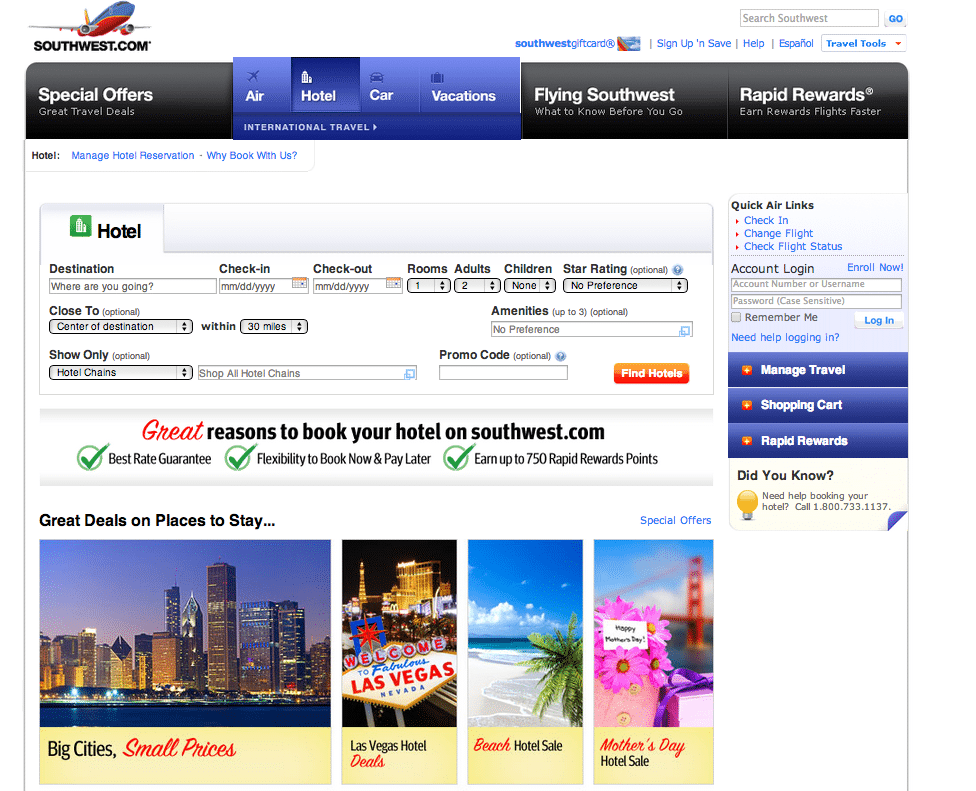

Low-Cost Airlines Aren't Getting Much Traction Upselling Hotels Through Their Sites

Skift Take

The big question for these low cost airlines: Can they ever become effective at diversification beyond their own main product. How many people actually end up buying these services beyond air?

Low-cost airlines are continuing their inevitable march across the world, and as part of that they have led a movement of ancillary fee-based services that are now driving record profits for these companies.

Among them are baggage fees, on-board food, seat assignments, in-flight Wi-Fi and many others. And while many of them are being now being sold and paid online as part of the book