Skift Take

Hotels are losing the battle for last-minute mobile bookings to the online travel agencies. It's not a huge surprise given their respective marketing resources, but this could hurt hotels even more in the future as the shift to mobile bookings accelerates.

Lots of travelers are searching for last-minute hotel stays on online travel agency and hotels’ mobile websites, but when it comes to booking these rooms, it’s the online travel agencies that are converting lookers to bookers to a much greater degree.

Yes, hotels are apparently losing the battle for last-minute bookings on mobile to the online travel agencies.

Another flash point, and more lumps.

But, it’s a competition that hotel revenue managers may feel conflicted about, at best.

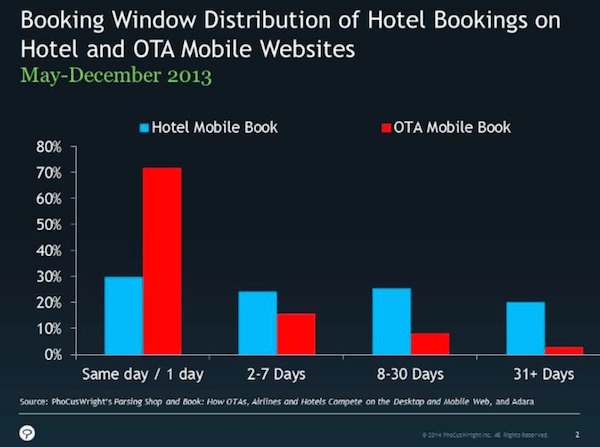

Consider the following chart from a PhoCusWright report, Parsing Shop and Book: How OTAs, Airlines and Hotels Compete on the Desktop and Mobile Web.

The chart, based on mobile website sessions captured by advertising platform Adara from May to December 2013, shows that more than 70% of online travel agency mobile bookings took place within 24 hours before check-in.

It was a totally different story for hotels’ mobile websites, however. For hotels, their percentage of mobile bookings were fairly evenly distributed throughout the 31 days before check-in. There is no big spike for same-day bookings.

The Adara mobile numbers were drawn from 2 billion user sessions covering online travel agency, hotel and airline websites, both mobile and desktop sites.

The disparate track record for last-minute mobile bookings for online travel agencies versus hotels comes despite the fact that the PhoCusWright-Adara study also showed that the percentage of their respective users searching for last-minute stays was comparable, 30% on online travel agency mobile sites and about 25% on hotel mobile sites.

It’s An Immediacy Thing

Douglas Quinby, PhoCusWright’s vice president, research, wrote about the findings here, and tells Skift that although the study doesn’t specify whether more travelers are searching for last-minute stays on online travel agency or hotel mobile websites, it is clear that the online travel agencies are turning them into bookers at a much higher clip.

The searches for same-day stays on hotel mobile sites may be driven by loyalty and elite program members, who tend to do more on mobile than guests who do not have elite status, Quinby says.

But, Quinby believes that the online travel agencies are converting users at a much higher rate than hotels for last-minute stays because of the immediacy of the need, and consumers’ desire to comparison-shop.

“Under those circumstances, your loyalty to one hotel brand will not be as important as location, price and star rating,” Quinby says.

Playing Field Isn’t Level

So online travel agencies and metasearch sites, for that matter, have a built-in advantage. They let consumers compare prices and see what’s available in the market while a hotel can only show its own rooms.

Another factor is that large online travel agencies like Priceline, Expedia and Orbitz are relatively massive marketing machines, and they tout their mobile-only and special, last-minute deals in a variety of ways.

Hotels don’t have the marketing resources to keep up — and the numbers show it.

In many instances, hotels’ revenue management systems have a built-in bias against reducing rates at the last minute, Quinby says.

The bigger challenge for hotels is not whether they are losing ground on the last-minute front to the online travel agencies, but how should hotels balance discounting for last-minute versus getting better rates from their top-paying guests, Quinby says.

“Don’t fight the OTAs for scraps the day before,” Quinby says. “Think how you can manage your distressed content while not angering your favorite customers.”

Have a confidential tip for Skift? Get in touch

Tags: last-minute, otas

Photo credit: Friends drinking in a nightclub at an Aloft property. Aloft Hotels