be sidelined because of liquidity issues as a result of being over-levered."

Pegasus Solutions on Why It Did What It Did

Despite the market share numbers that rival Sabre disclosed, Pegasus Solutions takes issue with the notion that its now-spun-off CRS business was nosediving, and argues that the transaction will give both Pegasus Solutions and Regent Equity Partners' Pegasus Reservations Services the opportunity to focus on their respective businesses.

"Pegasus Reservations Services' business is also stable, which is what prompted the competitive bidding process that led to the purchase by Regent," Pegasus Solutions states. "Separating the Distribution Services and Reservations Services businesses from each other allows for the expert focus and understanding needed to best serve our current and future hotel clients. With Regent’s support, Pegasus will refocus on being the best provider of leading-edge technology in the reservations space.

"With many of the top hotel operators in the world on our systems, we will continue to ensure our technology aligns well with their other technology systems and revenue management programs."

As Pegasus Reservations Services now goes out and tries to retain clients and attract new ones, at least the question of what happens to the Pegasus CRS business has been answered in the short term.

Regent Equity Partners

Regent Equity Partners describes itself as "a multi-sector private equity firm focused on event-driven situations where capital solutions are required on a certain and often accelerated basis. Our operating strategy is to partner with management teams and rapidly identify catalysts that can unlock value in a business over an indefinite time horizon."

Pegasus Solutions states that the acquisition of Pegasus Reservations Services is Regent Equity Partners' fifth acquisition in the past year, and that it operates small- and medium-size businesses in a variety of sectors, including hospitality technology.

A group led by Prides Capital Partners acquired Pegasus Solutions, which had been a public company, in 2005 for $275 million. Pegasus' spinoff of the reservations business announced today is believed to have taken place for a fraction of that amount.

The spinoff takes place at a time of heightened merger and acquisition activity in the field of hotel digital marketing and reservations services as this year Oracle acquired Micros for $4.6 billion, private equity firm Thoma Bravo acquired TravelClick for $930 million, and the Priceline Group acquired Buuteeq and Hotel Ninjas for $98 million, net of cash acquired.

And Alibaba's first post-IPO investment was to pour $457 million into Beijing Shiji Information Technology Co., which provides property management systems and other technology to hotels.

The Pegasus statement didn't detail whether the Open Hospitality portion of its business, which provides a hotel booking engine and digital marketing services to hotels, ends up with the spun-off reservations business or remains with Pegasus Solutions.

Nevertheless, the Open Hospitality division isn't considered cutting edge as it doesn't offer SaaS solutions as do TravelClick and Buuteeq.